US equities were mixed on Thursday as prices remain around key technical levels and investors await Friday’s employment report.

United States

The markets attempted to rally on Thursday on the news of a pullback by the Fed on interest rate hikes while traders witnessed a shift in the S&P 200 moving day average and technical resistance around 4,115. The S&P 500 edged -0.09 % lower along with the Dow Jones -0.56% while the Nasdaq Composite edged 0.13% higher. Elsewhere the Russell 2000 weakened -0.26% along with the VIX -3.45% to 19.87.

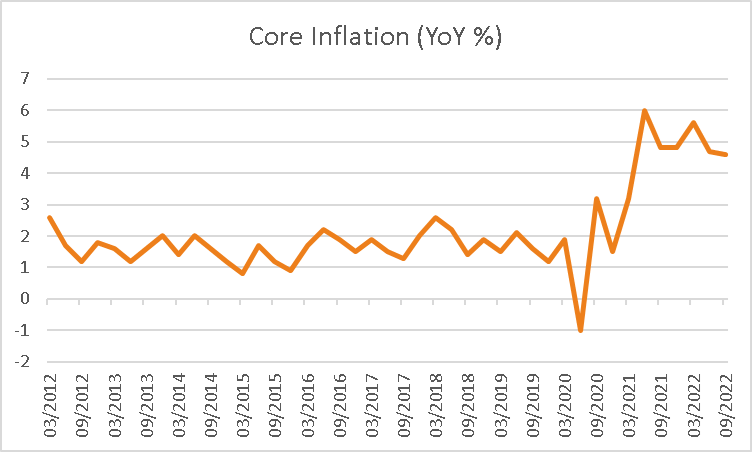

Economic data revealed PCE inflation was 6% in October, compared to 6.3% in September while core inflation in October was 5%, rising at a slower pace compared to the previous month.The year-on-year readings were in line with estimates, while the monthly readings were modestly below forecasts, and the data adds weight to the recent narrative that inflation has reached a peak for now. Meanwhile, jobless claims for the week ending November 26th declined to 225k from 240k previously, modestly below estimates. Elsewhere, the ISM manufacturing PMI report for November declined more than forecast to 49 missing estimates of 49.8 and is now in contractionary territory, adding to recessionary risks. Investor focus will now shift towards the non-farm payrolls data and unemployment rate to be released on Saturday. TD Securities weighed in their expectations on the upcoming reports, “We expect payrolls to have continued to lose steam at the margin in November, reflecting modest deceleration vs the 261k print registered in October.”, adding “We also look for the unemployment rate to remain steady at 3.7%, as we are also assuming a modest improvement in the labor force.”

Europe

European markets extended recent gains, buoyed by hopes of easing COVID policies in China as well as Jerome Powell’s speech on Thursday that the Federal Reserve was likely to slow the pace of rate increases. The Euro Stoxx 600 gained 0.63% higher, boosted by information technology, utilities and industrials which rose by 2.99%, 1.5% and 1.19% respectively. The CAC gained 0.23%, the Dax 0.65% while the FTSE 0.31%. In economic data, the final reading of manufacturing PMI for the Eurozone in November was lower than expected at 47.1 versus 47.3 remaining well within contractionary territory adding weight to the view the region is entering a recession.

*Note: These prices are based on futures and/or CFD pricing and may therefore differ slightly from spot pricing.

Australia

The ASX is expected to open lower this morning, with ASX futures down 18 points or 0.24% to 7,348. The ASX rose by 0.96% on Thursday, with 83% of the index closing higher than the previous day. Stocks rallied on optimism of the Fed slowing the pace of interest rate hikes and China’s easing its COVID lockdown policies. Energy and healthcare were the only underperformers, sliding by -0.84% and -0.37% respectively. The biggest winner was the materials sector climbing 2.65%, followed by utilities 1.17% and real estate by 1.05%. South32 gained 6.7%, Sandfire Resources 5.2% and Alumina 4.3%. BlueChips Rio Tinto, Fortescue and BHP added 3.3%, 3% and 2.1% respectively. Technology firms rallied, with Block climbing 7.4%, Xero jumping 6.2% and Megaport up by 4.6%. The banking sector held steady, ANZ firmed 0.9%, Westpac 0.6%, Commonwealth Bank 0.5% and NAB 0.4%. The biggest winner for the day was Ramelius Resources soaring 10.53% while HMC Capital dropped -7.28%.

Commodities

Commodity prices were boosted by the news of China reducing COVID-19 lockdown policies. WTI rose by 0.89% to $81.27 while Brent slipped -0.01% to $89.96. In precious metals, spot gold climbed 1.91% to $1,802.22, spot silver jumped 2.37% to $22.72. Industrials metals fared better with copper prices rising by 1.65% to $379, 0.53% to $26,880, and SGX Iron Ore slipping -0.14% to $99.76. Meanwhile the price of Bitcoin rose by 0.3% to $16,943.

Economic Data:

- Australian Retail Sales MoM Final (Oct) 11:00

- RBA Gov Lowe Speech 13:00

- Canadian Unemployment Rate (Nov) 00:30

- US Non-Farm Payrolls (Nov) 00:30

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.