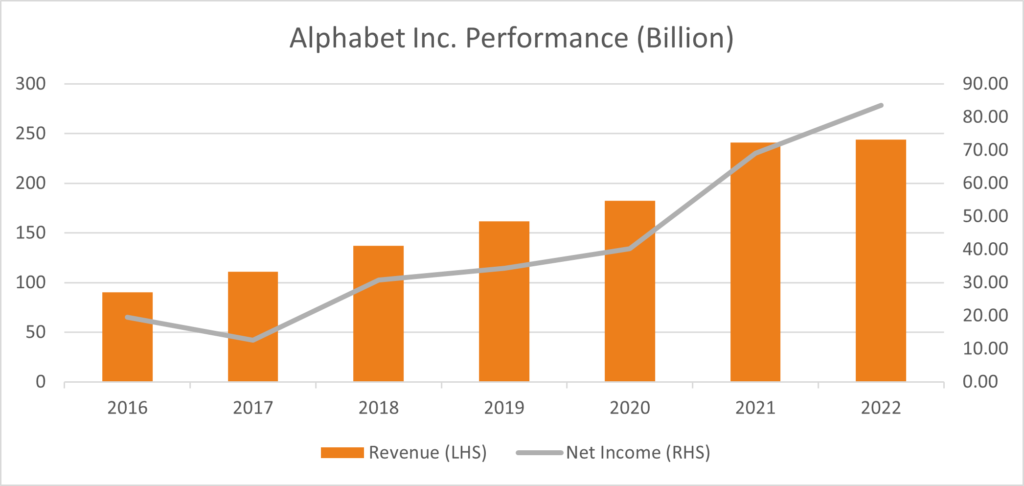

Alphabet Inc. (GOOG) posted revenues of US$56 billion for the first quarter of 2022.

Alphabet Inc. (GOOG), the parent company of Google, fell just short of analyst’s estimates of US$56.1 billion (-0.17%). Segment wise, search advertising added US$39.6 billion, Youtube added US$6.9 billion, cloud sales US$5.82 billion, and others making up the remaining US$3.68 billion. Net Income was at US$16.4 billion, below analyst’s estimates of US$18.9 billion (-13.0%).

CEO Sundar Pichai commented on the company’s performance and future investments:

“Q1 saw strong growth in Search and Cloud, in particular, which are both helping people and businesses as the digital transformation continues. We’ll keep investing in great products and services, and creating opportunities for partners and local communities around the world.”

CFO of Alphabet and Google Ruth Porat highlighted that revenue had been affected by the on-going conflict in Europe and its impact on advertising:

“There was a bit of a pullback on ad spend in Europe,” and “there’s a lot of uncertainty in the macro environment”. She continued by adding that the company aims to continue investing in capex and R&D, “We continue to make considered investments in Capex, R&D and talent to support long-term value creation for all stakeholders.”

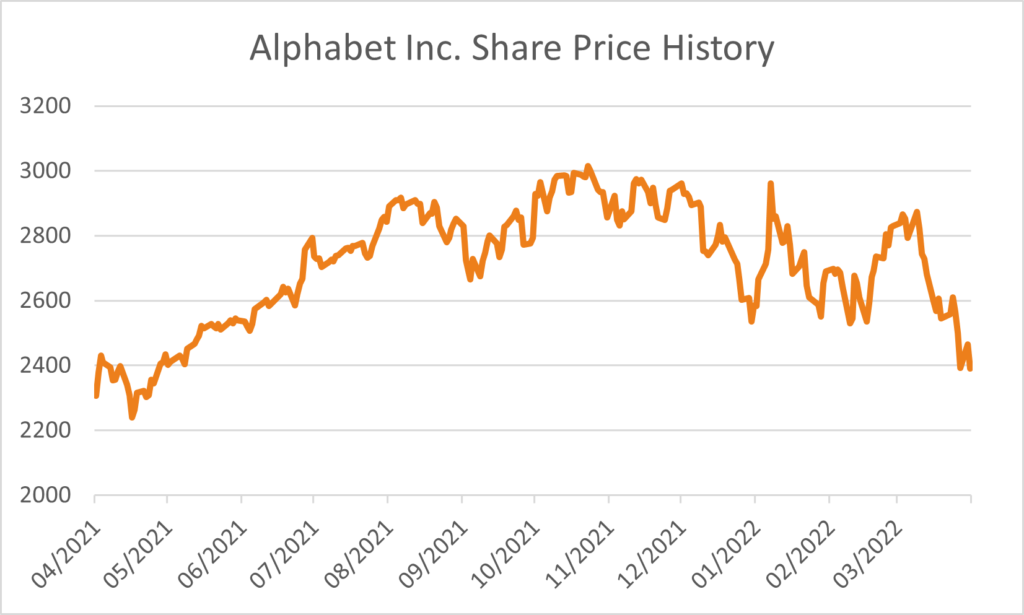

GOOG’s reported an earnings per share (EPS) of US$24.62, on the back of announcing a US$70 billion share buyback on April 20, 2022. The share price declined by -3% to $2390.12 on Tuesday, notably the stock price has declined -15% from a price of US$2830.42 over the past month. However, out of the 12 analysts on Bloomberg covering the stock, all have a buy recommendation with a consensus share price target of US$3,265.89.