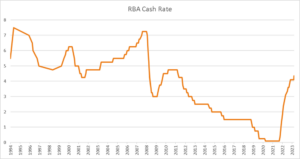

As widely forecast by economists, the Reserve Bank of Australia (RBA) has lifted interest rates by 0.25% bringing the cash rate to 4.35%, the highest level in 12 years.

Financial markets are reacting to the news very much in the style of “buy the rumour, sell the fact”, with the Australian dollar notably weaker, and equities reversing earlier losses to be little changed. The main reaction seems to be around dovish language in Governor Michelle Bullock’s statement which accompanied the decision, notably “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks”.

Given the lagging effect of tightening flowing through to the economy, this tempering of expectations suggests that the RBA is likely to join major global central banks in having reached a peak in the current cycle – presuming there is no sustained resurgence in inflation. Like other major central banks, the emphasis for the RBA is shifting to ensuring they do not overtighten and cause unnecessary damage to the economy as they seek to engineer a soft landing. Further details on their outlook will come on Friday with the latest release of the quarterly statement on monetary policy.

Inflation is projected to remain above the RBA’s 2-3% target into 2025, leaving room for further rate adjustments. This contrasts with the U.S., where rate cuts are foreseen next year amid rising unemployment. The RBA forecasts inflation at approximately 3.5% by end-2024 and at the upper end of the target by end-2025, a slight slowdown from previous expectations.

In reaction, the Australian dollar is -0.48% lower at 0.6458 while the ASX200 has pared back earlier losses of as much as -0.65% to be -0.15% lower. Financial markets are still pricing the potential for a further rate hike, currently sitting around 50% based on RBA cash rate futures.