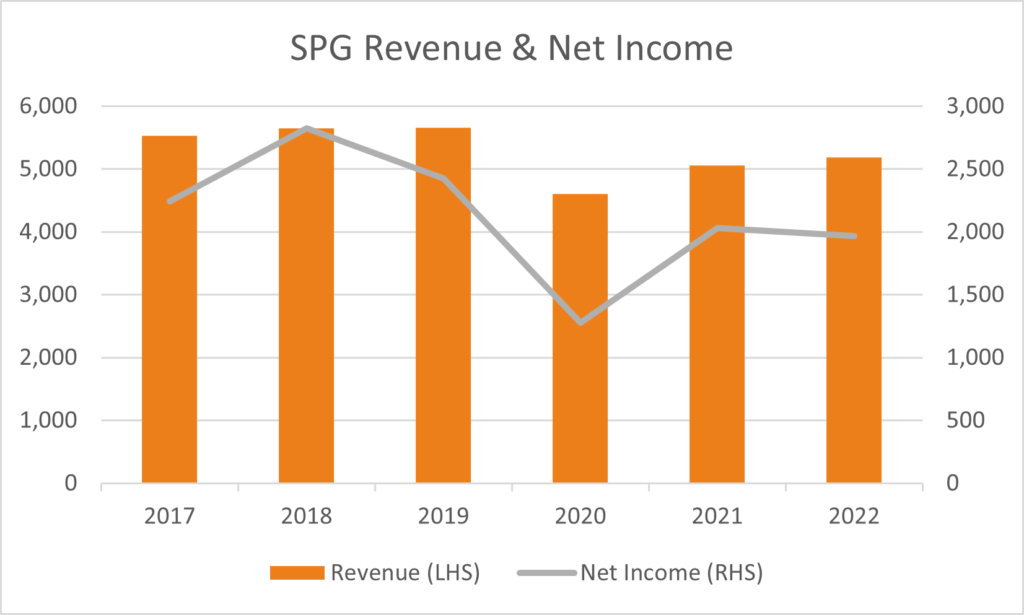

Simon Property Group (SPG) reported revenue of $1.297 billion for the Q32021, 22% higher than YoY Q32020’s revenue of $1.06 billion.

An increase of 3% compared to previous quarter’s $1.254 billion and 6% higher than analyst’s estimates of $1.214 billion. Management attributed this to high occupancy rates (92.8%) as at 30 Sep 2021.

Net income for Q32021 was $599.99 million, 1.5x higher compared to YoY net income of $237.2 million. This was, however, -3% lower than previous quarter’s net income of $617 million, but 34% higher than analyst’s estimates of $398 million.

David Simon, the Chairman and CEO stated:

“We produced impressive third quarter results,”….”Demand for our space from a broad spectrum of tenants is growing. Occupancy gains continued, retailer sales accelerated, including our owned brands, and cash flow increased. Based upon results to date and expectations for the remainder of 2021, we are once again increasing full-year 2021 guidance and raising our quarterly dividend.”

Development/ construction activities of multiple locations including international projects began in Q32021, with sufficient cash in hand balance of $1.1 billion, as at 30 Sep 2021. Forecasted revenue and net income for the next quarter is $1.266 billion and $458 million respectively.

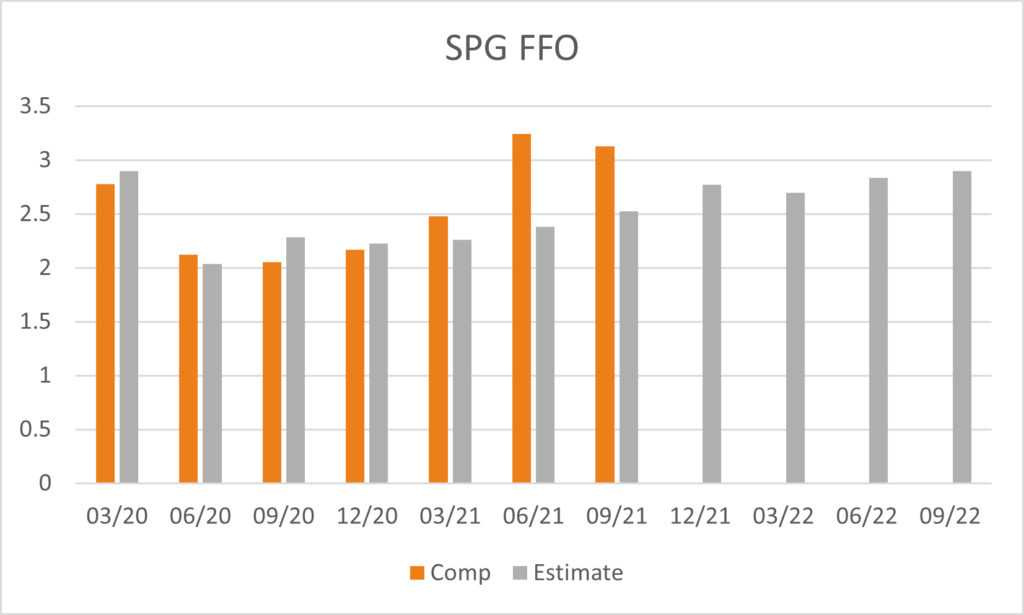

FFO for Q32021 was 3.13, a YoY increase of 53% from 2.05 in Q32020, -3% lower than the previous quarter of 3.24 and 19% higher than analyst’s estimate of 2.56. The FFO for Q32021 includes the loss on extinguishment of debt and the non-cash gain.

Management provided guidance for the next quarter for net income and Funds From Operations (FFO) within the range of $6.61 to $6.71 per share, and $11.5 to $11.65 per share respectively.

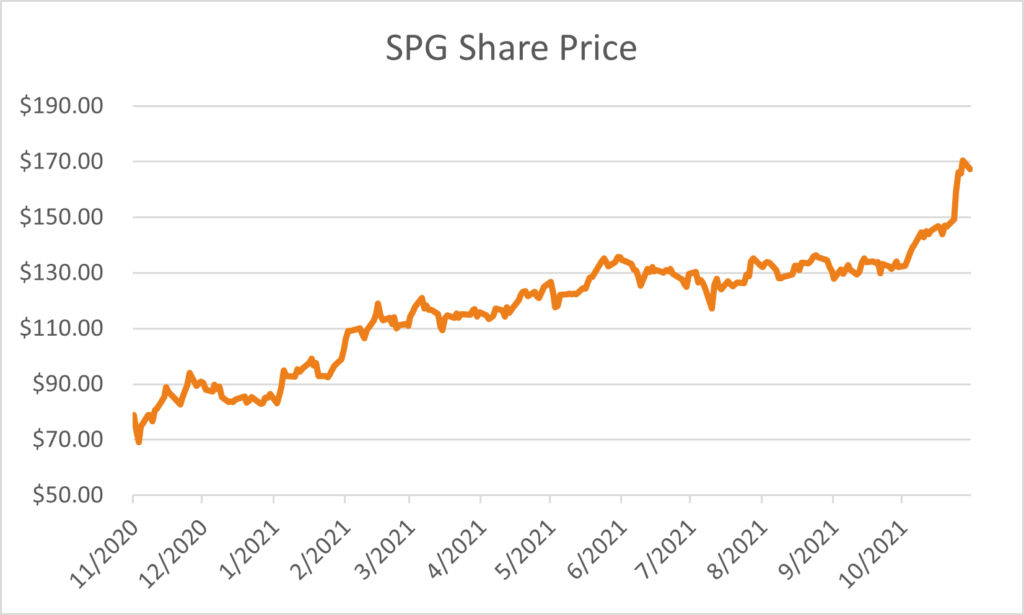

Investors reacted positively to the earnings update with the stock rising +6.45% to $158.99. Analysts maintain a fairly balanced outlook for the stock with 52% recommending a buy and 39% recommending a hold, with an average 12-month price target of $156.33.