US equities climbed to new record high on Tuesday despite the latest inflation data coming in slightly ahead of expectations.

United States

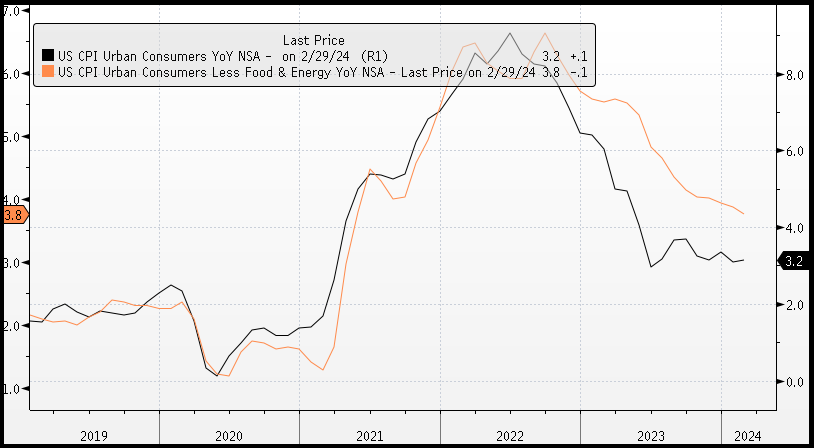

For the 12 months to February, headline prices rose 3.2% slightly above the 3.1% forecast with core prices up 3.8% also ahead of forecasts for 3.7%. The reaction in bonds is one would expect with yields rising, the 2-year traded 5 basis points higher at 4.586% with the 10-year up 5.3 basis points to 4.151% as traders pared their expectations of a June rate cut.

US Inflation (YoY %)

Despite this, equities closed strongly higher suggesting investors are shrugging off the inflation print which only narrowly missed expectations, although highlighted signs of stickiness, suggesting traders were braced for a hotter print. The S&P500 leapt 1.12% with gains led by technology 2.54% and communications 1.18%, although stock performance was mixed with only 57% of stocks higher. The Nasdaq Composite rose 1.54% along with the Dow Jones 0.61% while the Russell 2000 was little changed.

Europe

European equities extended a run of gains with the Euro Stoxx 600 up 1% to a new record high. The DAX also lifted 1.23% along with the CAC 0.84% and FTSE100 1.02%. The latest employment data for the UK in January showed a decrease of 21k jobs missing expectations for a 10k increase, with the unemployment rate ticking up to 3.9% from 3.8%. In focus tonight is the latest GDP data for the UK to January, expected to show the economy contracted -0.3% over the year.

Australia

The ASX is expected to open higher this morning, with ASX200 futures up 14 points or 0.18% to 7,729. The index rose 0.11% on Tuesday amid sector performance with technology up 1.15% while energy lagged -0.77%. Major miners were weaker despite iron ore futures in Singapore trading higher with BHP down -0.7% along with RIO -0.2% and FMG -1.2%. There are no major data releases locally for today, with the Australian Dollar slightly weaker by -0.11% to 0.6607.

Commodities

To commodities, oil prices are little changed overnight with WTI unchanged at US$77.95 while Brent is 0.07% higher at US$82.27. Iron ore futures in Singapore climbed 1.89% on Tuesday although have given back those gains this morning, trading -1.81% weaker with copper down just -0.05%. Gold slipped -1.11% to US$2,158 pulling back from a record high, with silver -1.35% weaker at US$24.14 and Bitcoin -1.54% to US$71,005.

Economic Calendar

13th March 2024

UK GDP (YoY Jan) 18:00

Eurozone Industrial Production (YoY Jan) 21:00

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.