Mineral Resources (MIN) is a mining service company, providing solutions including open pit mining, crushing, processing, transport, and accommodation.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 11.79 – 41.19 | 1,054,526 | 6,855.5 | 3.9% | 85.0% | 37.45 | 3.67 | 10/02/2021 |

Mineral Resources (MIN) is a mining service company, providing solutions including open-pit mining, crushing, processing, transport, and accommodation. Mineral Resources owns and operates iron ore and lithium mining operations as well as lithium hydroxide processing facilities, serving customers in Australia. It operates mine sites in the Pilbara and Goldfields regions of Western Australia, including Iron Valley, Koolyanobbing, Wodgina, and Mt Marion. Iron Valley is located in the Pilbara region. Iron Valley and Koolyanobbing sites are focused on iron ore and Wodgina and Mt Marion is focused on lithium. The Company also has a commodities portfolio located in the Pilbara and Yilgarn regions in Western Australia. Its commodities portfolio includes iron ore, lithium, and graphite.

Revenue is generated through two segments, mining services which operate through two subsidiaries CSI Mining Services and Process Minerals International, accounting for 43% of revenue in the financial year ending June 30th 2020. In the second segment, commodities accounted for the remaining 57% across projects mining iron ore, lithium, and graphite.

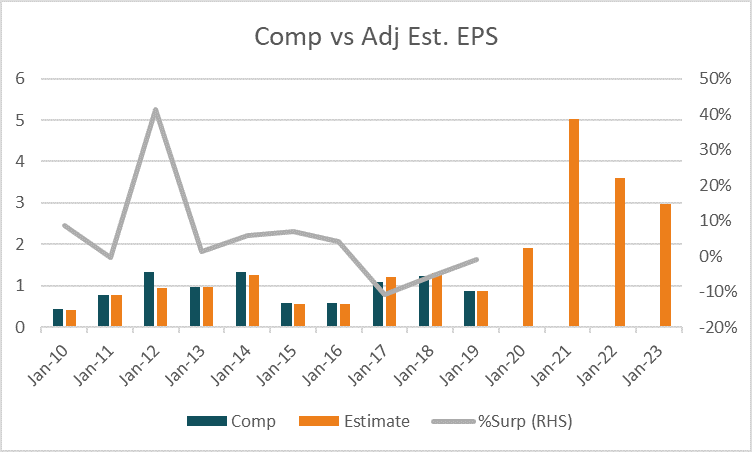

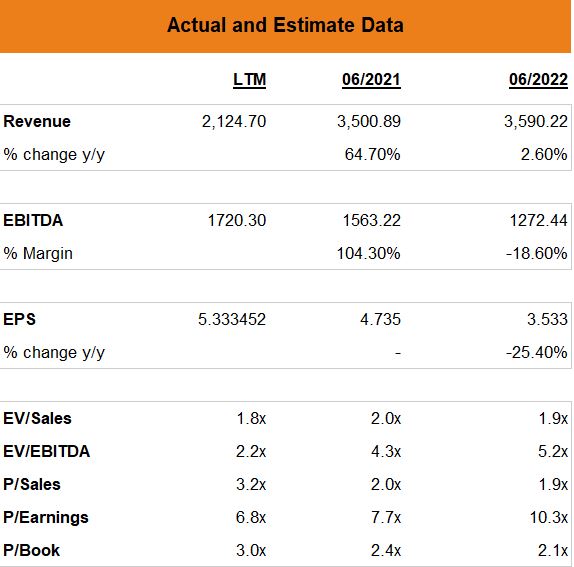

For the financial year ending June 2021 revenue is forecast to grow +65% to A$3,500m, and little changed in 2022 to A$3,590m. Adjusted earnings per share are expected to rise +130% in 2021 to A$4.74 before declining -25% in 2022 to A$3.53. Based on these estimates the stock trades on forward P/E multiples of 7.7 and 10.3 for 2021 and 2022 respectively, a 13% discount compared to the 2021 peer group average and in line with the 2022 peer group average.

The average target price of analysts covering the stock is $37.45 with 56% of analysts rating the stock as a buy, compared to 22% as a sell and 22% as a hold.