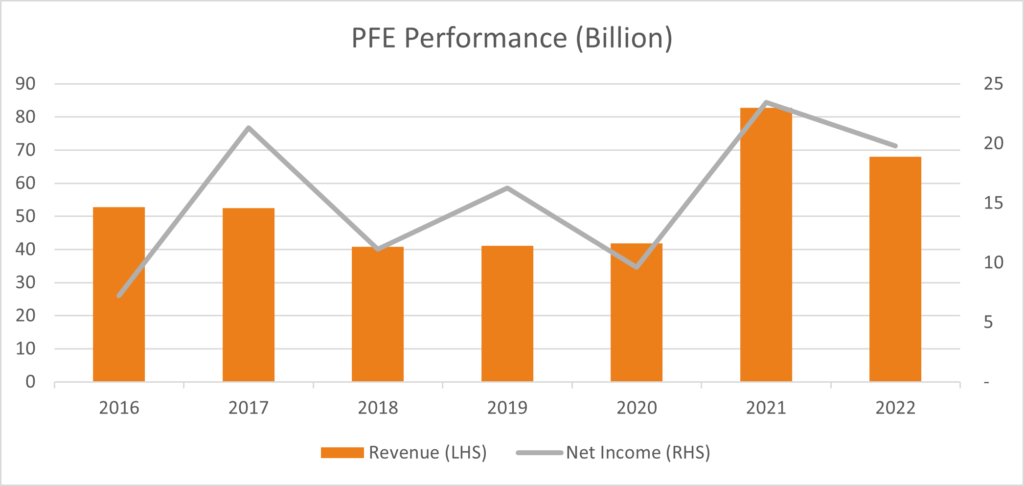

Pfizer Inc. (PFE) reported a revenue of $24.09 billion for Q32021, nearly double last year’s $12.13 billion Q32020 results.

This was 27% higher than previous quarter’s $18.9 billion and 6.2% higher than analyst’s estimates of $22.63 billion. The coronavirus vaccine alone has become the largest contributor to revenue and biggest selling pharmaceutical product of all time in a-given-year. The vaccine alone is expected to generate $36 billion in sales for 2021, beating earlier estimates by $2.5 billion. Excluding the coronavirus vaccine, revenues from drug sales grew by 11%.

It’s net income for Q32021 was $7.68 billion, 88% higher than YoY Q32020’s $4 billion, 26% higher than previous quarter’s $6.08 billion and 24% higher than estimates of $6.21 billion.

The company estimates a conservative figure of $29 billion in revenues from the COVID19 vaccine, with an estimated 1.7 billion doses. It is seeking out private customers for its vaccine, highlighting that governments have yet to make multi-year contracts. Revenues and net income for Q42021 are forecasted at $25.14 billion and $5.77 billion respectively. Management provided updated guidance on revenue and earnings, forecasting EPS of $4.13 to $4.18 per share in 2021, up from $4.05 previously with revenue forecasts increasing to $81 to $82 billion from $80 billion previously.

The CEO Albert Bourla spoke on the PFE partner’s capacity to distribute up to 4 billion doses with room for new customers:

“Quantity will not be a problem,”…“if people place orders now, we will honor them.”

Angela Hwang, president of Pfizer’s biopharmaceutical unit commented:

“That’ll be a new dynamic that we are absolutely ready to manage,”

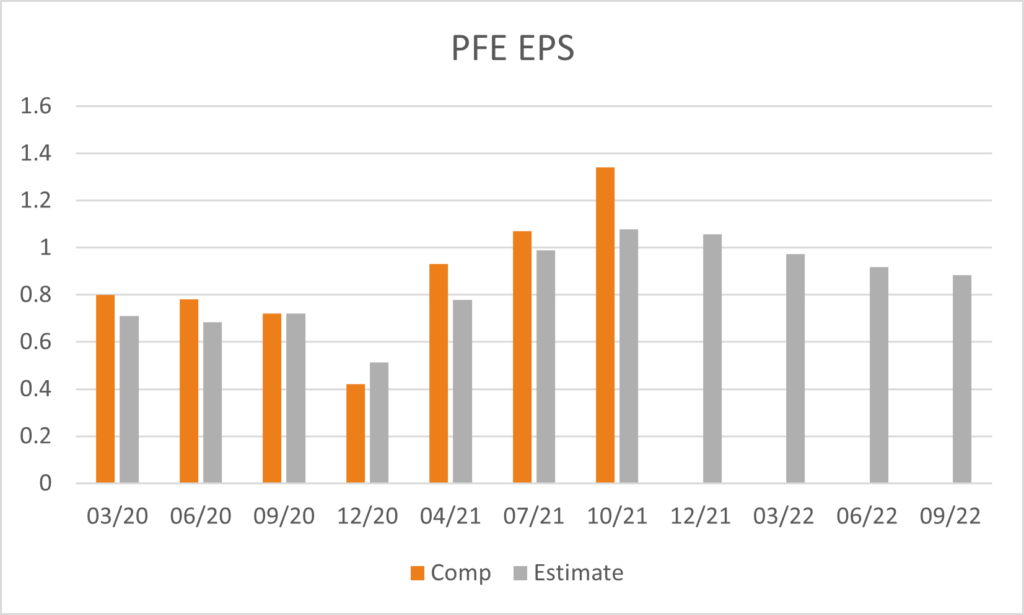

Earnings per share increased by 86% YoY on an adjusted basis, from $0.72 in Q32020 to $1.34 in Q32021. This was 25% higher than previous quarter’s $1.07, and 24% higher than estimates of $1.079.

Investors are keeping a keen eye on the booster shots and shots for kids. Results for trial vaccine of children ages 2-4 years and its preliminary results for the COVID pill are expected to be released in this quarter, which will put pressure on its competitors Moderna. Looking ahead to the final quarter of 2021, analysts forecast EPS to decline lower by 22% to $1.041.

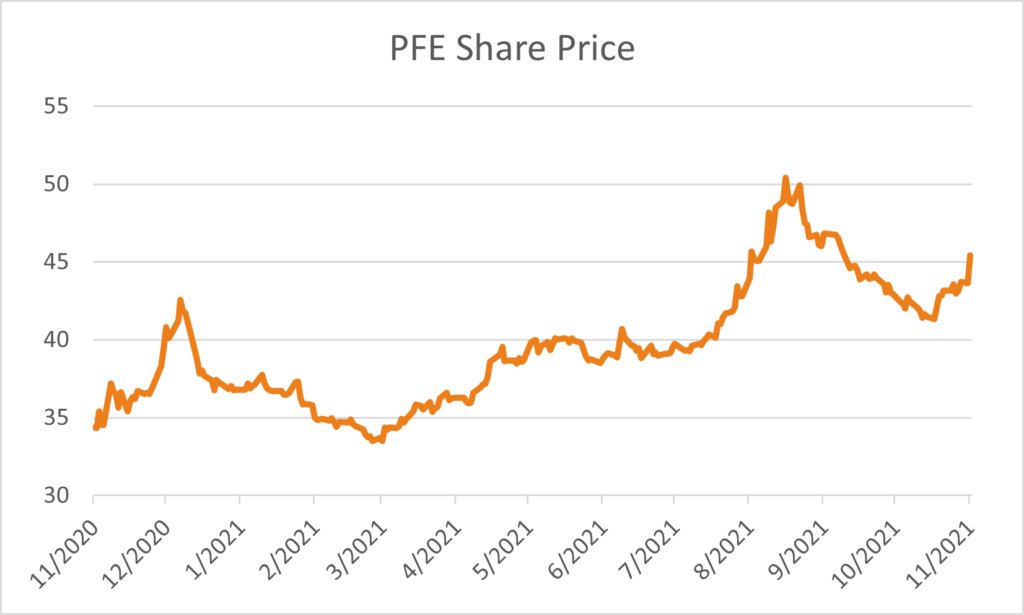

Investors reacted positively to the earnings update with shares rising to close at $45.45. Analysts maintain a fairly positive outlook for the stock, with 34% of analysts having a buy recommendation with 65% maintaining a hold recommendation with an average 12-month price target of $46.39.