In the wake of a steep 18-month tightening campaign by central banks to curb post-pandemic inflation, it would be natural to expect equities to suffer. Surprisingly, this has not been the case. Despite short-term volatility and a rise in risk-free interest rates seen this week, along looming recession fears, equities have remained robust sitting modestly below record highs. How can this resilience be explained?

The Emergence from Post-GFC Economic Lethargy

In the years following the Global Financial Crisis (GFC), central banks were virtually the “only game in town,” as governments adopted fiscal austerity to manage spiralling debt. This led to unprecedented monetary policy measures, with low-interest rates supporting an economy where both growth and corporate earnings were tepid. As a result, equity multiples inflated, and the stock market began to operate in a realm largely detached from broader economic realities.

Fiscal Spending Re-Enters the Arena

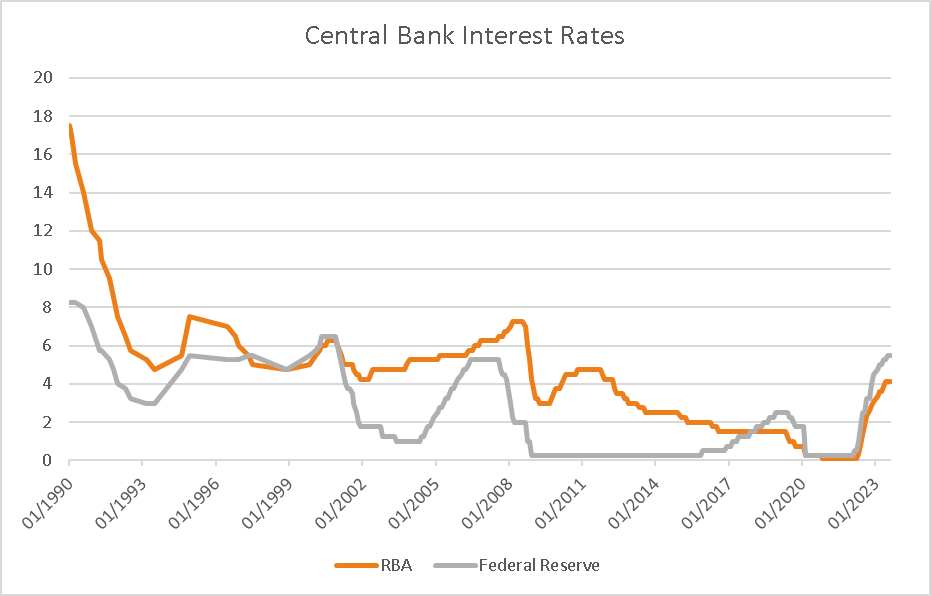

Investors adapted to a world of low-interest rates, weak inflation, and sluggish growth in the wake of the GFC. Yet history shows that equities perform well in a more “normal” environment, where 5% interest rates are reasonable by historical standards given robust economic growth, and strong corporate earnings.

The COVID-19 crisis marked a change in this dynamic, reviving the role of fiscal policy in economic support. The government stimulus not only alleviated the burden on central banks but also unleashed pent-up demand and savings post-lockdowns. This strategy risked fuelling inflation but offered a preferable alternative to mass business closures and potential global depression.

Rekindling of Economic Growth

The stimulus packages had a revitalising effect on business and consumer activity, rarely seen since the GFC. This is consistent with historical instances where government intervention has successfully reignited economic engines.

The Peak of Interest Rates

While inflation remains a threat and higher interest rates remain a headwind for equities, investors are increasingly comfortable with a peak in the current cycle having been reached, evidenced by the Reserve Bank of New Zealand and the European Central Bank having signalled a peak has been reached for now. Other central banks including the Reserve Bank of Australia and Federal Reserve have also left rates on hold, although signalled they are willing to increase further should inflation persist. What was a major headwind for risk assets in 2022 is now easing, providing a more optimistic outlook.

The Productivity Potential

Artificial Intelligence (AI) presents a considerable opportunity to boost productivity, which has been lagging in recent years. Akin to other technological advancements such as the computer and the internet, artificial intelligence can drive productivity.

So where do we see the most compelling opportunities within equity markets?

In the United States, market leaders within Artificial Intelligence are the best exposure in our view, names including Lam Research (LRCX) and Nvidia (NVDA) tied to the demand for semiconductors, but also names such as Microsoft (MSFT), Alphabet (GOOG), Apple (AAPL), Meta Platforms (META), Adobe (ADBE), Amazon.com (AMZN). Many of these names are also large-capitalisation stocks, which not only have commanding market leader positions and products embedded into our everyday life cycle but have also so far proved a safe haven for investors with these stocks at times becoming decoupled with the economy.

Cyber security names such as Palo Alto Networks (PANW) are also likely to be a beneficiary given improved software and demand for protection. Several of these names are held within the US Growth Apex Separately Managed Account, for which Rivkin is the investment manager.

In Australia, from a risk-reward basis, large-capitalisation and more established stocks are appealing, given they have strong cash flows, a margin of safety in their valuations, and have historically held up well during higher interest rates given solid levels of dividend and cash flow yields. This includes high quality such as BHP (BHP) and RIO Tinto (RIO), not only due to their ability to produce returns but also their ties to what we believe is a multi-decade tailwind as part of the transition to clean energy.

Major financials including Commonwealth Bank (CBA) and National Australia Bank (NAB) are also compelling given their ability to produce record profits, with concerns of a housing crash so far overblown, with the banks also maintaining strong capital buffers that can see them through any potential slowdown in housing. A lack of supply in housing and strong levels of migration help to explain why the Australian housing market has held up so well amid levels of interest rates not seen since the early 2000s. Stocks such as BHP, CBA, and NAB along with several other high-quality companies are held within the ASX Income and ASX Growth portfolios for the Apex Separately Managed Accounts.

As investors, we are generally optimistic about the assets that we invest in. However, we need to maintain a balanced view and understand the potential outcomes and risks associated. Risks to our views presented above include a contraction in economic growth should central bank tightening have gone too far, or inflation proves more persistent than expected. Higher levels of debt in recent years are also a threat. However, our job is the balance risk and reward, and on the balance of probability, we view the outlook as supportive for equities.

While there may be short-term volatility, especially among growth stocks, the overall outlook for equities remains positive. Higher interest rates are not a death knell for the stock market but a return to historical norms, underpinned by solid economic growth and opportunities in technological advancements. While we see opportunities in specific segments of equity markets, a well-diversified portfolio is always a solid strategy for investors moving forward.