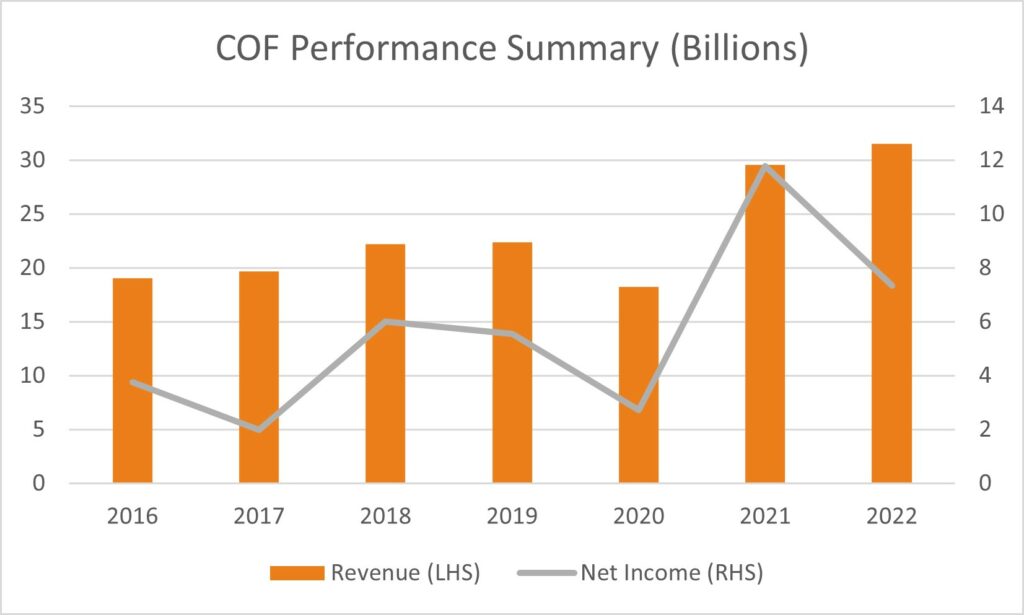

Capital One Financial Corporation (COF) reported a revenue of $7.83 billion for Q32021, increasing by 6% compared to Q22021 revenue of $7.37 billion.

This was 5.2% above analyst’s estimates of $7.44 billion, with revenue forecast for Q42021 at $7.62 billion. The increase was due to a rise in period-end loans held for investment by $11.8 billion to $261.4 billion (across all segments i.e. credit card, consumer banking & commercial).

Net income for Q32021 was $2.99 billion, -14% lower than Q22021’s net income of $3.49 billion, but 30% higher than analyst’s estimates of $2.296 billion. This is due to credit losses of $342 million, increasing by $818 million from Q22021 (which includes a charge off of $426 million and $770 million loan reserve release). Net income forecast for Q42021 is expected at $4.87 billion.

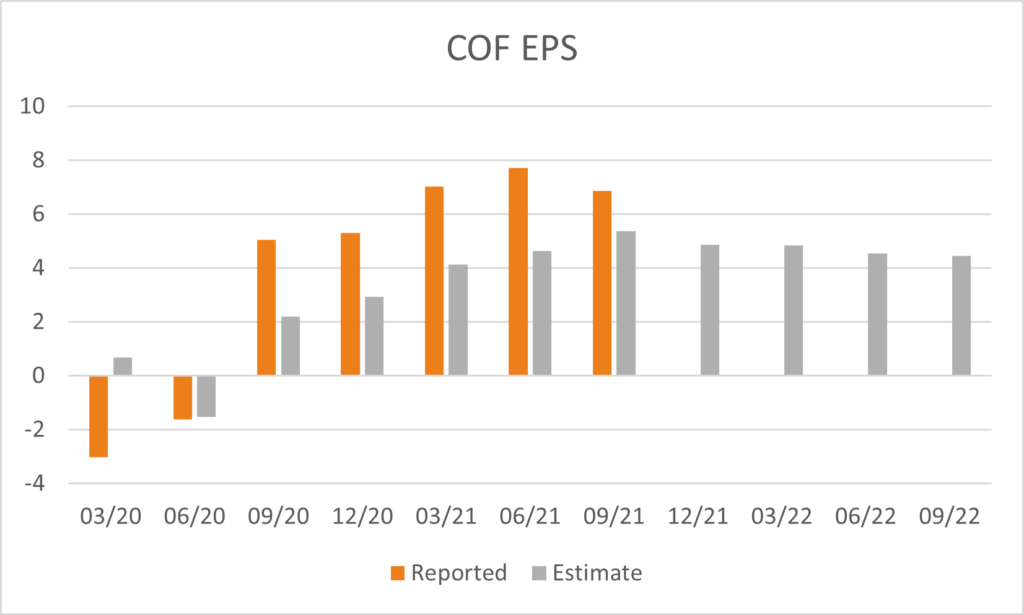

The EPS for Q32021 dropped by -11% to $6.86 in relation to the Q22021 EPS of $7.71, yet was 27.5% higher than the estimates of $5.38. Looking ahead to the fourth quarter, the average analyst estimate is for EPS to decline –26% to $4.978 on a GAAP basis.

COF has recently acquired “Lola”, a fintech which offers digital solutions to small-medium sized businesses. Richard D. Fairbank, Founder, Chairman and Chief Executive Officer emphasized their commitment to a digital era:

“Our modern technology stack is powering our performance and our opportunity,”…..”It’s setting us up to capitalize on the accelerating digital revolution in banking, and it’s the engine that drives enduring value creation over the long-term.”

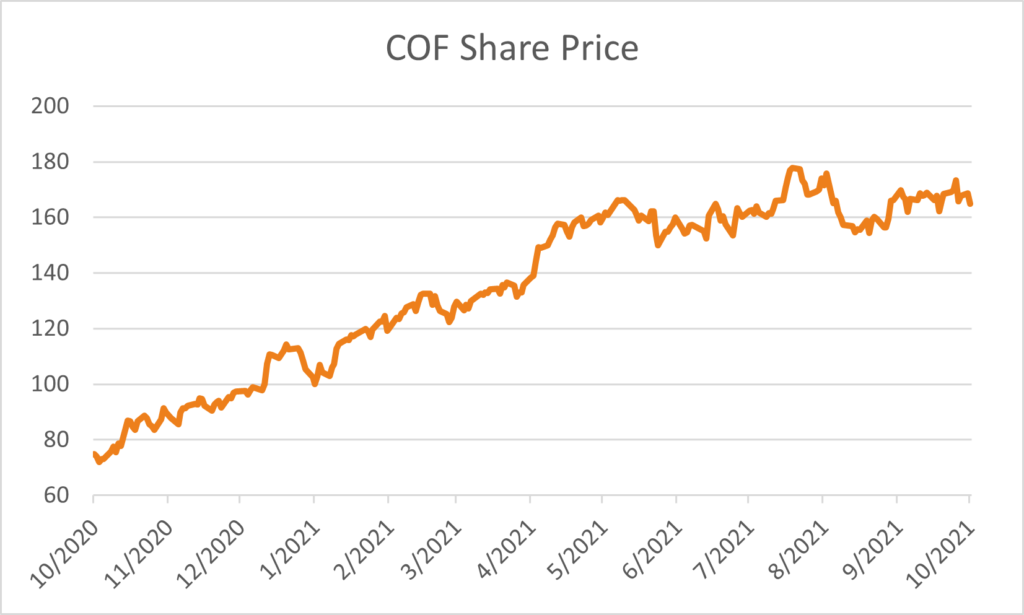

The share price declined by 2%, dropping $3.83 to $164.56 on the day the results for Q32021 were announced. However, majority of analysts’ forecast the price to rise to $185.32 in the next 12 months, with 74% having a buy recommendation while 18.5% maintain a hold recommendation.