Peloton Interactive Inc. provides recreational facilities and services.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 17.70-167.37 | 15,081,997 | 42,054.5 | 0% | 95.5% | 147.81 | 4.61 | 05/02/2021 |

Peloton Interactive Inc. provides recreational facilities and services. The company offers workout bikes for indoor cycling, as well as other fitness-related instruments, servicing customers predominantly in the United States but also expanding globally. Through technology, PTON offers its interactive fitness platform where customers can participate in immersive instructor-led classes anywhere, anytime. Classes are offered across a variety of activities including indoor cycling, indoor/outdoor running, Bootcamp, yoga, strength training, stretching and meditation.

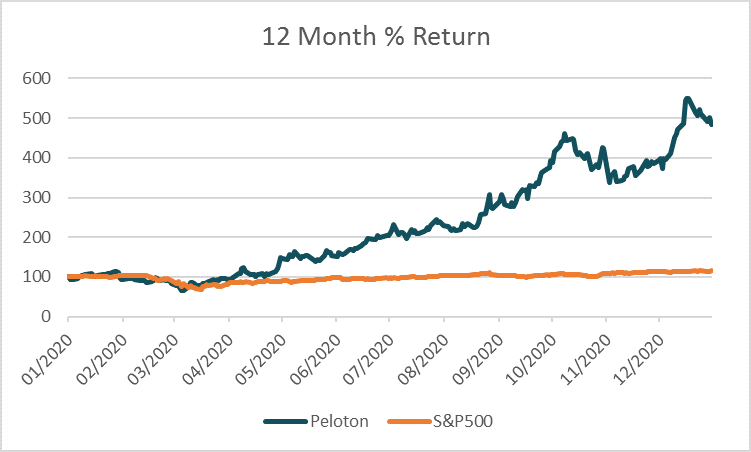

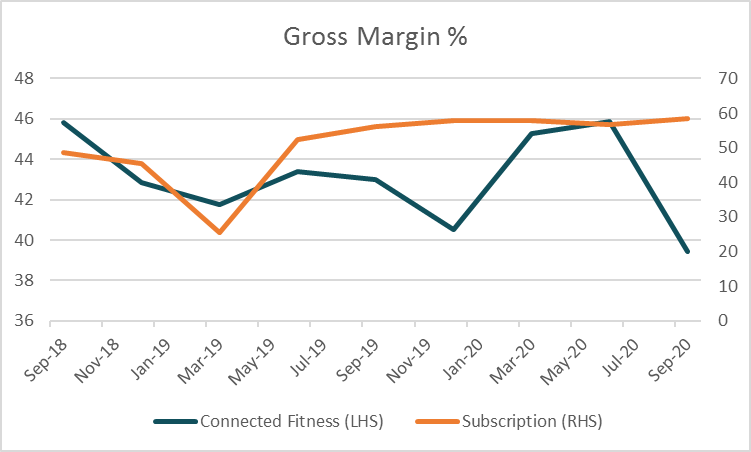

PTON has benefited from the surge in demand for home workouts as a result of the COVID-19 pandemic allowing an accelerated disruption of the fitness industry with customers cautious or unable to return to physical locations. In the 2021 fiscal year, the company has guided a 1.5 million unit production expansion following the opening of its Shin Ji factory in Taiwan, doubling of its van fleet to improve delivery times and expanding into other fitness areas such as strength and meditation. Based on these catalysts it expects Connected Fitness Subscriptions to cross the 2 million mark boosted revenue and EBITDA with greater margins on digital subscriptions vs connected fitness.

Revenue is generated primarily through the sale of Connected Fitness Products such as the Peloton Bike, and Peloton Tread, accounting for 80% of sales in 2020. The remaining 20% of revenue is generated from recurring subscription revenue to access the interactive fitness platform, classes and instructors, which grew by 113% in 2020. Sales are generated by a multi-channel sales platform including 95 showrooms across the U.S., Canada, United Kingdom and Germany, as well as sales specialists and high-touch delivery service.

While the company originally had first-mover advantage in disrupting the fitness industry it faces challenges from increased competition from competitors SoulCycle, NordicTrack and Echelon which offer comparable fitness equipment and online subscriptions. PTON has attempted to use its intellectual property to block competitors although this is seen to be an unsuccessful strategy.

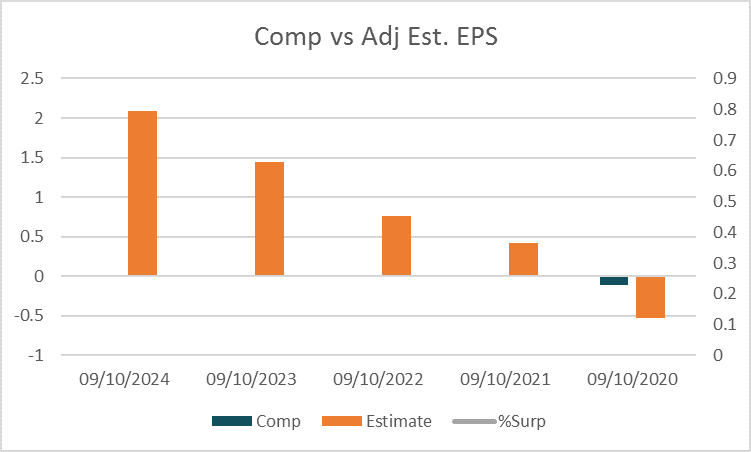

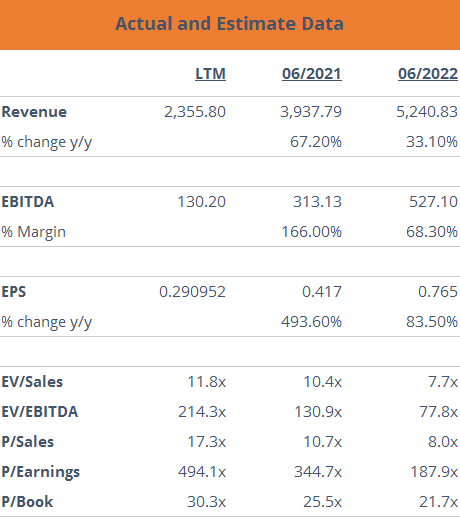

For the financial year 2021 revenue is forecast to rise 115.7% to US$3,937.8m followed by a 33% increase in 2022 to US$5,240.8m. Adjusted earnings per share is forecast to grow 500% to US$0.42 in 2021 from -US$0.11 in 2020, and a further gain of 83% in 2022 to US$0.77. Based on these adjusted figures the stock trades on forward P/E multiples of 334.7 and 187.9 respectively, significant premiums to the peer group averages of 22.8 and 16.4.

The average target price of analysts covering the stock is $149.54 with 86% of analysts rating the stock as a buy, compared to 4% as a sell and 10% as a hold.