Fund Objective: The Rivkin Australian Equity Fund aims to produce positive average annual returns while seeking to maintain a level of volatility lower than that of the S&P/ASX 200 Accumulation Index over the same investment period.

31 March 2021 Unit Price – A$1.0806

Welcome investors to the monthly update for the Australian Equity Fund (AEF) for March 2021. For the month of March, the AEF gained 2.99%, concluding with a NAV price of 1.0806.

| PORTFOLIOS | AEF |

|---|---|

| Latest Month | 2.99% |

| QTD | 0.32% |

| Calendar YTD | 0.32% |

| Financial YTD | 9.69% |

| 12m | 21.00% |

| Inception | 8.10% |

Monthly Commentary

Equity markets for the most part continued their slow but steady recovery from the March 2020 lows, but with a noticeable divergence between sectors. The ASX200 closed at the end of March at 6790, up roughly 1.5% for the month. In the US, the S&P500 closed at 3973 points (+160 points) which was a new all-time closing high. Technology stocks, however, were flat overall despite a late month rally, after a big sell-off in February. For the month of March, the AEF gained 2.99%, concluding with a NAV price of 1.0806.

The theme that accelerated in February continued throughout March, with the rotation from ‘growth’ stocks to ‘value’ stocks. The catalyst for this rotation has been the rapid climb in long-term government bond yields (particularly 10-year yields) as global economic growth expectations have improved and the potential impact that could have on inflation. At least towards the end of March, we have seen a ‘buy the dip’ mentality in these names as the growth stories remain unchanged despite the changing long-term bond yields. Our view remains that inflation is likely to be a short-term phenomenon until we see full employment and sustained wage growth in the US and locally, and the picture for equities therefore remains bright with supportive monetary and fiscal environments and rapidly recovering economies.

Throughout March, we did start to see a noticeable switch out of some of the beneficiaries of the pandemic (such as technology stocks and auto names) into some sectors a little left behind such as healthcare names such as Clinuvel Pharmaceuticals (CUV) and CSL Ltd (CSL). Healthcare names have lagged their peers in the US – perhaps a consequence of the falling USD – and with a bit of recent weakness in the AUD we have enjoyed some recent strength in these names.

In terms of our quantitative strategies, the Quality strategy has performed well throughout March, outperforming Momentum. In particular, Technology One (TNE), Elders (ELD) and CUV all gained roughly 10%, whereas the worst performing stocks for the month were Momentum holdings such as Fortescue Metals (FMG) and Afterpay (APT), down 11.7% and 15.1% respectively. This reversed the performance of February where Momentum outperformed Quality and demonstrates the benefit of holding both strategies to lower overall volatility.

If you have any questions regarding the above or your investments with Rivkin in general, please call us on 02 8302 3605.

Performance

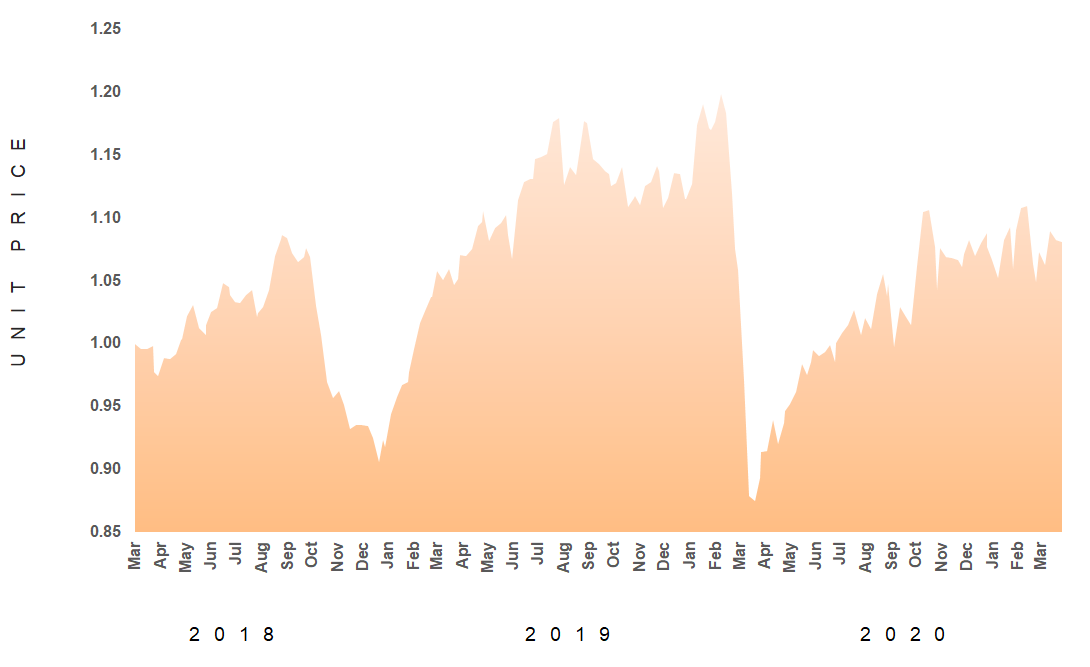

NAV Price Chart

Monthly Returns

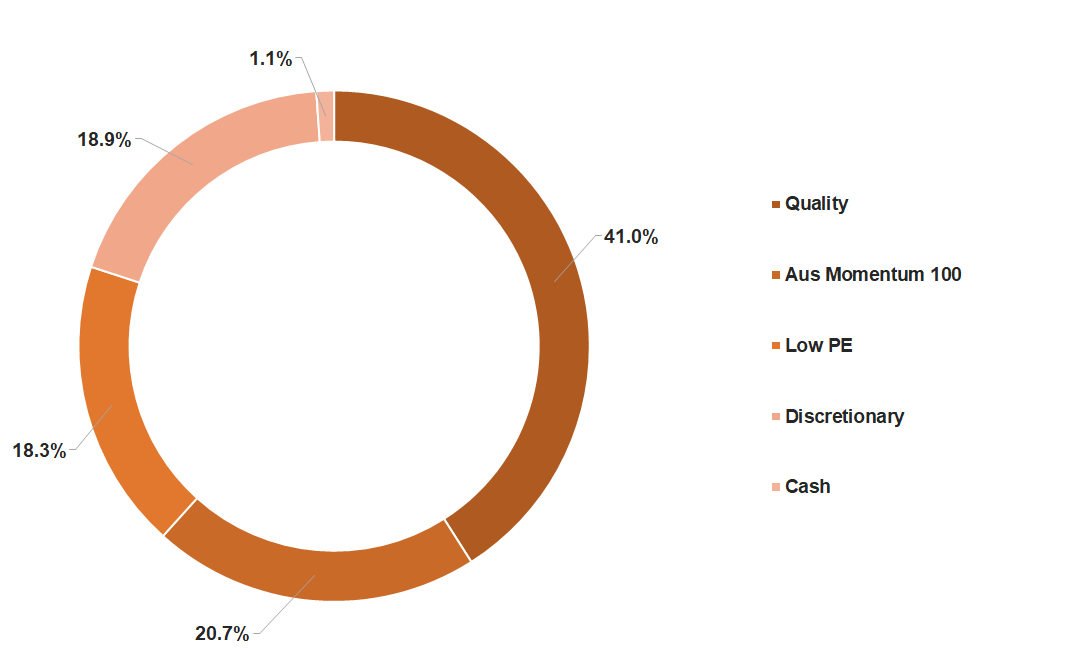

Portfolio Composition

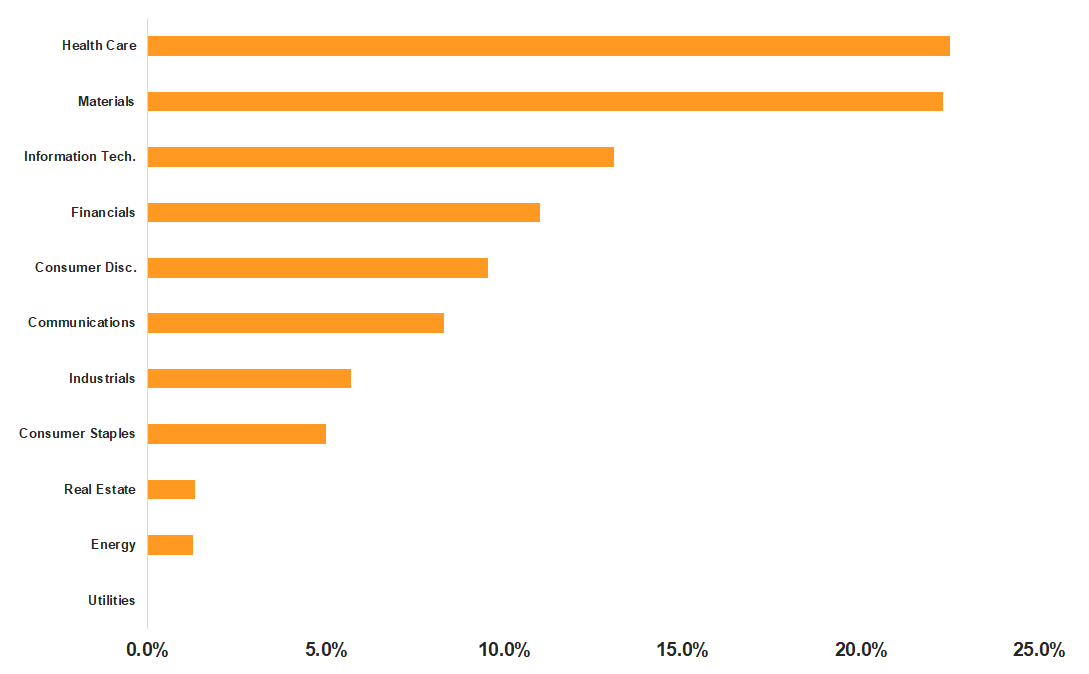

Sector Breakdown

Top 10 Stock Holdings

| Stock | Ticker | Sector | Weight |

| Clinuvel Pharmaceuticals | CUV | Health Care | 3.87% |

| Technology One | TNE | Information Tech. | 3.65% |

| Wisetech Global | WTC | Information Tech. | 3.58% |

| CSL | CSL | Health Care | 3.45% |

| Healius | HLS | Health Care | 3.42% |

| IDP Education | IEL | Consumer Disc. | 3.38% |

| Ramsay Health Care | RHC | Health Care | 3.36% |

| Reece | REH | Industrials | 2.88% |

| Nine Entertainment | NEC | Communications | 2.80% |

| Washington H Soul Pattinson | SOL | Materials | 2.75% |

Strategy Weighting

Fund Description & Information

The Fund invests predominantly in listed Australian companies whose characteristics satisfy one or more of the strategies that occupy the portfolio. These strategies include: Momentum 100 & 200, being two discreet segments (ASX 100 & ASX 200 ex the ASX 100) of securities that are enjoying positive price trends; Quality, being companies with robust earnings profiles that are priced favourably versus their peers; In addition, approximately 20% of the portfolio is held in a defensive strategy, which offers non-equity style returns.

Important Disclaimer

The Rivkin Australian Equity Fund is available to wholesale investors only. Past performance is not a reliable indicator of future performance. The value of your investment may rise and fall, and you may not receive the amount originally invested.

Contact

Thomas Silitonga – Director, Rivkin Asset Management

[email protected] – +612 8302 3605