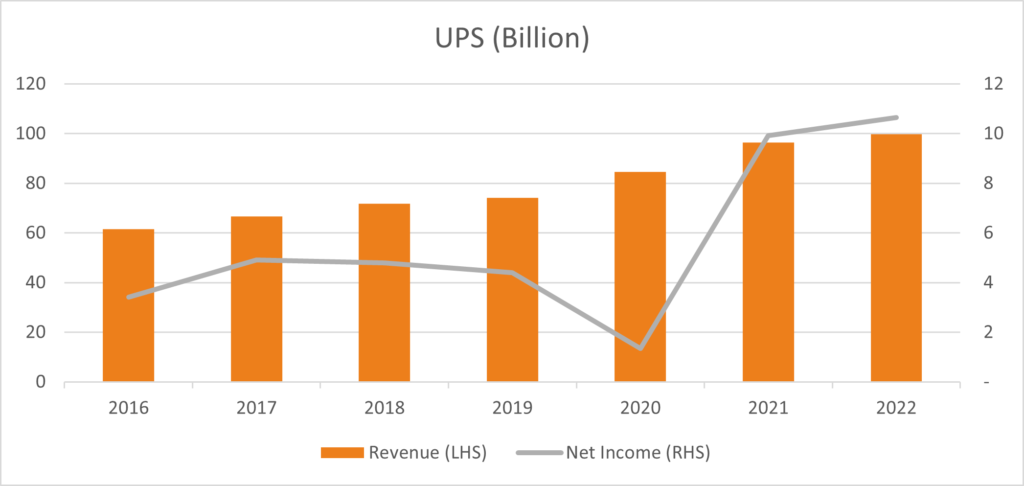

United Parcel Service (UPS) reported a Q32021 revenue of $23.18 billion, 9.16% higher than YoY Q32020 revenue of $21.24 billion.

This was -1.02% lower than previous quarter’s revenue of $23.24 billion and 2.64% higher than analyst’s estimates of $22.58 billion for Q32021. Growth was attributed to increased pricing per package, which led to a 13% increase in revenue overall (12% in the US and 15% internationally) offsetting a reduction in the volume of packages.

Net income was $2.383 billion for Q32021, a YoY increase of 19.75% compared to Q32020’s net income of $1.99 billion. This was -11.3% below previous quarter’s net income of $2.68 billion, but 6.24% above analyst’s estimates of $2.24 billion. UPS adopted a strategy to increase prices for residential packages to cope with the high demand during the pandemic, amidst supply chain constraints and labor shortages. The company’s CEO Carol Tome took office last year and reiterated her new strategy of “Better, not bigger”, which emphasizes improving margins rather than seeking volume, even reducing the volume of packages from its biggest customer i.e. Amazon. The CEO stated:

“We used to think that every package was the same. We don’t think that anymore,”…..”we’re controlling the volume that comes into our network because we’re laser focused on revenue quality.”

She briefly commented on the company’s ability to weather the labour shortage better than its competitors e.g. FedEx, as it’s labour is unionized and receives the highest wage in the industry with compensation and benefits only rising +0.60% over the year. :

“I feel really good about our ability to manage through the labor cost inflation that many companies are dealing with today.”

Demand is expected to remain strong, however, UPS pushed up its expectations for capital spending in the next quarter. Forecasted revenue and net income for the next quarter is expected to be $26.92 billion and $2.7 billion respectively.

UPS has been growing its margin segments including health care, pharmaceuticals and medical devices while lowering its dependence on lower-margin segments such as business to consumer delivery. This is apparent following the recent sale of its low margin freight business for $800 million while also purchasing same-day delivery start-up Roadie in September.

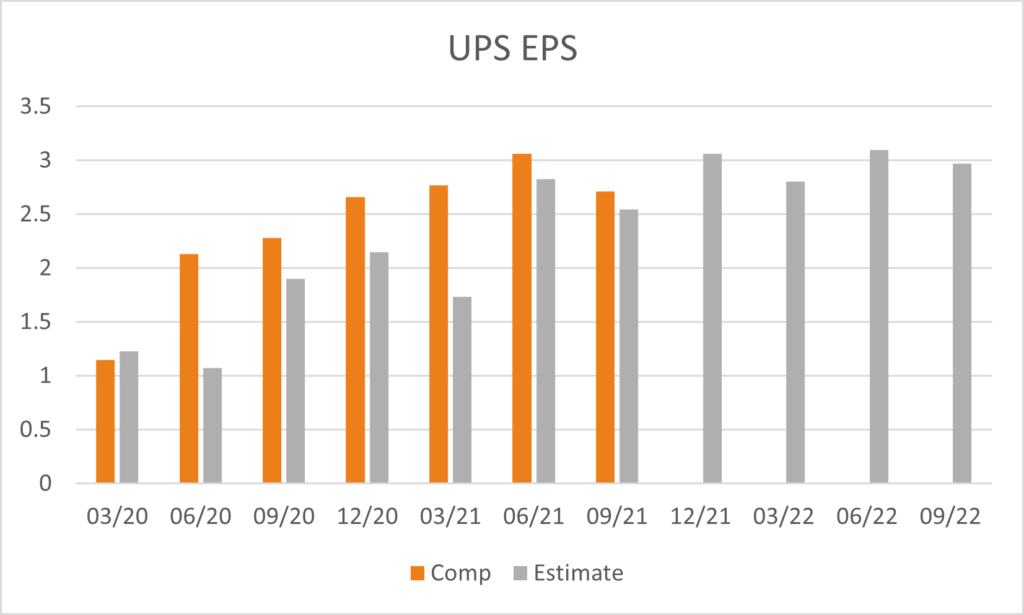

EPS improved by 18.86% YoY from $2.28 in Q32020 to $2.71 in Q32021. This is -11.4% lower than previous quarter’s EPS of $3.06, and 6.68% higher than analyst’s estimates of $2.54. EPS is forecasted to be $3.062 for the next quarter.

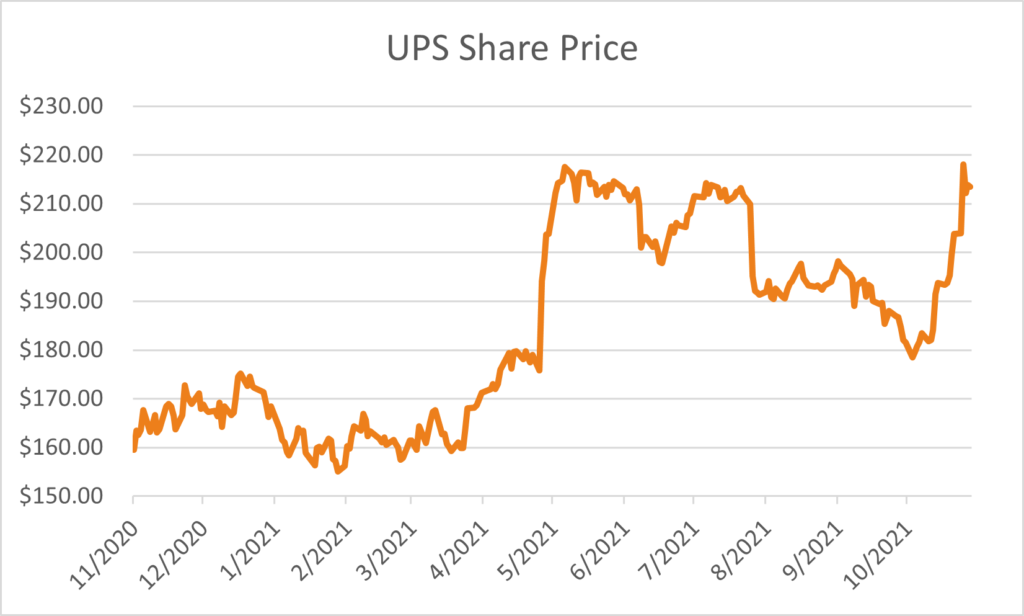

Investors reacted positively to the earnings update with the share price jumping +6.95% to $218.07. Analysts generally maintain an optimistic outlook for the stock with 59% maintain a buy recommendation while 28% recommend holding and 12.5% recommended selling with an average 12-month price target of $230.47.