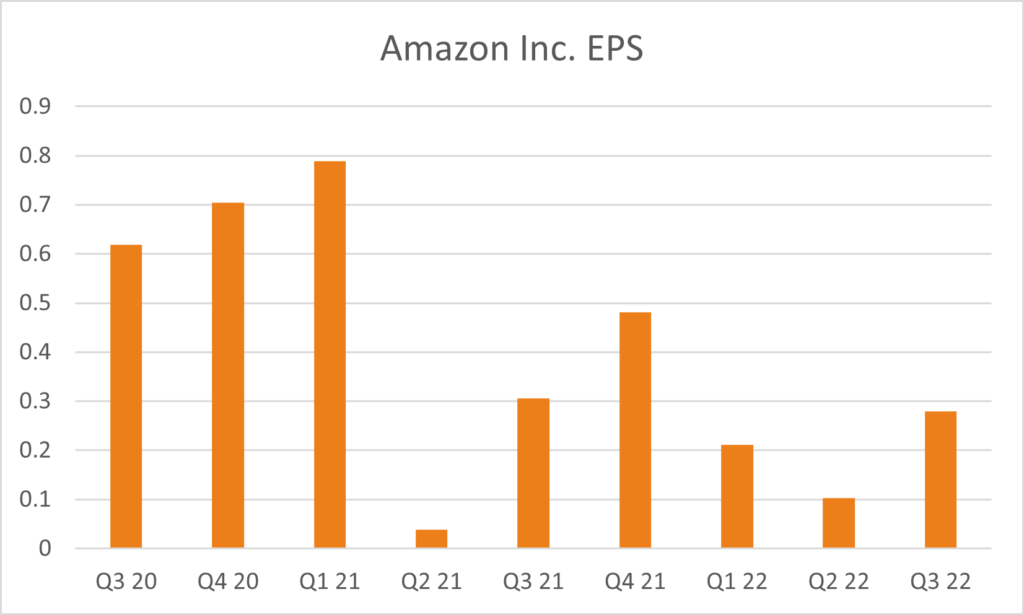

Amazon.com Inc. (AMZN) reported revenue of $127 billion, 15% higher than last year with an EPS of $0.28.

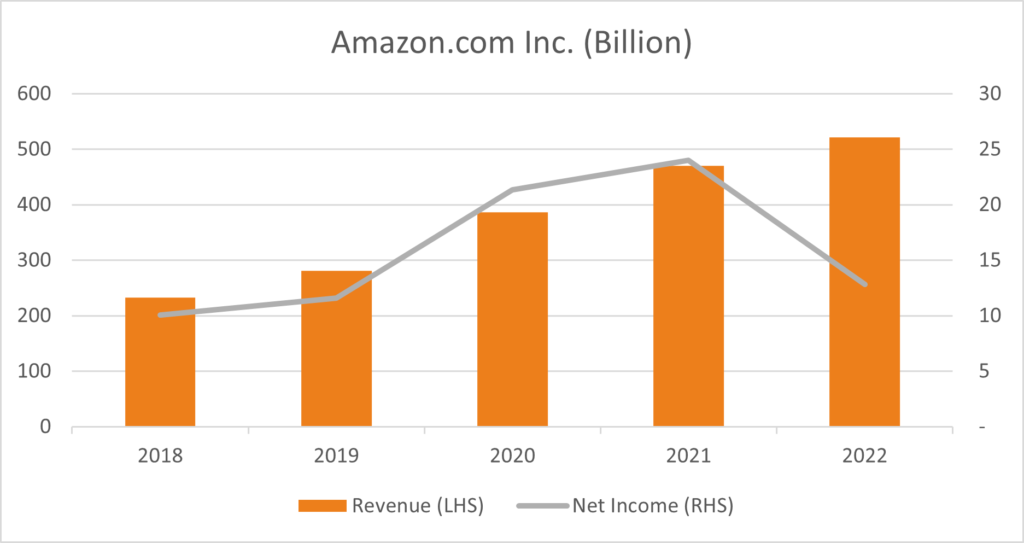

Amazon.com Inc. (AMZN) reported earnings for the quarter ended 30 September 2022 on Thursday, with revenue of $127 billion, 15% higher on a year-on-year comparison and 5% higher than the previous quarter, but fell short of estimates by $535 million. Segment wise, sales in the US were the highest contributor ($78.8 billion), followed by International sales ($27.7 billion) and AWS ($20.5 billion). The company provided guidance on the sales forecast for the upcoming quarter to range between $140 to $148 billion, taking into account headwinds from foreign exchange. AMZN’s net income was $2.87 billion, nearly double compared to the last quarter’s net income of $1.05 billion, but fell nearly –10% from last year’s $3.1 billion net income for the same period.

CEO Andy Jassy assured investors of the company’s direction stating, “There is obviously a lot happening in the macroeconomic environment, and we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets. What won’t change is our maniacal focus on the customer experience, and we feel confident that we’re ready to deliver a great experience for customers this holiday shopping season.”

EPS was $0.28, double last quarter’s EPS of $0.1, but below estimates of $0.44 and -8% lower compared to last year’s EPS of $0.31. AMZN’s share price fell -20.47% in after-hours trading to close at $110.96. Analysts, however, continue to hold a positive outlook on the stock. Out of the 58 analysts covering the stock on Wall Street, 95% recommend a buy, with only 3% recommending a hold, and one analyst recommending sell, with a consensus on the twelve months share price of $165.71.