Alphabet (GOOG), a current holding within the US Growth portfolio, has reported Q4 earnings after the market close on Tuesday with shares falling despite headline beats in both revenue and earnings.

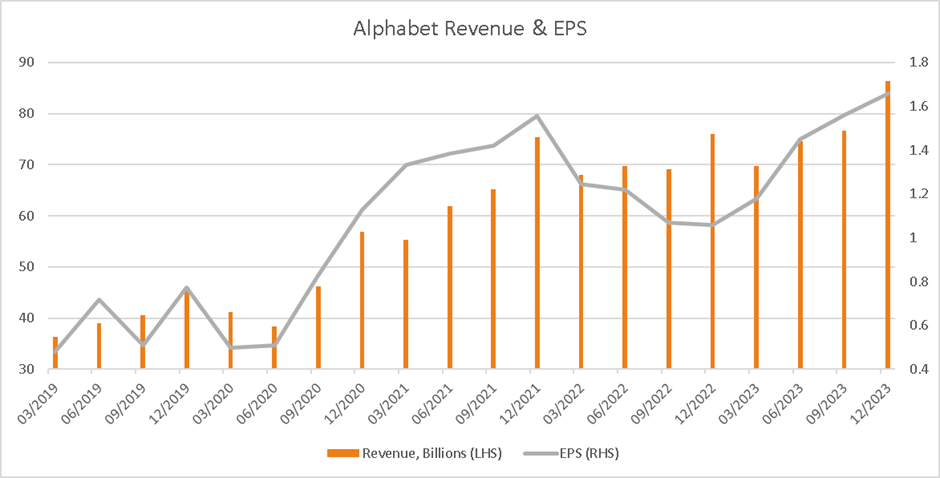

Headline revenue came in at $86.31 billion, above estimates of $85.36 billion with earnings per share also topping estimates of $1.59 with an actual of $1.64. However, investors are reacting to a miss in revenue for Alphabet’s core search business was $48 billion versus analysts’ projections for $48.15 billion, a likely cause of the weakness after hours. Despite these challenges, Alphabet’s cloud unit showed remarkable performance, reporting an operating profit of $864 million, well above the expected $427 million. This marks the first full year of profitability for Google Cloud, a sign of a maturing and potentially lucrative segment of the business.

The disappointing results come at a time of broader uncertainty for Google’s search engine, which has dominated the global internet for years and is the subject of a major antitrust case. Its leading position is threatened by new competition as the rise of generative AI has enabled companies like Microsoft Corp. and OpenAI to deliver programs that answer users’ questions in a more conversational fashion, like the wildly popular chatbot ChatGPT.

Wall Street had high expectations for Alphabet’s efforts in AI, pushing the stock up almost 60% over the past 12 months, valuing the company at nearly $2 trillion. But now investors are looking for a sense of when the technology will actually start moving the needle for earnings and revenue.

Alphabet has raced to weave the new AI technology into its own products, and last month released its most powerful large language model, called Gemini to compete with Open AI’s ChatGPT. But Alphabet has been dogged by concerns that it’s been too slow to capitalize on the shift in the market and has been playing catch up to Microsoft in the AI race.

Overall, despite the miss in the core search business, the headline figures from Alphabet are encouraging and reflect a quality business. The reaction in the share price should also be viewed in the context of recent gains which have seen shares surge 53% in the past twelve months, leaving investors with little appetite for a miss in expectations. Rather than reflecting a shift in the outlook for the stock, we see this as reasonable reaction with some of the froth coming out of the stock after strong gains.