Equities rose along with Treasury yields and the US dollar on Monday ahead of Tuesday’s CPI report

United States

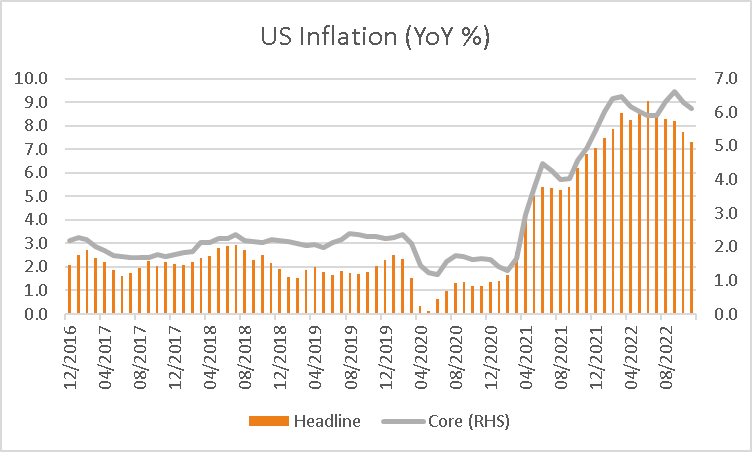

US equities started the week on a stronger note with monetary policy decisions from the Fed, ECB and BOE in focus as well as Tuesday’s CPI print. Expectations are for headline inflation to have risen 0.3% over the month of November, down from 0.4% in October and rise 7.3% over the year, slowing from 7.7% previously. Core inflation is expected to remain stable at 0.3% over the month and rise at a more modest pace of 6.1% over the year from 6.3% previously. The data is the final piece of key information before the Federal Reserve meets on Wednesday where it is widely tipped to slow the pace of rate increases to 0.5% from 0.75%. Updated economic projections known as “dot plots” will also accompany the decision, providing insight into the expected path of future interest rates as well as inflation, the labour market and economic growth. Should the inflation print come in line with expectations or below it would give the green light for the Fed to ease off from aggressive rate increases. However, investors expecting a similar surge following October’s softer-than-expected reading should consider what is currently priced in by financial markets. We never know exactly how much is priced in, and we may see a classic case of “buy the rumour, sell the fact” given the clear narrative that inflation has peaked for now.

The S&P500 climbed 1.43% along with the Dow Jones 1.58%, Nasdaq Composite 1.20% and Russell 2000 1.22% while the VIX jumped 9.46% to 24.99. The higher VIX is surprising given it typically has an inverse relationship to equities, suggesting that investors are adding hedges ahead of the inflation reading and policy decision. Treasury yields also rose across the curve with the 2-year up 4.2 basis points to 4.386% along with both the 10 and 30-year rates by 3.1 and 1.2 basis points respectively with the US Dollar index up 0.21% to 105.025.

Europe

European equities were lower on Monday ahead of decisions from the ECB and BOE on Thursday with both central banks expected to lift rates by 0.50%. The Euro Stoxx 600 declined -0.49% along with the DAX -0.45%, CAC -0.41% and FTSE100 -0.41%. Strategists at Sanford C. Bernstein said they see short-term pressure for European stocks with earnings downgrades and fund outflows, while the longer-term picture is improving with moderating inflation and China’s reopening. Among individual movers, London Stock Exchange Group was a notable performer, up 2.97% after Microsoft agreed to buy a 4% stake as part of a broader deal to migrate the exchange’s data to the cloud. In focus tonight is the release of UK employment for September expected to show a decrease of -17k jobs and the unemployment rate tick higher to 3.7% from 3.6%. The ZEW Economic sentiment indices for December will also be released for the Eurozone and Germany, expected to show an improvement from November although remain deeply in pessimistic territory.

*Note: These prices are based on futures and/or CFD pricing and may therefore differ slightly from spot pricing.

Australia

The ASX is expected to open higher this morning with ASX200 futures up 48 points or 0.67% to 7,232. The index declined -0.45% to start the week with the Federal Government’s proposed gas price cap due to be legislated this week weighing on sentiment. In reaction Origin energy shares fell -7.8% as investors assessed whether last month’s proposed $9 per share takeover offer from Brookfield and MidOcean would fall over given it was a non-binding offer. Shares in Tyro Payments slumped -19.5% after Westpac walked away from talks with the payments company, with Tyro also knocking back a separate increased offer of $1.60 from Potentia Capital. Elsewhere, shares in Nitro Software rose 4.7% after recommending an increased offer of $2.15 from Alludo, a 7.5% increase on the prior offer from Potentia Capital of $2. In focus for economic data today is the release of the Westpac consumer confidence index for December due out at 10:30 AEDT.

Commodities

Oil prices rose overnight with both WTI and Brent crude up 3.45% and 2.85% respectively to US$73.47 and US$78.27 a barrel. Strategists at Bank of America see a more positive outlook for crude noting “longer dated oil prices have been more resilient, pointing to a much more constructive market over the next 12 to 36 months as China reopens and the US and Europe come out of recession”. Iron ore futures in Singapore finished -1.91% weaker on Monday and are a further -0.54% lower this morning at US$108.80 with copper also -2.09% lower. Gold declined -0.90% to US$1,781 an oz along with silver -0.74% while Bitcoin edged 0.27% higher to US$17,160.

Economic data:

- Australian Consumer Confidence (MoM Dec) 10:30

- German Inflation Final (YoY Nov) 18:00

- UK Employment (MoM Sep) 18:00

- Eurozone Economic Sentiment (MoM Dec) 21:00

- US Inflation (YoY Nov) 00:30

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.