United States

The US market slid overnight as investors continued to take money out of the market. The NASDAQ fell 0.7% to 17,871 and the S&P was down 0.75% settling at 5,544. The sell off today was not only in technology shares but quite broad based. 11 of the 12 sectors in the S&P were lower with healthcare falling the most down 2.3% and consumer shares down 1.29%. The rotation into small caps also came to a halt today with the Russell 2000 down 1.85% and the Dow Jones off over 500 points down 1.35%. Corporate earnings for the second quarter continue with analysts commenting “earnings need to be not only good but good enough” to sustain current equity prices. Netflix earnings were reported after the close which were better than expected. In early after-market trading Netflix is trading down 2.5%.

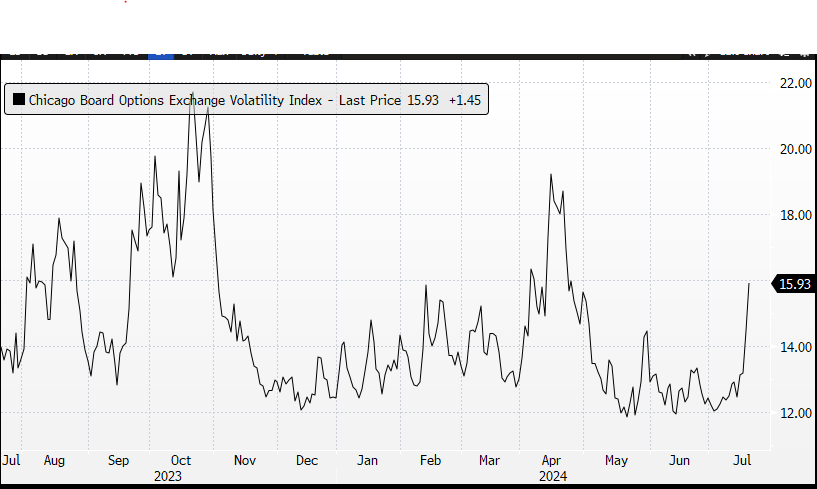

The turmoil in the market has had a corresponding influence on the volatility index which has jumped to 15.92%, the highest level since early May. This large increase suggests that the traders expect these outside moves to continue in the near term.

CBOE Volatility Index (VIX)

In data released on Thursday the employment survey showed the jobless claims had jumped to 243,000 versus an expected 229-1000 and long-term claims increased increase their uptrend. The 10-year yield on government is increased to 4.20% up four basis points. The US dollar was broadly stronger against other currencies

Europe

In European markets trade was mixed with the EuroStoxx 600 falling 0.2% along with the DAX 0.4% the German DAX was led by a fall in Siemens of over 4.4% post broker down grades. Both the British and French market edged out small gains to be up 0.2 0% each. Shell led the advance in the UK being up 1.3%.

The ECB announced no change to their benchmark interest rate of 3.75% at their meeting on Thursday. President Lagarde reiterated that the bank will be led by the data and will keep rates “sufficiently restrictive for as long as necessary” to get inflation to return below their 2% goal. There is an expectation of cuts later in the year with current flat inflation reading at 2.5%

Australia

In overnight trade the ASX 200 futures fell sharply, down over 1.15%, 92 points. Trading of BHP shares in New York indicate aa large decline to $A41.82 off 1.9% from Thursdays close. The AUDUSD slid slightly to 0.6707.

The ASX 200 fell on Thursday losing 0.27% to close lower by 21 points at 8.036.50. The fall was attributed to further concerns around Chinese demand and a tariff war breaking out between the US and China. The technology sector was the worst hit on the day being down 3.39%. Wisetech being the worst hit falling 6.32% and NextDC falling 4.61%. Other sectors were mixed on the day. Both REA group and Car Sales were hit today being down 4.0% and 3.5% respectively. Domino shares fell 8.2% after announcing the closure of stores in both Japan and France.

Employment data for June was released on Thursday. The data showed that 50,200 jobs were added in June, more than double what was expected. The higher-than-expected number of people employed turned attention back to Australian interest rates rather than those in the United States. Expectations of a rate rise in August was back in focus. The unemployment rate moved up to 4.1% as the number of people looking for jobs also increased.

Commodities

Oil was slightly lower on Thursday after big advance the day before. Brent crude fell below $US84.76 down 0.38% and WTI crude similarly down 0.57% to close at $US84.77. Copper was sharply lower in London trade to $US4,266 down 3.0% on day, Iron ore was lower to trade at $US105.50

Gold was trading at $US2,455.08 down 0.56% with Silver down 1.55% to $US29.83. Bitcoin slid to 63,818 down 1.0%

JP

- Inflation rate (Jun) 9.00 am

US

- – Fed members Williams and Bostic Speak

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.