Fund Objective: The Rivkin Australian Equity Fund aims to produce positive average annual returns while seeking to maintain a level of volatility lower than that of the S&P/ASX 200 Accumulation Index over the same investment period.

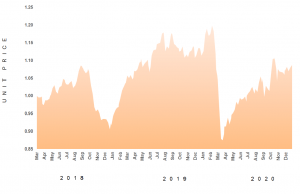

31 December 2020 Unit Price – A$1.0771

Welcome investors to the monthly update for the Australian Equity Fund (AEF) for December 2020. For the month of December, the AEF gained 1.55%, concluding with a NAV price of 1.0771.

| PORTFOLIOS | AEF |

|---|---|

| Latest Month | 1.55% |

| QTD | 6.11% |

| Calendar YTD | -3.42% |

| Financial YTD | 9.34% |

| 12m | -3.42% |

| Inception | 7.75% |

Monthly Commentary

December tends to be a quieter month for equities, with volumes declining markedly, particularly over the last two weeks, as Christmas holidays begin. Despite the decrease in activity, historically, December has also been a very positive one in terms of performance. Assessing the performance for 2020, after an early rally, the ASX200 drifted sideways for much of the month, keeping to a range between approximately 6,600 and 6,770, before closing at 6,587.1, for a gain of 1.21%.

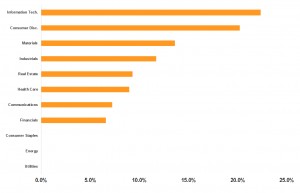

There were pockets of the market that performed quite strongly however, with many technology and materials companies doing quite well. This can be seen by the performance of the ASX200 Information Technology and Materials Indices which were up 9.4% and 8.8% respectively. On the other hand, utilities and healthcare stocks were weaker, with their indices declining 6.8% and 4.9%.

Overall, equity markets remain buoyant, despite much of the new flow remaining pessimistic. The two major global events at present remain the Covid-19 pandemic, which shows no sign of slowing. More so, despite the rollout of vaccines across the US and UK, infection rates continue to surge, leading to new lockdowns being imposed. Even in Australia, Brisbane has recently announced a 3-day hard lockdown, based on a confirmed case of the more virulent strain of the virus from the UK. Such measures, while necessary, will only serve to prolong the road to recovery within the real economy. The other major event is the transition in power in the US, which is going less than smoothly, thanks to continued claims for fraud from Trump. At least of this front, this should be well behind us come our update at the end of January, with Joe Biden due to be sworn in on Inauguration day, which is January 20th.

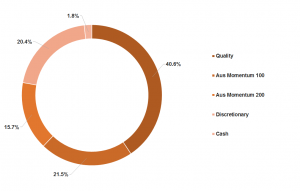

In terms of the current composition of the portfolio, there has been little change over the course of December. All of our strategies remain fully invested, and the Fund holds a minimal cash weighting as of month end at 1.8%. The information technology (22.4%) and consumer discretionary (20.2%) sectors remain are largest exposures. Afterpay (APT) and Pro Medicus (PME) were the top performing stocks for the month, gaining 24.2% and 15.6% respectively, while Appen was the major detractor, declining 21.7% in December. Please see the table below for the top 10 holdings, as well as the full sector and strategy weights as of December 31st.

2020 was quite an extraordinary year, both in terms of global events, but also share market performance. The speed of the February to March decline, as well as the relentless recovery since then goes to highlight the near impossible task of predicting stock market performance. It is partly for this reason, i.e. the difficulty in prediction, that so many of our strategies use a systematic approach to guide our investments. As it relates to our momentum strategies, which can and do go to cash when markets roll over, with strong uptrends currently in place, our portfolios remain fully invested as we start the new year.

If you have any questions regarding the above or your investments with Rivkin in general, please call us on 02 8302 3605.

Performance

NAV Price Chart

Monthly Returns

Portfolio Composition

Sector Breakdown

Top 10 Stock Holdings

Strategy Weighting

Fund Description & Information

The Fund invests predominantly in listed Australian companies whose characteristics satisfy one or more of the strategies that occupy the portfolio. These strategies include: Momentum 100 & 200, being two discreet segments (ASX 100 & ASX 200 ex the ASX 100) of securities that are enjoying positive price trends; Quality, being companies with robust earnings profiles that are priced favourably versus their peers; In addition, approximately 20% of the portfolio is held in a defensive strategy, which offers non-equity style returns.

Important Disclaimer

The Rivkin Australian Equity Fund is available to wholesale investors only. Past performance is not a reliable indicator of future performance. The value of your investment may rise and fall, and you may not receive the amount originally invested.

Contact

Thomas Silitonga – Director, Rivkin Asset Management

[email protected] – +612 8302 3605