U.S. equities edged lower on Wednesday, paring initial gains after Jerome Powell’s testimony before Congress noted the increasing probability of recession, suggesting the Fed may soon become more data dependant and aggressive monetary policy is not on autopilot.

In semi-annual testimony on Wednesday, Powell signaled the Federal Reserve will factor in economic fundamentals and the possibility of a recession as it moves to curtail inflation. While Powell admitted the Fed had failed to get the job done on inflation, it would be difficult to engineer a “soft landing” while making no mention of the size of future hikes. Demand in rate-sensitive sectors is already showing signs of cooling, and consumers are in good shape, he added. Elsewhere Patrick Harker said the U.S. could experience a couple of quarters of negative growth and that he wants to see rates at +3% by the end of the year. Charles Evans said another +0.75% increase is a “very reasonable place” for discussion at the July meeting but doesn’t believe that a +1.0% increase is necessary.

The S&P500 reversed an initial gain of up to +0.98% before edging -0.13% lower with health care +1.42% offsetting weakness in energy -4.19% in mixed breadth with +50% of stocks rising. The Dow Jones was also -0.15% weaker along with the Nasdaq Composite -0.15% and Russell 2000 -0.22% with the VIX retreating -4.11% to 28.95. Treasury yields declined across the curve benefiting from the Fed likely becoming more data-dependent in the coming months with the 2-year yield down -13.8 basis points to 3.056%, as did both the 10 and 30-year rates by -11.3 and -8.6 basis points respectively with the U.S. dollar index weakening -0.22% to 104.21. In focus tonight are PMI reports for June expected to show manufacturing moved lower to 56 from 57 previously and services was little changed at 53.5 and Powell will give a second day of testimony.

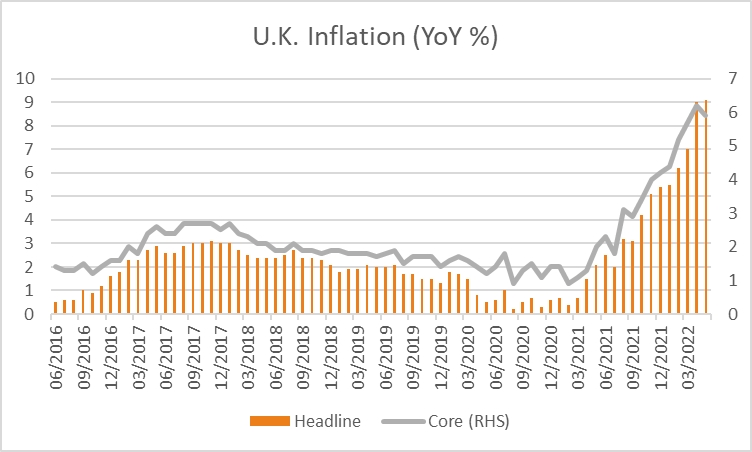

European equities were lower taking a weak lead from U.S. futures as well as high U.K. inflation weighing on sentiment. For the 12-months to May, U.K. headline inflation rose +9.1 as forecast from +9.0 previously, while the core measure moderated more than expected, rising at +5.9% compared to estimates of +6% and a prior reading of +6.2%. The Euro Stoxx 600 declined -0.70%, as did the DAX -1.11%, CAC -0.81% and FTSE100 -0.88% with benchmarks lower across the region. In focus tonight are PMI reports for June expected to show economic activity slowed across both manufacturing and services in the Eurozone, Germany, and U.K.

*Note: These prices are based on futures and/or CFD pricing and may therefore differ slightly from spot pricing.

The ASX looks set to open higher this morning with ASX200 futures up +27 points or +0.42% to 6,416. The index reversed initial gains to finish -0.23% lower on Wednesday with financials -0.40% and consumer discretionary -1.36% offsetting a +1.52% gain in energy. Shares in ZIP co tumbled -11.4% despite management moving to reassure investors of its operating performance noting it was “well-placed to respond to, and offset, the effects of rising interest rates” as the stock has fallen -96% since its February 2021 high. St Barbara was a notable underperformer, falling -18.1% after announcing a strategic review on whether to proceed with a project to extend the life of its Simberi mine in Papua New Guinea. The Australian dollar is -0.63% weaker at 0.6927 overnight and the 10-year government bond yield declined -7.8 basis points to 3.986% ahead of manufacturing and services PMI data for June out at 09:00 AEDT.

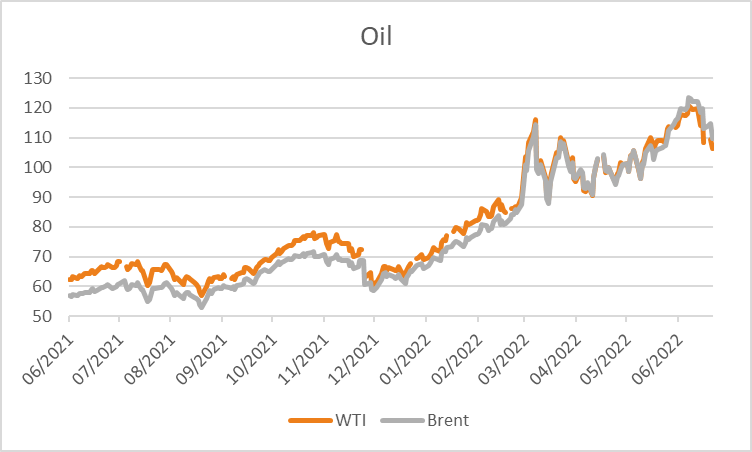

Oil prices fell overnight after API crude oil stockpiles unexpectedly climbed for the week ending June 17th by +5.607 million barrels compared to estimates of a -1.433 million barrel draw. The price of oil has also been under pressure lately as concerns of a recession outweigh tight supply. Both WTI and Brent crude weakened -4.78% and -4.18% respectively to US$104.38 and US$109.98 a barrel. Iron ore futures in Singapore fell -5.89% on Wednesday although have partially reversed those losses in early trade this morning being +3.11% higher at US$111.50. Gold edged +0.26% higher to US$1,837.72 an oz, while silver fell -1.24% to US$21.42 along with Bitcoin -4.71% to US$19,857.

Economic data:

- Australian PMI (MoM Jun) 09:00

- Eurozone PMI (MoM Jun) 18:00

- U.K. PMI (MoM Jun) 18:30

- U.S. Initial Jobless Claims (18th Jun) 22:30

- U.S. PMI (MoM Jun) 23:45

- Fed Chair Powell Testimony 00:00

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.