Amgen Inc. is an independent biotechnology medicines company that discovers, develops, manufactures, and markets medicines for grievous illnesses.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 173.51-261.43 | 2,585,723 | 138,841.4 | 3.0% | 99.8% | 255.08 | 3.88 | 02/02/2021 |

Amgen Inc. is an independent biotechnology medicines company that discovers, develops, manufactures, and markets medicines for grievous illnesses. The Company focuses on human therapeutics and concentrates on innovating novel medicines based on cellular and molecular biology. One of the largest biotechs globally, Amgen uses cellular biology and medicinal chemistry to target cancers, kidney ailments, inflammatory disorders and other diseases including rheumatoid arthritis, osteoporosis and anaemia.

AMGN operates one business segment, human therapeutics, which focuses on six areas being oncology/haematology, inflammation, bone health, cardiovascular disease, neuroscience, and biosimilars. It’s top-selling drug Enbrel, used in the treatment of rheumatoid arthritis and psoriasis treatment, generated sales of US$5.226 billion in 2020 followed by the second-largest revenue-generating drug Neulasta, a cancer-related infection preventative, totalling US$3.221 billion. While its drugs are sold globally, the U.S. is the dominate geography accounting for approximately 70% of sales.

AMGN has managed to navigate the COVID-19 disruptions somewhat successfully, although has faced recent disappointments in trials for Tezepelumab (severe asthma) and omecamtiv (heart failure). Otezla which is used for the treatment of psoriatic arthritis which affects some people with the skin condition psoriasis was recently acquired by AMGN for US$11b and has been a reliable source of revenue. Additionally, the KRAS Inhibitor Sotorasib, which is being trailed in the treatment of lung cancer, has been hailed as a standout in Amgen’s pipeline and key to driving growth with data due in late January 2021. With revenue growth forecast to rise modestly, M&A opportunities similar to Otezla or the success of its pipeline drug trials are seen as the catalysts for delivering long-term growth.

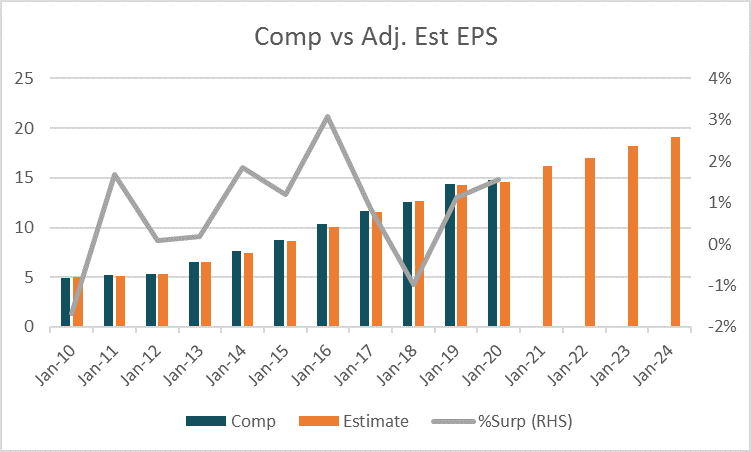

For the year ending December 2020 revenue is forecast to have risen +8.6% to US$25,376m and rise a further +4.1% in 2021 to US$26,419m. Adjusted earnings per share is expected to rise +24% to US$16.17 in 2020 and a further +5.1% in 2021 to US$16.99. Based on these adjusted estimates the stock trades on forward P/E multiples for 2021 and 2022 of 14.1 and 13.2, premiums of 24% and 18% respectively to the peer group averages of 11.4 and 11.2.

The average target price of analysts covering the stock is $253.68 with 47% of analysts rating the stock as a buy, compared to 3% as a sell and 50% as a hold.