Strategy Objective: The Rivkin Australian Equity Managed Account aims to produce positive average annual returns while seeking to maintain a level of volatility lower than that of the S&P/ASX 200 Accumulation Index over the same investment period.

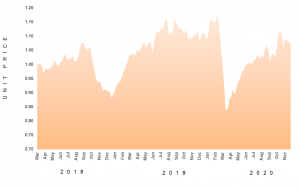

30 November 2020 Equivalent Unit Price – A$1.0750

Welcome investors to the monthly update for the Rivkin Australian Equity Managed Account (RAEMA) for November 2020. Broadly speaking, November was a good month for equities, both in Australia and the U.S, however individual stock performance was concentrated in specific areas of the market, the reasons which we discuss below. The Portfolio gained 2.02% during the month of November, concluding with Equivalent Unit Price (EUP) of 1.0750.

| RAEMA | |

|---|---|

| Latest Month | 2.02% |

| Quarter to Date | 4.48% |

| Calendar Year to Date | -1.40% |

| Financial Year to Date | 7.77% |

| 12-month | -3.73% |

| Inception | 7.50% |

Monthly Commentary

There were two major events for the month, the first being the U.S Presidential election, while the second was several news announcements relating to the roll out of Covid-19 vaccines. Beginning with the US election, and while the results were closer than expected, the result was in line with prior polling, with Joe Biden declared the presumptive winner. Despite Donald Trump failing to formally concede at this point and pushing his case of voter fraud in several key swing states, a change in the US Presidency seems all but guaranteed. This has been met by optimism from equity investors, clearly excited by a return to a more predictable administration.

However, it was the announcement by Pfizer on Monday the 9th that the FDA had endorsed the safety and efficacy of their Covid-19 vaccine that led to sharp moves in specific areas of the market. As effective vaccines are perceived as a key requirement in enabling economies to reopen, it was the stocks that would directly benefit from this occurring that rallied. Such stocks tended to be the ones sold off the heaviest earlier in the year, such as travel, banking, energy, and property stocks. To highlight, the four best performing sectors from the ASX200 for the month of October were energy (+28.37%), financials (+15.23%), telecommunications (+13.63%), and real estate (+13.62%). While on the other hand, the consumer staples Index closed lower for the month, down 0.73%.

The announcement by Pfizer has since been followed by two other major pharmaceutical companies announcing that their vaccines are due for release, with the UK being the first major western country to authorize one for use. This week, the UK will begin its initial roll out of the Pfizer/BioNtech vaccine, with health care workers and the elderly in care homes amongst the first groups to receive it.

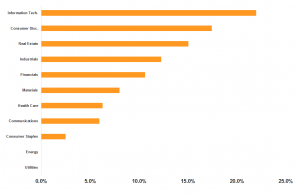

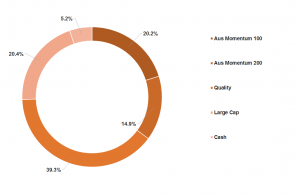

In terms of the current positioning of the portfolio, we have maintained a relatively aggressive weighting to equities over this time, with the cash weighting of the portfolio decreasing further from 10.2% at the end of October to just 5.2% by the end of November. Our systematic strategies all remain fully invested, expect for a slight reduction in ASX200 Momentum, while we have now deployed the full 20% allocation we have to discretionary decisions. Most of the stocks that we have chosen on a discretionary basis are those that we believe will benefit from economies reopening, such as financials, travel, and property, and are areas of the market which our systematic strategies are not overly exposed to at present. In terms of sector exposure, the information technology and consumer discretionary sectors remain our highest weightings at 22.0% and 17.4% respectively.

Looking ahead, and December tends to be a positive time for stocks, particularly in Australia. Based on data over the past 20 years, the average return for December for the ASX200 has been 1.42%, the second highest monthly average behind April (+1.63%). More so, we expect to see additional fiscal stimulus in the US early in the new year once the transition to a new administration occurs.

If you have any questions regarding the above or your investments with Rivkin in general, please call us on 02 8302 3605.

Performance

NAV Price Chart

Monthly Returns

Portfolio Composition

Sector Breakdown

Top 10 Stock Holdings

Strategy Weighting

Strategy Description & Information

The RAEMA Strategy invests predominantly in listed Australian companies whose characteristics satisfy one or more of the strategies that occupy the portfolio. These strategies include: Momentum 100 & 200, being two discreet segments (ASX 100 & ASX 200 ex the ASX 100) of securities that are enjoying positive price trends; Quality, being companies with robust earnings profiles that are priced favourably versus their peers; Income, being securities that provide a high yield relative to the broader market; and Low Volatility, which cushions market shocks.

Important Disclaimer

The Rivkin Australian Equity Managed Account is available to wholesale investors only. Past performance is not a reliable indicator of future performance. The value of your investment may rise and fall, and you may not receive the amount originally invested.

Contact

Thomas Silitonga – Director, Rivkin Asset Management

[email protected] – +612 8302 3605