With the recent success of the Metcash (MTS) buyback and the open CBA investment, we have had some questions asking why companies pursue off-market buybacks and how the tax workings of these investments can be beneficial.

Buybacks are pursued by companies seeking to deploy excess capital. That excess capital can be returned to shareholders in several ways, but buybacks are popular as they will increase the earnings per share (EPS) into the future as there will be fewer shares on issue. On-market buybacks are pursued at the prevailing market price, but occasionally when a company is sitting on a big franking credit balance above what is needed to frank ordinary dividends, the company could opt for an off-market buyback. Off-market buybacks are usually paid with a small capital component and the remainder in a fully franked dividend. There are significant tax benefits for shareholders holding shares in low-income tax-paying vehicles such as pension funds. This allows the company to buy back shares at a discount (typically 14%), ensuring that future EPS will be even greater.

Determining whether a buyback could suit an investor will depend on one’s personal circumstances. While buybacks may usually only be worthwhile for investors paying very little tax, as they generate significant capital losses, buybacks could appeal to some investors sitting on significant potential capital gains tax bills.

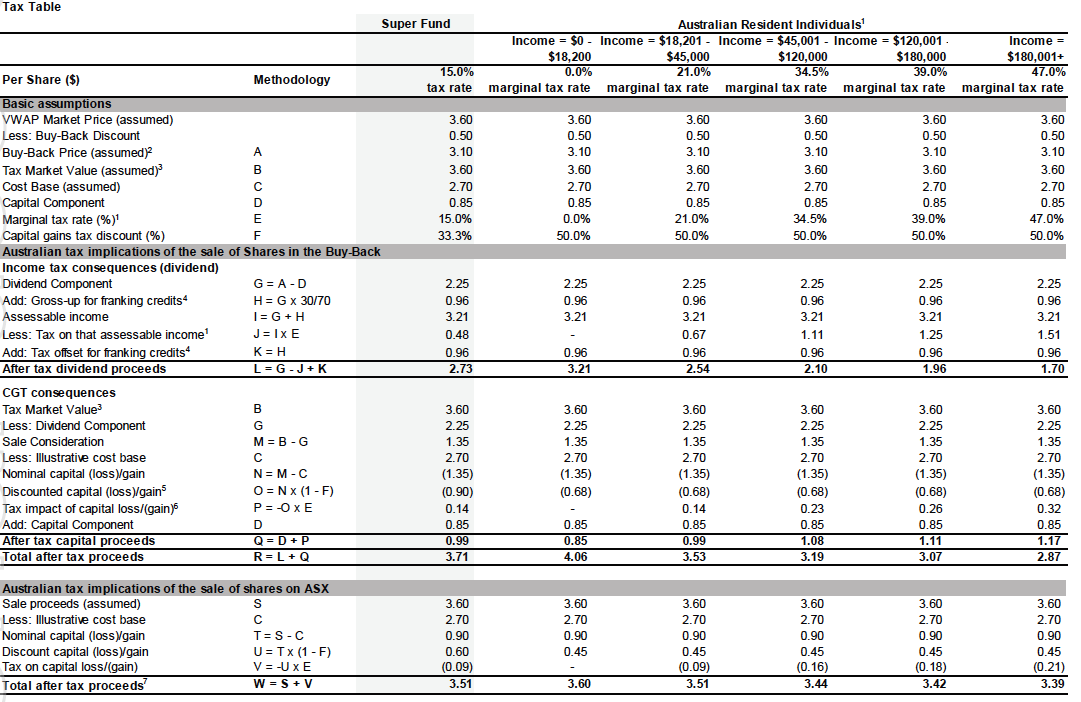

The table below shows the MTS buyback booklet explaining the different after-tax outcomes of the buyback depending on your tax bracket.

This example uses a price of $3.60 to determine the buyback price, which was done at the maximum 14% discount after the tender process was completed. The table demonstrates that those investors that pay no tax would receive after-tax proceeds of $4.06 per share, a 12.8% premium to the market price. Super funds paying 15% tax yielded a more marginal $0.11 profit. Still, the benefit could be far greater if the investor was sitting on realised capital gains within the investor’s portfolio because of the significant capital loss. It is worth noting that the investment in MTS worked out considerably better than the example below; the price at which the discount applied was eventually around $4.10, so the gross profit ended up closer to 30%. Of course, it is possible for the share price to go against us between buying the stock and when the buyback price is determined. Still, with a considerable margin of safety and the usual brief holding period, it’s unlikely to see the entire profit eroded.