Apple Inc. designs, manufactures, and markets personal computers and related personal computing and mobile communication devices along with a variety of related software, services, peripherals, and networking solutions.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 52.82-138.78 | 114,983,968 | 2,169,864.5 | 0.6% | 88.0% | 129.04 | 4.23 | 27/01/2021 |

Apple Inc. designs, manufactures, and markets personal computers and related personal computing and mobile communication devices along with a variety of related software, services, peripherals, and networking solutions. Apple sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. The company’s most popular product, the iPhone which is in its 12th year, has been a significant driver of revenue in excess of tens of billions. Additional products and services such as the Mac computer, iPad tablets, Apple music, Apple Store, Apple TV+ and Apple Watch have also helped entrench the brand with consumers worldwide.

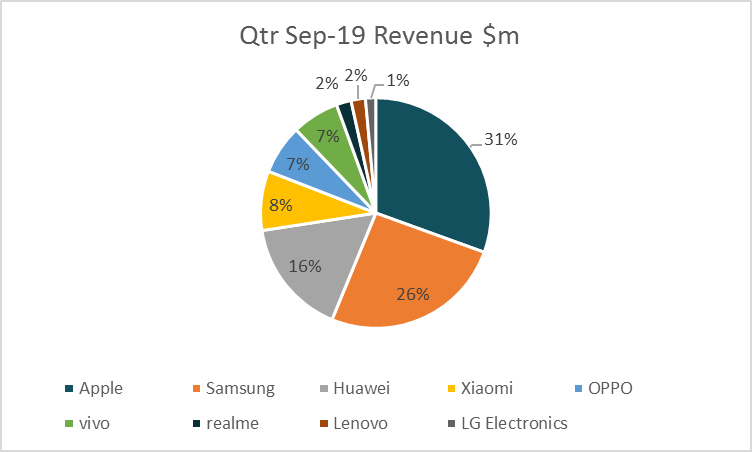

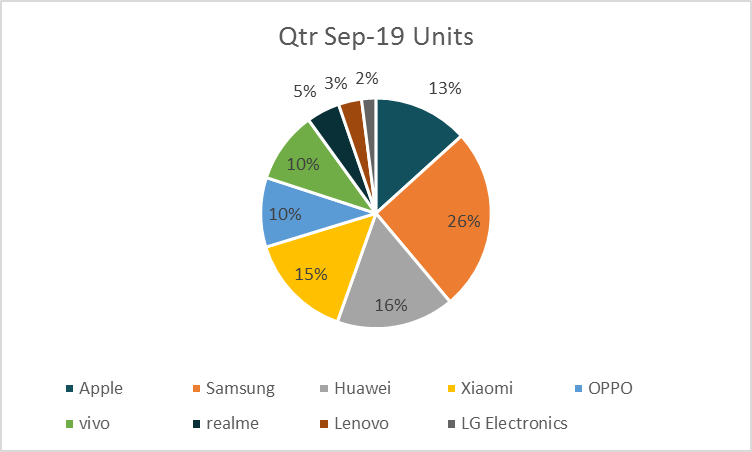

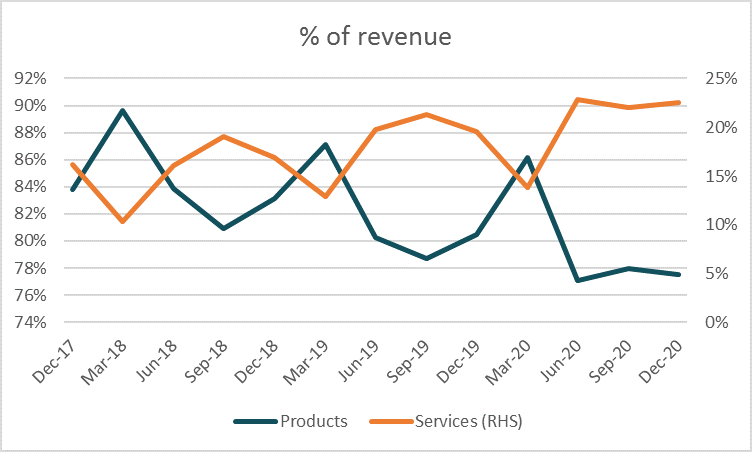

Apple’s products are the dominant driver of sales totalling 80% of sales in 2020 compared with services at 20%. Of its products the iPhone is the largest contributor, generating 50% of total revenue in 2020, although declining each of the past few years from 60% in 2017. Wearable, Home and Accessories which includes the Apple Watch, totalled 11.2% of sales while Mac computer products totalled 10.4% and iPads +8.6%. Geographically the U.S. is the largest market, accounting for 45% of revenue in 2020, followed by Europe with 25%, China at 15%, Japan at 8% and the rest of Asia 7%.

On January 7th Apple announced its intention to build a car in the next seven years although such a product would likely face production, regulatory and safety challenges that could delay the timeline. Apple has weathered the COVID-19 with demand for iPhones, including the iPhone 12 and services including Apple TV+ among a resilient customer base. Services is of growing importance for driving revenue, up from 14% in 2017 to 20% in 2020, and Apple can leverage its loyal base of customers which have over 1 billion units of products to boost services sales. Revenue is expected to be driven by the 5G cycle through to 2022 after which services is seen as driving growth.

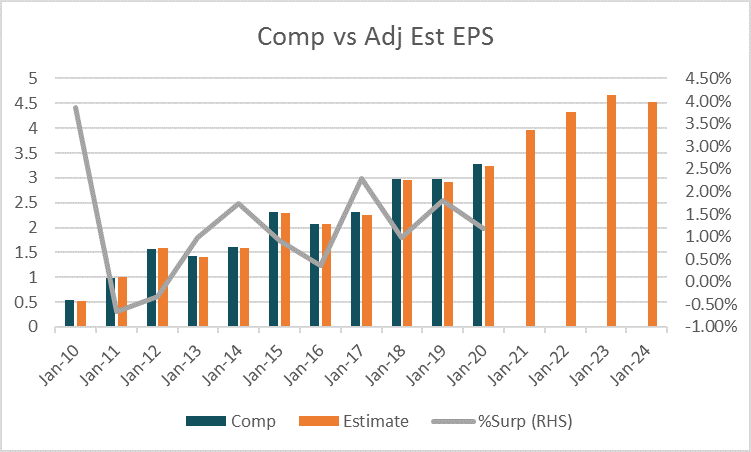

For the year ending September 2021, revenue is expected to rise +15.1% to US$315,894m and a further +5.7% in 2022 to US$333,838m. Adjusted earnings per share are expected to rise +21% to September 2021 totalling US$3.96 and a further increase of +8.9% in 2022 to US$4.32. Based on these adjusted estimates the stock trades on forward P/E ratios for 2021 and 2022 of 32.6 and 29.9 respectively, 33% and 40% above the peer group averages of 24.6 and 21.3.

The average target price of analysts covering the stock is $253.68 with 68% of analysts rating the stock as a buy, compared to 7% as a sell and 25% as a hold.