U.S. equities traded mixed on Thursday following conflicting earnings reports and mixed economic data.

As of 3:45pm in New York the S&P 500 was -0.41% lower, weighed down by communications which fell -3.98%, information technology down -1.3% and consumer discretionary slipping -1.3%. The Nasdaq weakened -1.53% lower due to META’s disappointing earnings, the Dow climbed +0.87%, the Russell 2000 was up by +0.93% while the VIX index declined to 27.13. The US 10-year bond fell 6 basis points to 3.94%. Wedbush Securities’ Dan Ives referred to META’s results as a “disaster” and commenting on the earnings from other large-cap stocks, “While Alphabet and Microsoft saw weakness with lower guidance that spooked the Street, Meta’s results last night was an absolute train wreck”. Shares in McDonald’s rose, showing consumers were willing to pay for higher for their meals while battling inflation in their energy and grocery bills.

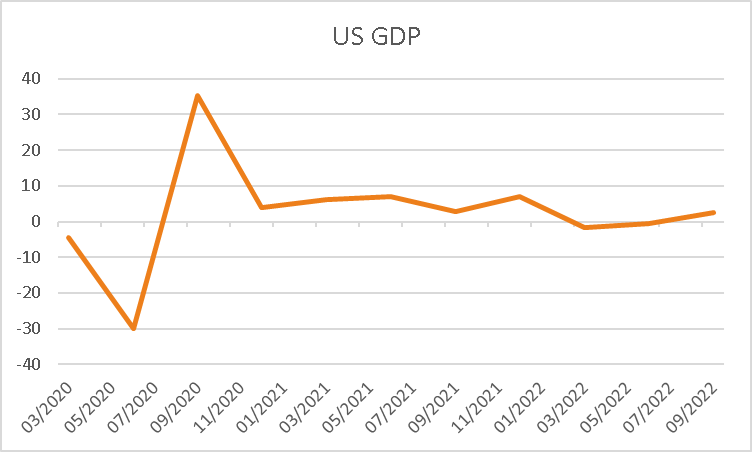

Economic data released on Thursday revealed that US GDP rose 2.6%, above expectations of 2.4%. Durable goods orders fell to 0.4%, below forecasts of 0.6%, 50k more continuing jobless claims were filed for the week ending 15th October than the expected figure of 1,438k. Economists and strategists continue to expect further interest rate hikes by the Federal Reserve in the upcoming meeting next week. Managing Director at Charles Schwab UK Richard Flynn commented, “On the one hand, it is good to see that the economy is continuing to grow and that should bode well for the stock market. However, given that we are in the middle of an inflation fight, the Federal Reserve will likely feel that they need to continue to be aggressive in their rate hikes.”

In Europe, markets closed lower on Thursday after the ECB announced a further hike in the cash rate to 2% from 1.25% in line with expectations. The STOXX 600 slipped by -0.16%, weighed down by information technology, healthcare and materials which fell by -1.76%, -1.13% and -0.87% respectively, offsetting the gains made by energy which closed +3.76% higher and real estate rising +2.56%. The FTSE edged +0.9% higher, the CAC fell by -0.51% and the DAX rose by +0.12%. The UK 10-year bond yield fell 18 basis points to 3.39%. Oanda’s Edward Moya commented on the most recent interest rate hike and future market expectations, “ECB policymakers signaled they expect to raise rates further and markets are still convinced that they could raise rates by 75bp again in December. It seems the market is convinced that the ECB’s hiking cycle won’t have to be as aggressive next year, and traders are now expecting rates to peak at around the 2.75 per cent level”.

*Note: These prices are based on futures and/or CFD pricing and may therefore differ slightly from spot pricing.

The ASX is expected to open lower today, with ASX futures down 10 points or 0.15% to 6,829. The ASX closed 0.5% higher on Thursday, with energy, materials and industrials boosting the index by rising +2.37%, +1.68% and +0.74% respectively. Rising crude oil prices helped the large cap stocks. BHP, Woodside and South32 were all up by more than 2.4%. Pinnacle’s share price tumbled 3.4% after it revealed a drop in funds under management fell by 4%. Super Retail gained +2.7% after revealing 20% growth in sales, while Reece Rose gained 2.2% from a 28.8% hike in sales. Core Lithium lost -5.2% after failing to secure a contract with Tesla. Australian Clinical Labs dropped -5.4% after revealing a cyber attack in it’s Medlab affiliate. The local currency weakened against the greenback by -0.5% to 0.6463, while the yield on the 10-year Australian bond was at 3.83%.

In commodities, oil prices rose with WTI and Brent crude jumping +1.35% and +1.37% to $89.11and $97.04 respectively. In precious metals, spot gold slid -0.3% to $1,659.52, while spot silver was down by -0.47% to $19.49. Industrials metals were mixed with copper down -0.75% to $352, nickel up by +1.59% to $22,569, while SGX Iron Ore dropped -2.53% to $86.54. The price of bitcoin fell by 0.9% to $20,598.

Economic Calendar:

- Japan Unemployment Rate (SEP) 10:30

- Japan BoJ Kuroda Speech 11:00

- BoJ Interest Rate Decision 14:00

- ECB Consumer Confidence & Economic Sentiment (OCT) 20:00

- US PCE Price Index YoY (SEP) 23:30

- US Michigan Consumer Sentiment Final (OCT) 01:00

This article was written by James Woods, Portfolio Manager, Rivkin Securities Pty Ltd. Enquiries can be made via [email protected] or by phoning +612 8302 3632.