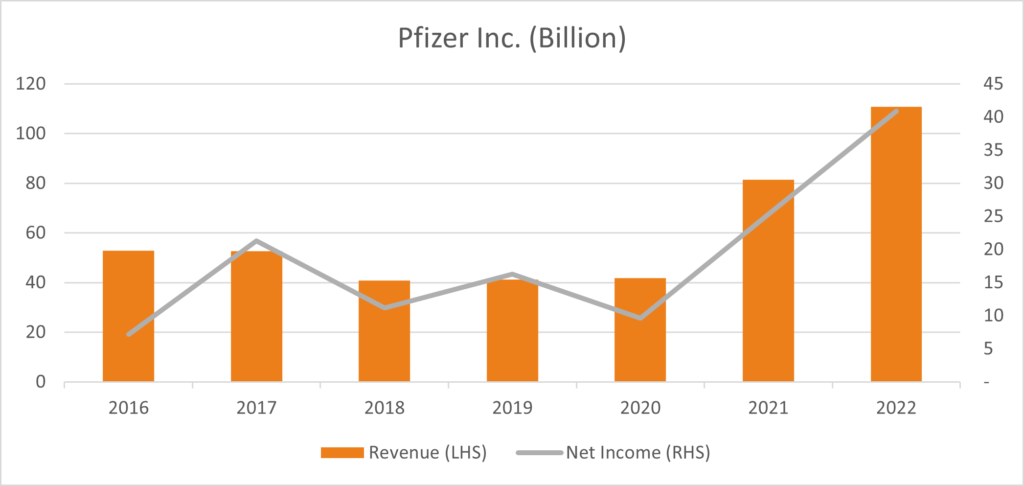

Pfizer Inc. (PFE) announced revenue of $23.8 billion for the final fiscal quarter of 2021, 104% higher than last year’s $11.6 billion for the same period.

This is -1% lower than the last quarter’s revenue and analyst estimate for the current quarter of $24.1 billion (each). Net income was reported at $6.2 billion for Q4 2021, 164% higher compared to last year’s net income of $2.3 billion for the same quarter, -18% lower than Q3 2021 net income of $7.7 billion and $24% higher than analyst estimate of $5 billion.

EPS rose by 157% YoY from $0.42 to $1.08 in the final quarter, -19% lower than the previous quarter’s EPS of $1.34 and 23% higher than analyst estimates of $0.87. PFE provided guidance for EPS between $6.35 to $6.55. CFO Frank D’Amelio commented on the EPS guidance:

“As I prepare to retire as CFO of Pfizer, I am proud to see that the company is performing better than at any other time during my nearly 15 years here. Today we are issuing guidance for the coming year which, if achieved, would represent the highest level of annual revenues and Adjusted diluted EPS in Pfizer’s long history.”

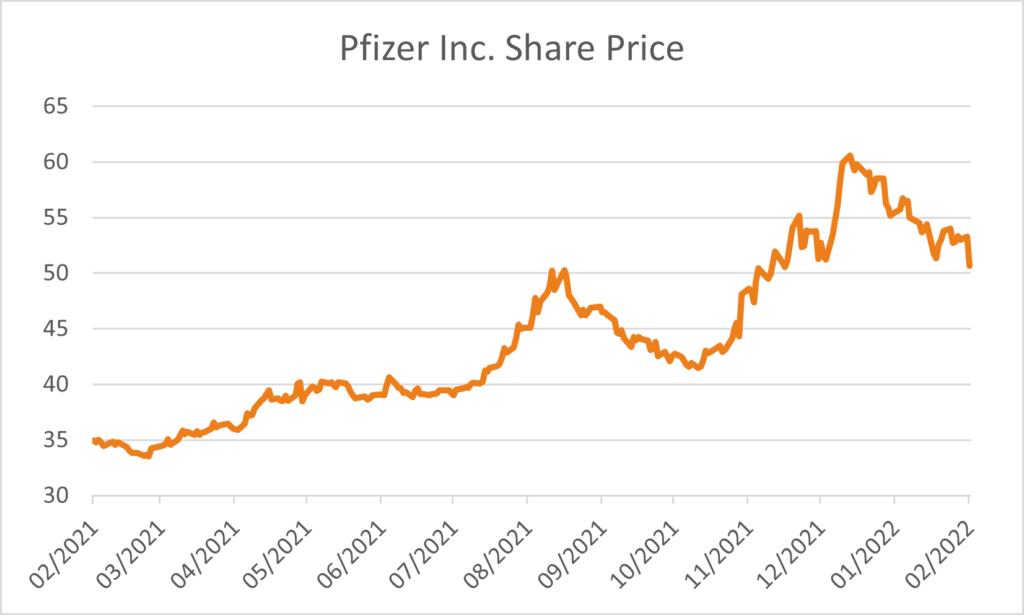

PFE’s market capitalization fell by $15 billion after revenue guidance of $98.0 to $102 billion for the COVID-19 injections & pill were below analyst’s expectations. Competitors in the industry also saw similar declines in their share price: Moderna, BioNTech and Novavax have all fallen close to 40% since the start of 2022. Leading experts are beginning to question the sustainability of the sales of vaccines from these companies, as the world comes to grips with the news that the COVID-19 virus is a disease which the world may need to coexist with other diseases such as the flu.

PFE share price fell by 2.8% when sales and profits missed the consensus of experts on Wall Street. Analysts have a moderate view on the share price, as 50% recommend buy, 46.2% recommend hold and 3.8% recommend sell. The consensus twelve-month trading share price is $58.7, and current share price is at $51.7.