The General Electric Company (GE) reported a revenue of $14.49 billion, beating estimates by $1.04 billion with an EPS of $0.49.

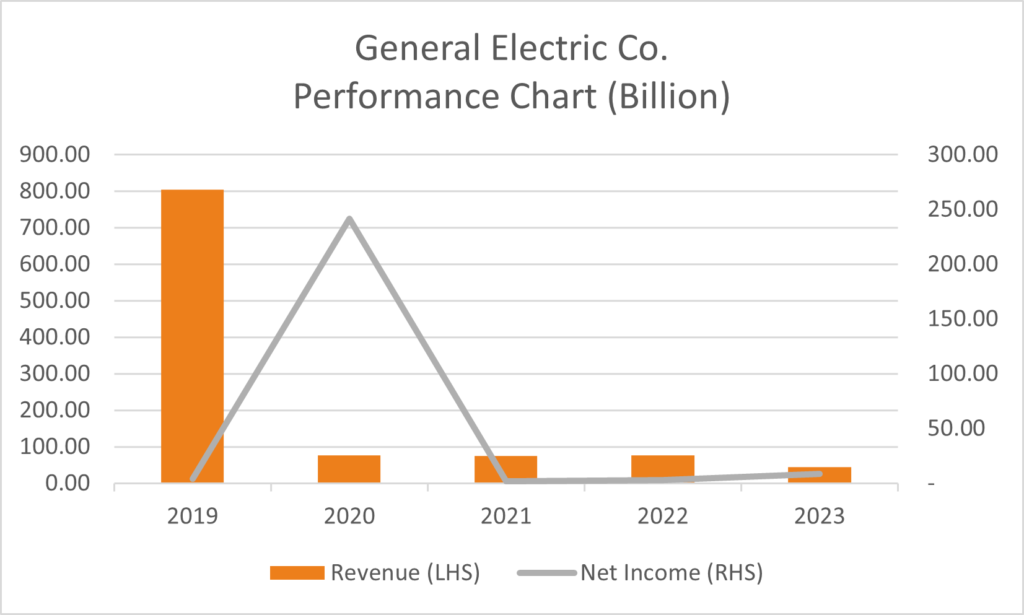

The General Electric Company (GE) reported revenue for the first quarter of 2023 was $14.49 billion, beating analyst forecasts by $1.04 billion. This is -15% lower compared to last year’s $17.04 billion for the same period and -34% lower from the final quarter of 2022. Net Income for Q1 of 2023 was $7.361 billion, a huge leap compared to the $262 million for the same period in 2022 and an improvement of more than 4 times compared to the final quarter of 2022. The industrial conglomerate generated a positive cash flow of $102 million.

Larry Culp, CEO of GE commented on the company’s performance during a call with analysts,” The recovery has strengthened as the world is eager to travel.”

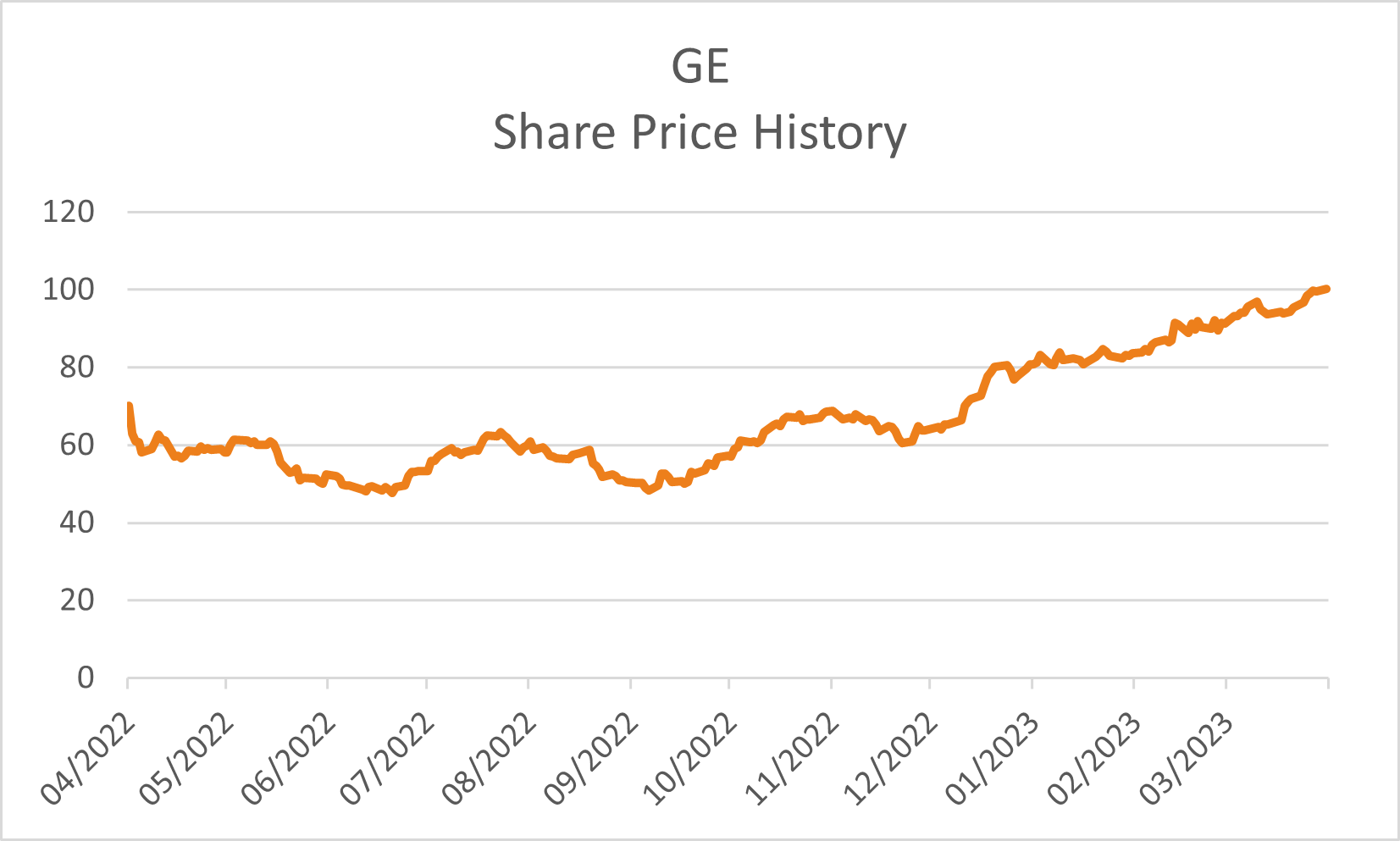

EPS for the quarter ending March 2023 was $0.49, more than double the $0.23 EPS for the final quarter of 2022, but fell -63% compared to the previous quarter’s EPS of $1.33. GE updated the guidance for EPS in 2023 to range from $1.70 to $2.00. The company’s share price fell -1.71% to $98.44 at the end of trading on Tuesday. Analysts have a positive outlook on the stock, with 70% recommending a buy position, while the remaining 30% recommend hold. The consensus of the share price in the upcoming twelve months is $103.90.