Microsoft (MSFT) is a current holding within the US Growth and Discretionary portfolios, and this morning has announced its latest Q4 earnings report, with shares modestly lower by -1.03% in after-hours trading.

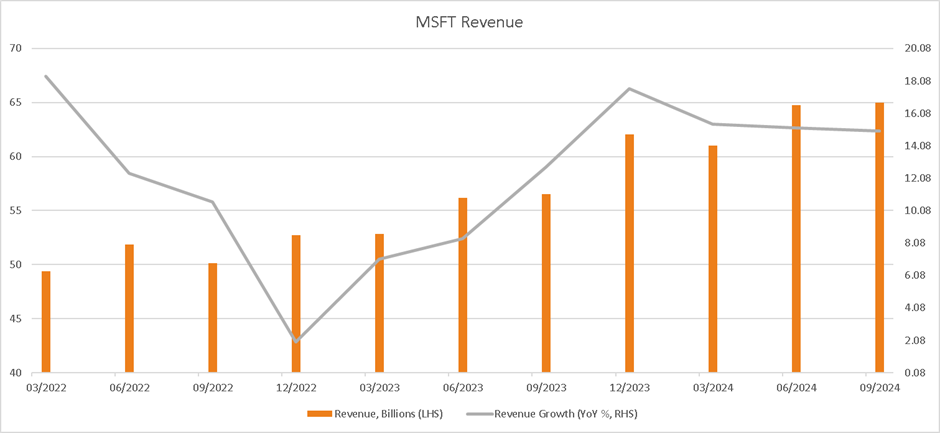

Microsoft’s fourth-quarter earnings, which concluded on December 31st, showcased an 18% increase in revenue to $62 billion, surpassing forecasts of $61.1 billion, while earnings per share also exceeded expectations at $2.93, compared to the forecasted $2.78. Despite this performance, Microsoft’s stock dipped in after-hours trading, likely reflecting the high expectations of investors for even more substantial growth in the cloud division, despite a 30% increase in revenue for Azure cloud services supported by the enthusiasm around new AI tools and Microsoft’s heavy push to its customers, above the 28% projected by analysts. For the quarter, Microsoft’s Office cloud service for business users also topped 400 million paid customers, while Microsoft’s Commercial cloud product revenue rose 24% to $33.7 billion.

Much like the rest of the “magnificent seven”, Microsoft enjoyed a strong performance in the final quarter of 2023 with the tech giant rising 19%, outperforming the S&P 500’s 11% rise. This rise saw the company’s valuation rise above $3 trillion, surpassing Apple as the world’s most valuable company.

Microsoft CEO, Satya Nadella, has pledged to turn Microsoft into an industry leader in artificial intelligence by partnering with OpenAI. This high-profile partnership with OpenAI has seen the introduction of AI-powered enhancements to Microsoft’s Office suite and cloud services designed to leverage OpenAI’s technology, enabling businesses to create bespoke AI applications. This partnership contributed to Azure cloud-services sales which exceeded analyst forecasts of 28% at 30%, with the company’s growth rate increasing by 6%.

With the rollout of Microsoft 365 Copilot, an AI assistant for Office Suite programs, for businesses and a subsequent expansion to provide smaller firms access, with a $20 consumers version. The new tools cost companies an extra $30 a month on top of their existing subscriptions and has the potential to become a significant revenue source.

Another area of growth was the More Personal Computing unit, with sales of $16.9 billion slightly exceeding analyst projections. With global personal computer sales increasing 0.3% in the quarter, the first increase in around two years. Additionally, the Xbox segment reported a 61% jump in content and services revenue, including contributions from the newly acquired Activision Blizzard.

Looking ahead, investors are awaiting more concrete data and projections from Microsoft on how AI will materially contribute to its future. As a reminder, Microsoft’s inclusion in the US Growth portfolio is based on the momentum component of the portfolio and its inclusion will depend on how the stock trades between now and the next rebalance date of February 1st, 2024. Its inclusion in the Discretionary portfolio is based on a longer-term fundamental view and remains an active hold in this portfolio.