Caterpillar Inc. (CAT) designs, manufactures, and markets construction, mining, and forestry machinery.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating | Next Earnings Announcement |

| 85.08 – 199.11 | 2,974,974 | 104,848.8 | 2.1% | 99.8% | 208.57 | 3.80 | 29/04/2021 |

*5 – strong buy, 1- strong sell

Caterpillar Inc. (CAT) designs, manufactures and markets construction, mining, and forestry machinery. Caterpillar is the world’s largest manufacturer of construction and mining equipment, including excavators, loaders, and tractors as well as forestry, paving, tunnelling machinery, diesel engines, gas turbines and diesel-electric trains. Its products are distributed worldwide to dealers and customers with subsidiary Caterpillar Financial Services offering financing products and services while its Progress Rail Services subsidiary offers remanufacturing and rail-related maintenance services.

CAT operates across two main segments, machinery, energy and transportation, and financial products. Machinery, energy and transportation is by far the largest segment, accounting for 93% of revenue in the 2020 financial year, with construction industries across infrastructure, forestry and building account for 40% of the segment, followed by energy and transportation which produces and sells engines, turbines and electric locomotives at around 35% of the segment. Resource industries account for the remaining portion of the segment which produces and sells machinery for mining, quarry, waste and material handling as well as technology for customers fleet management systems, equipment management analytics and autonomous machine capabilities. The second main segment is financial products which totalled 7% of revenue in 2020 and provides financing to Caterpillar customers and dealers, with most dealers independently owned outside of Japan.

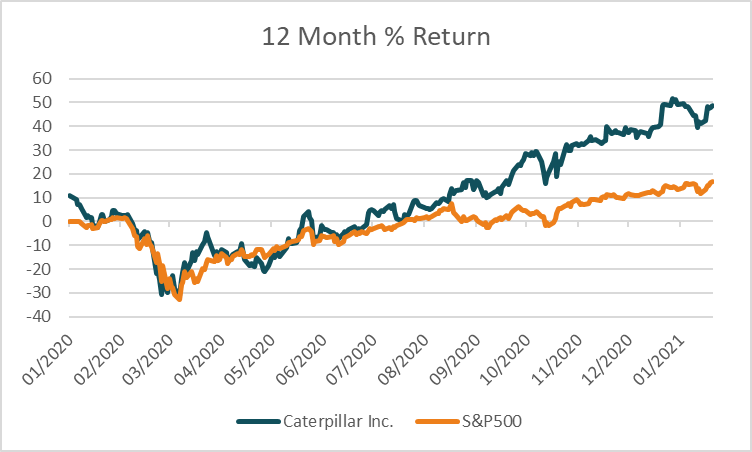

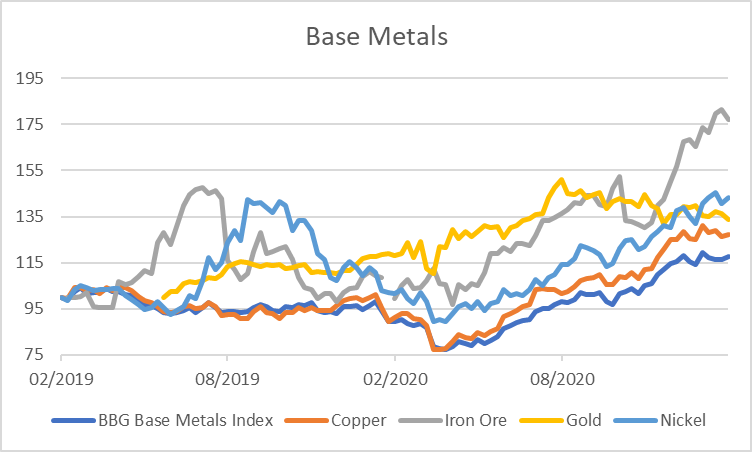

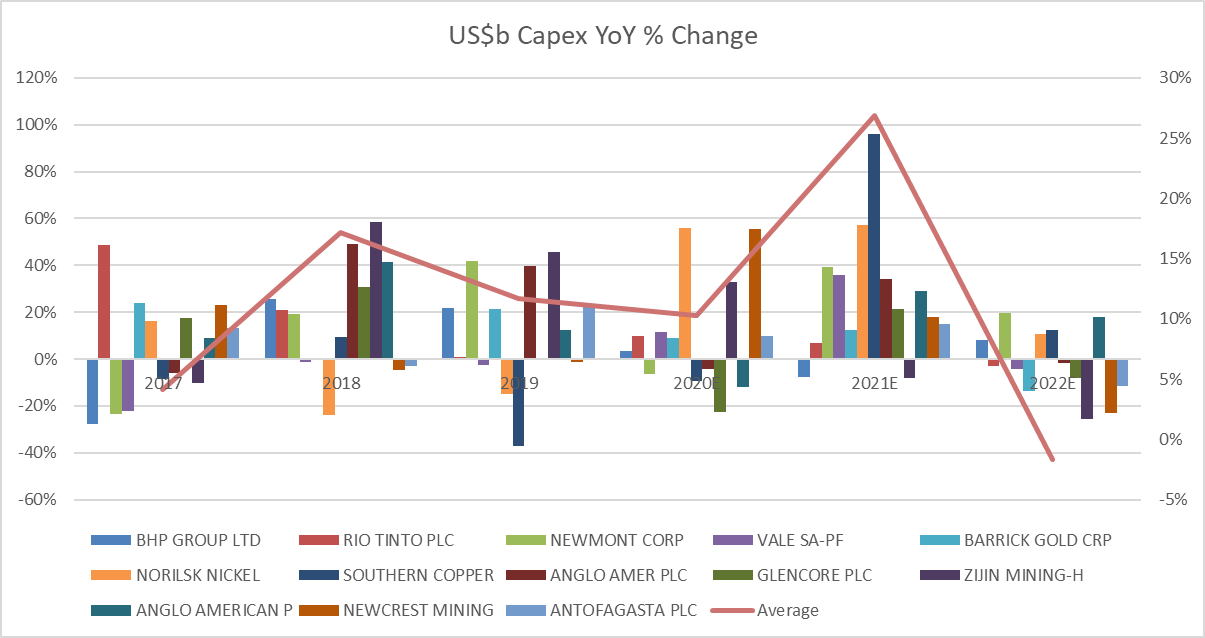

Caterpillar stands to benefit from the post-pandemic recovery, particularly as extradentary monetary and fiscal support is set to see infrastructure spending rise as part of a reflationary trade, of which CAT will be a major beneficiary. Improving growth prospects globally will accelerate end-user demand in construction and mining markets, with double-digit growth forecast for Caterpillar in 2021/2022. Mining capital expenditure is expected to rise as companies replace ageing fleets to take advantage of rising commodity prices, and with spending well below the peaks in 2012/2013 there is further room to run. Key drivers of mining-equipment demand as the prices of gold, nickel, zinc, copper and iron ore, with the 12-month price returns shown below along with the Bloomberg base metals index.

A key focus for future growth in services, with management targeting the doubling of revenue to US$28b by 2026. Services is one of the largest opportunities for organic growth and will help to reduce the cyclical nature of earnings and in-turn improving long-term profitability. Additionally, management is targeting 3-6% improvement in operating margins through structural cost reductions.

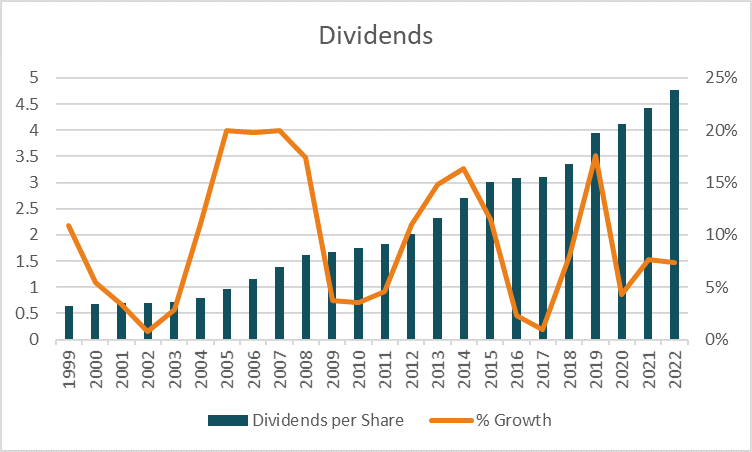

Additionally, Caterpillar is considered a dividend-paying stock, having increased the yearly pay-out each of the past 27 years and part of the S&P500 Dividend Aristocrats. The dividend remains a priority for the company, and with a strong balance sheet and free cash flow generation, there is further room to increase the dividend with management targeting high single-digit growth over each of the next four years.

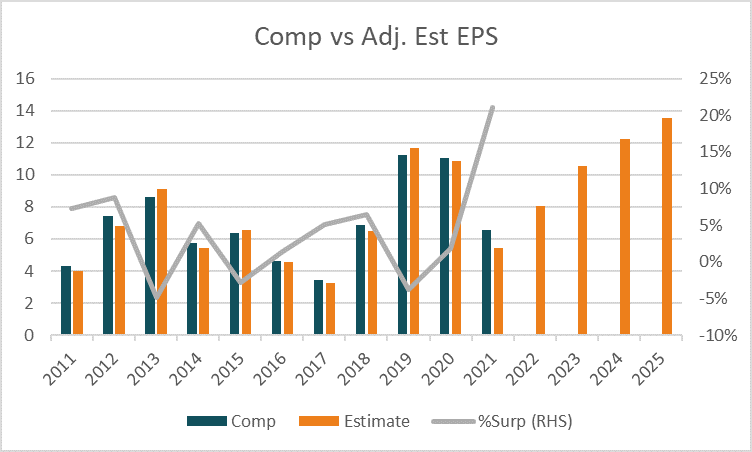

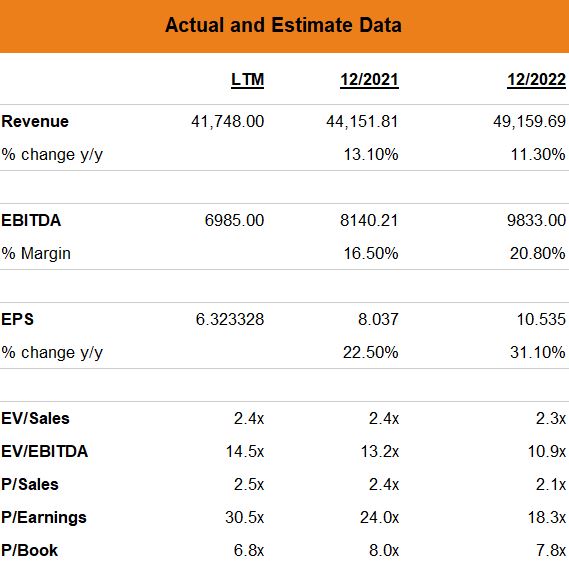

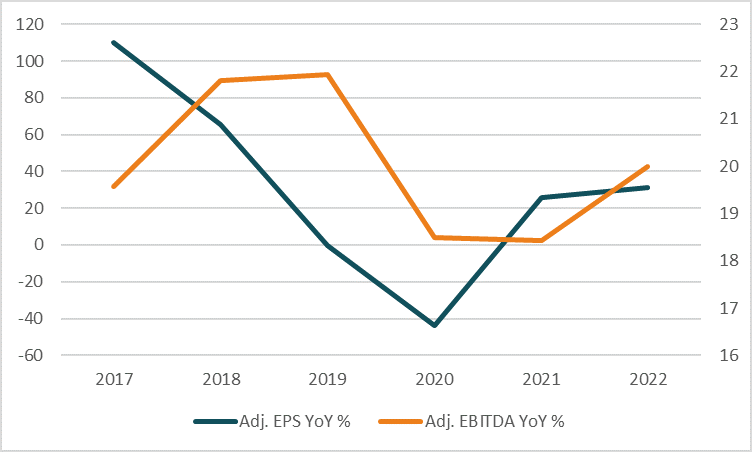

For the financial year ending December 2021 revenue is forecast to grow +5.8% to US$44,151m and rise a further +11.3% in 2022 to US$49,159. Adjusted earnings per share is expected to grow +26% in 2021 to US$8.04 and rise a further +31% in 2022 to US$10.54. Based on these adjusted estimates the stock trades on forward P/E multiples of 24.0 and 18.3 for 2021 and 2022, 39% and 35% premiums to the peer group averages of 17.3 and 13.6.

The average target price of analysts covering the stock is $208.57 with 48% of analysts rating the stock as a buy, compared to 8% as a sell and 44% as a hold.