Starbucks Corporation retails, roasts, and provides its own brand of specialty coffee.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 49.23-107.75 | 6,275,872 | 120,104.7 | 1.8% | 99.8% | 105.81 | 3.86 | 26/01/2021 |

Starbucks Corporation retails, roasts, and provides its own brand of specialty coffee. The Company operates retail locations worldwide and sells whole bean coffees through its sales group, direct response business, supermarkets, and on the world wide web. Starbucks also produces and sells bottled coffee drinks and a line of ice creams.

The Americas, being the U.S., Canada and Latin America is the largest geography for revenue, accounting for 70% in 2020, with Starbucks operating nearly 16,000 stores in the U.S. selling coffee, food, roasted beans, accessories and teas. A further 22% of revenue is generated internationally, where SBUX licenses and franchises another ~15,000 stores. The final segment is channel development which generated 8% of revenue in 2020 which sells branded Starbucks products through third parties including coffee beans and ready to drink bottled beverages.

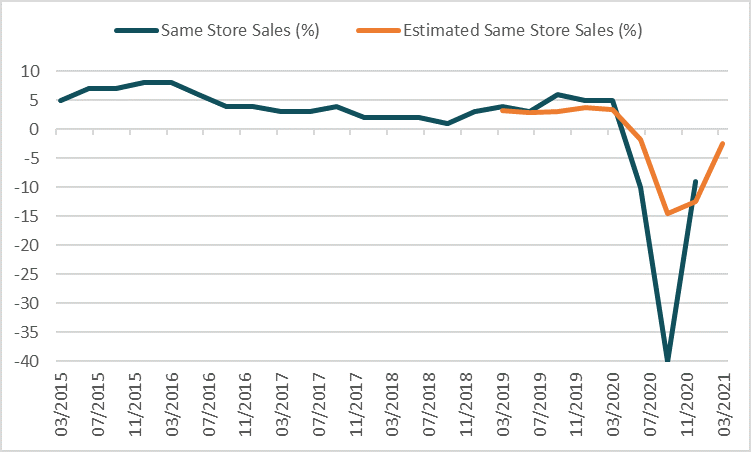

The pandemic has affected Starbucks same-store sales given it is seen as a meeting place and services a high volume of customers. Still, management remain optimistic, expecting same-store sales to recover by the second fiscal quarter.

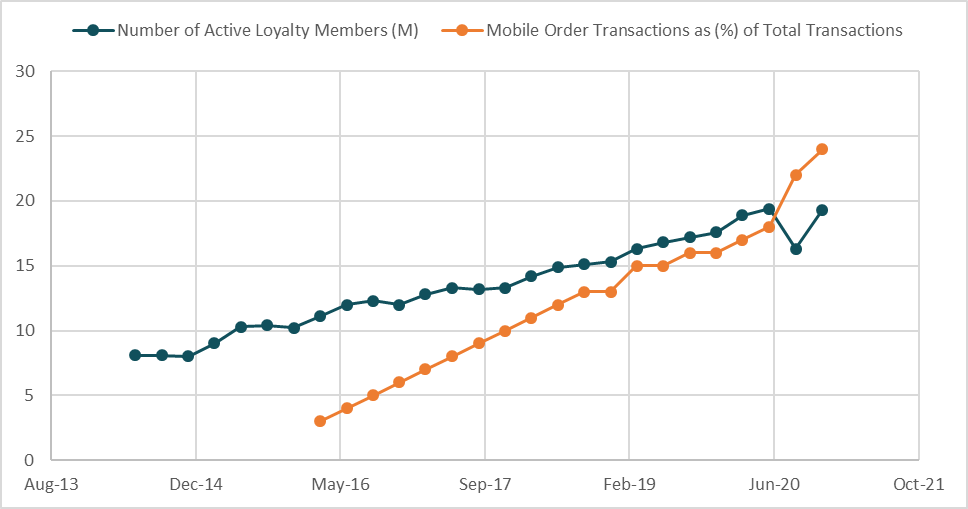

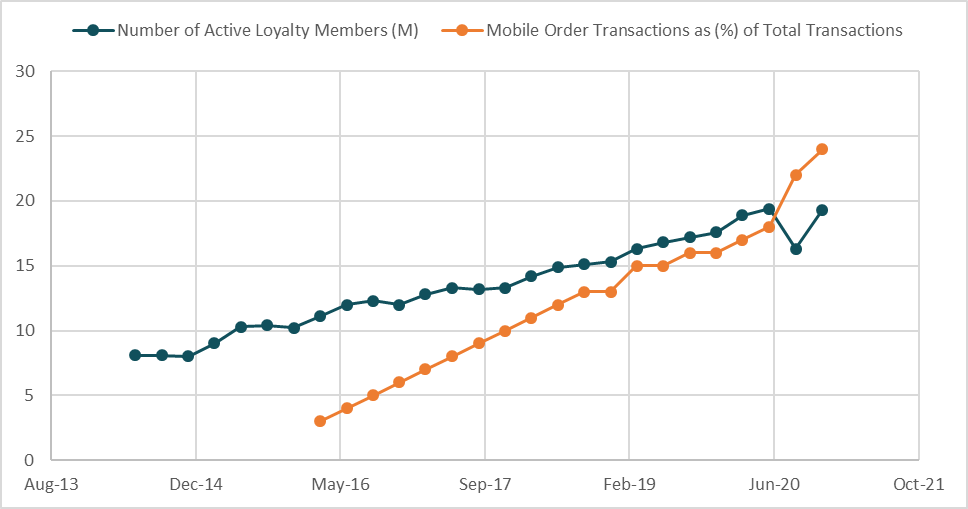

Going forward, while same-store sales may remain under pressure, SBUX’s technology platform and mobile application could fuel sales through digital ordering, loyalty and data analytics once the pandemic has passed. Management has guided the impact over a multi-year approach to the loyalty program will boost sales by 1-2% per annum and provides detailed data that can be used for customer marketing. Additionally, Starbucks digital partnership with Chinese technology giant Alibaba is seen as an important driver of growth, with Chinese customers using mobile ordering and payments more than those in the U.S.

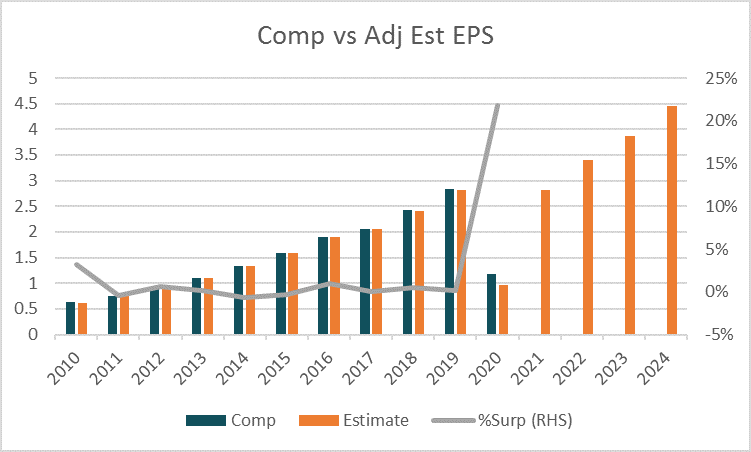

For the year ending September 30th 2021 revenue is expected to increase +21% year-on-year to US$28,476.5m and gain a further +7.7% in 2022 to US$30,675.2m. Adjusted earnings per share is forecast to rise +140% to US$2.82 and a further +21% in 2022 to US$3.40. Based on these adjusted estimates the stock trades on forward P/E multiples of 36.3 and 30.1, approximately 30% premiums to the peer group averages of 27.8 and 23.3.

The average target price of analysts covering the stock is $106.55 with 44% of analysts rating the stock as a buy, compared to 3% as a sell and 53% as a hold.