In recent years, the stock market often seems surrounded by a multitude of unsettling. From the COVID-19 pandemic, soaring inflation, and geopolitical strife to political standoffs, these are just some of the frequently dominating financial headlines, causing apprehension among investors that “now is not a good time to invest”.

History, however, offers some reassurance. Despite numerous periods marked by economic turmoil and uncertainty, the stock market has demonstrated a remarkable ability to grow over the long term. This resilience underscores a vital lesson for investors: the importance of remaining invested in the market, even in the face of daunting headlines.

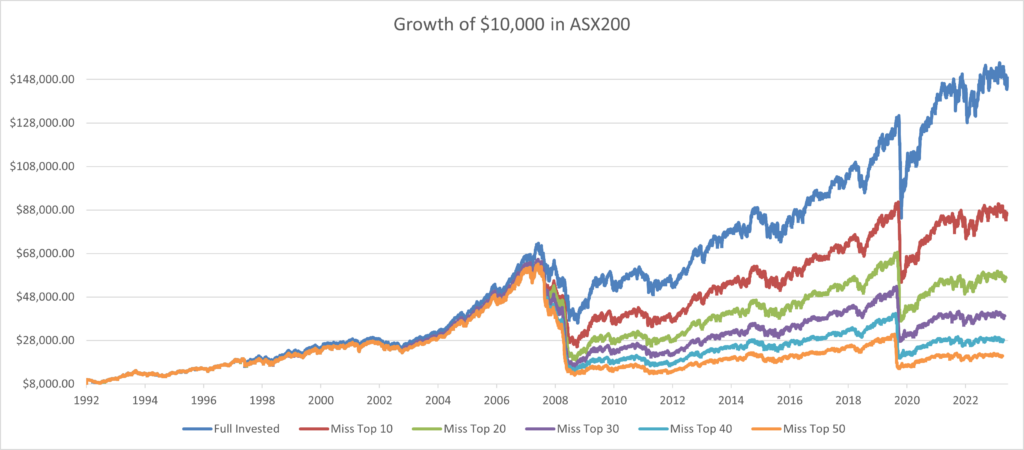

Looking back at 1992 across both the S&P500 and ASX200, a total of 31.4 years, we analyse the impact of remaining fully invested, against missing the largest 10, 20, 30, 40, and 50 daily returns. The outcome, remaining fully invested in the face of uncertainty generates the highest returns in the long run.

For the ASX200, remaining fully invested in a portfolio with a $10,000 starting value generates a total of $147,917, returning an impressive 1379%. As we begin to exclude the top daily returns from this dataset, we can see returns quickly deteriorate. For example, missing the top 10 daily returns, or 0.13% of all days returns 763%. Most troubling, missing the top 50 days returns a meager 109% or 2.38% per annum.

This isn’t just limited to the Australian market, $10,000 invested in the S&P500 returned 1862% while returns dramatically fall as we begin to exclude the top-performing days. Missing the best 50 days for the S&P500 over the past 30 years generated a return of 1.29% per annum, well below the 9.9% annualised return for a fully invested portfolio.

These simple examples illustrate a crucial investment principle: the risk of attempting to time the market. Predicting the best days for trading is fraught with danger, leading to missed opportunities and diminished returns. A long-term, steady, and consistent investment approach not only amplifies potential gains but also mitigates the risks associated with poor market timing.