Strategy Objective: The Rivkin Australian Equity Managed Account aims to produce positive average annual returns while seeking to maintain a level of volatility lower than that of the S&P/ASX 200 Accumulation Index over the same investment period.

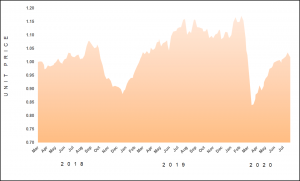

31 July 2020 Equivalent Unit Price – A$1.0189

Welcome investors to the monthly update for the Rivkin Australian Equity Managed Account (RAEMA) for July 2020. It was a positive month for the RAEMA, with the value of the portfolio increasing 2.15% to end July with an Equivalent Unit Price of 1.0189. July was a considerably quieter month for Australian equities, with the ASX200 confined to a relative tight trading range centred around the 6000 level. The reduction in volatility is quite welcomed however, considering what 2020 has been like to date. By month’s end, the ASX200 Accumulation Index gained 0.50%.

| RAEMA | |

|---|---|

| Latest Month | 2.15% |

| Quarter to Date | 2.15% |

| Calendar Year to Date | -6.55% |

| Financial Year to Date | 2.15% |

| 12-month | -12.18% |

| Inception | 1.89% |

Monthly Commentary

It has been a slightly different and more bullish story in the US, where following a pause in June, the major stock indices have continued their upward trajectory, with the S&P500 and Nasdaq100 Total Return Indices gaining 5.64% and 7.41% respectively in July. It is often thought that the Australian and US equity markets are higher correlated, and while this is true in terms of the day to day ups and downs, over the longer-term, significant performance differences can and do occur. The recovery off the March lows is a good example of this, with US equities, particularly the Nasdaq listed technology stocks, far outperforming local equities.

The strong recovery in equity prices (in the US in particular) has prompted quite a few clients across our business, both in funds management, and the general advice reports to question the sustainability of the current rally and ponder whether or not a bubble is forming. Part of the benefit of using a systematic investment strategy, is that our portfolios will stay invested while the trend remains up, and revert partly to cash when the trend reverses, via the momentum strategy component, which removes the need to have to guess when or if a bull market is at risk of ending. Sitting on the sidelines while a strong trend is underway can be just as detrimental to long-term performance, as holding into the beginnings of a downturn.

With all that said, we have taken some steps to de-risk the portfolio slightly throughout the month of July, by increasing the weighting to cash from 8.1% to 18.5%. This has been done by selling the bulk of stocks held in the discretionary portfolio, with the view that we will have cash on hand to enter stocks at lower levels, should they present themselves. This leaves slightly over 80% of the portfolio currently invested in ASX equities, which we believe strikes a good balance between risk and reward in the current environment.

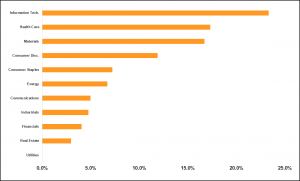

We are also content with the composition of the portfolio, with both the Momentum and Quality strategies invested across a broad range of businesses, which is evident from our current sector exposure. Information technology remains the highest ranked sector at 23.3%, however we also have good weightings to the health care (+17.3%), materials (16.7%), and consumer discretionary (11.9%) stocks.

It was the Momentum strategies that performed the best throughout the month, led by a 25.7% rally in Fortescue Metals Group (FMG), which benefitted from strong iron ore prices, which are currently trading back above US$110 a tonne, the highest price since July 2019. A stronger AUD gold price also helped the likes of Northern Star Resources (NST) and Silver Lake Resources (SLR) which gained 15.7% and 15.0% respectively for the month. Other stocks worth a mention are Afterpay (APT) and Mineral Resources (MIN), which also contributed to the overall portfolio return.

Looking to the weeks and months ahead, we discussed in the June update the possibility of a period of sideways trading to develop, which is often the case after a strong rally. This has occurred, with both the ASX200 and S&P500 consolidating for several weeks. Such a pause in a trend is often a healthy development, making the trend more sustainable over the longer term. And although the Covid-19 pandemic continues to grow, in terms of the number of infected people, equity markets are currently pushing ahead regardless.

If you have any questions regarding the above or your investments with Rivkin in general, please call us on 02 8302 3605.

Performance

NAV Price Chart

Monthly Returns

Portfolio Composition

Sector Breakdown

Top 10 Stock Holdings

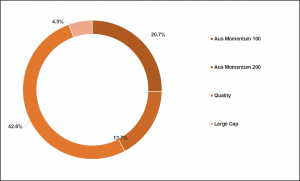

Strategy Weighting

Strategy Description & Information

The RAEMA Strategy invests predominantly in listed Australian companies whose characteristics satisfy one or more of the strategies that occupy the portfolio. These strategies include: Momentum 100 & 200, being two discreet segments (ASX 100 & ASX 200 ex the ASX 100) of securities that are enjoying positive price trends; Quality, being companies with robust earnings profiles that are priced favourably versus their peers; Income, being securities that provide a high yield relative to the broader market; and Low Volatility, which cushions market shocks.

Important Disclaimer

The Rivkin Australian Equity Managed Account is available to wholesale investors only. Past performance is not a reliable indicator of future performance. The value of your investment may rise and fall, and you may not receive the amount originally invested.

Contact

Thomas Silitonga – Director, Rivkin Asset Management

[email protected] – +612 8302 3605