U.S. equities were lower on Wednesday along with bonds yields with the risk of a recession in 2023 weighing on sentiment.

United States

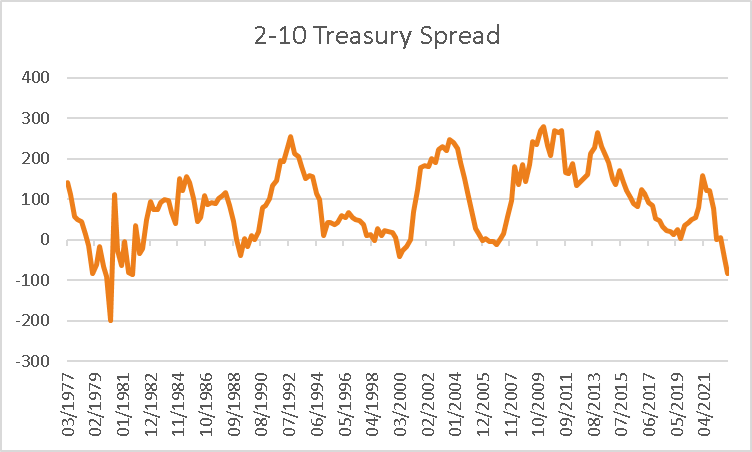

The S&P500 edged -0.19% lower on Wednesday along with the Nasdaq Composite -0.51% and Russell 2000 -0.31% with the Dow Jones unchanged and the VIX rising 2.35% to 22.69. There was little economic data to guide investors as markets continue to correct following a strong rally from the October lows, a healthy part of trending moves in markets. In a sign investors remained concerned about the outlook for economic growth, the spread between the 2 and 10-year Treasury yields remains the most inverted since the early 1980’s highlighting investors expect rates to be lower in the coming years as economic growth slows. Yields were lower across the board with the 2-year rate down -11.7 basis points to 4.25% with both the 10 and 30-year rates -12.4 and -12.6 basis points lower respectively.

Nicholas Colas at DataTrek Research noted the spread between two and 10-year rates is extremely wide, spooking equity traders. That’s a signal that markets believe the Fed policy is “very, very restrictive” and “The last time we were here was at the start of the Volcker recession”. Now we have a Fed that is still talking about ‘higher for longer’ rates. Markets are essentially saying there will be another man-made economic contraction soon: the Powell recession”.

Europe

European equities were also lower with geopolitical risks weighing on sentiment. Russian President Vladimir Putin warned the threat of nuclear war is rising and reiterated Russia will defend itself and allies with “all means if necessary”. The Euro Stoxx 600 finished -0.62% lower along with the DAX -0.57%, CAC -0.41%, and FTSE100 -0.43%. Also weighing on sentiment was weaker data from China on Wednesday that showed the country’s exports and imports both contracted at a steeper rate than expected. Exports in dollar terms declined -9% year-on-year, the largest contraction since the first COVID lockdowns. While European stocks are on track for their best quarter since 2020, strategists maintain a cautious outlook for 2023 with the average forecast suggesting just a 2% gain from Wednesday’s close although sector performance will likely vary greatly.

*Note: These prices are based on futures and/or CFD pricing and may therefore differ slightly from spot pricing.

Australia

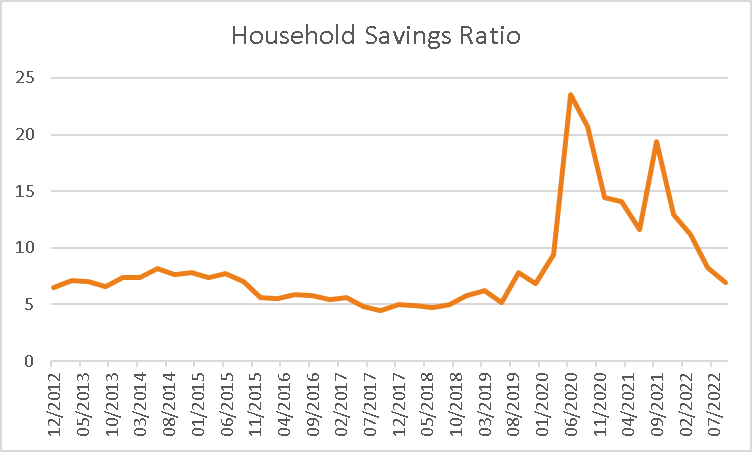

The ASX is expected to open modestly lower this morning with ASX200 futures down -16 points or -0.22% to 7,230. The index declined -0.75% on Wednesday with materials 0.22% the only positive sector while technology -3.29% led declines. Economic growth for Q3 over the 12 months was lower than forecast at 5.9% compared to estimates of 6.2% rising 0.6% over the quarter, down from 0.9% previously. Economists were quick to note the data does not fully reflect the impact of the RBA’s aggressive tightening and forecasts for slowing growth in 2023 are adding to calls for the RBA to pause interest rates or only lift them very modestly from current levels. Also adding weight to the case for monetary policy to proceed cautiously, the household savings rate declined to 6.9% in Q3 and has been is a relatively steady downtrend since mid-2020 and households draw on excess cash, something that is likely to continue as roughly 1/3 of home loans are still on fixed rates that will expire in the latter half of 2023 seeing borrowers faced with sharply higher repayments.

Commodities

Oil prices were also lower overnight as investors assessed the outlook for demand should economic growth slow as forecast. Both WTI and Brent crude traded -2.44% and -2.33% lower respectively at US$72.44 and US$77.50 a barrel. Iron ore futures in Singapore finished -1.94% lower on Wednesday although are 0.33% higher at US$106.45 this morning with copper gaining 1.13%. Gold rose 0.85% to US$1,786 supported by lower yields, the more volatile silver rose 2.36% to US$22.72 while Bitcoin declined -1% to US$16,824.

Economic data:

- Australian Balance of Trade (MoM Oct) 11:30

- ECB President Lagarde Speech 23:000

- US Initial Jobless Claims (Dec 3rd) 00:30

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.