Apple posted a revenue of $83.36 billion for Q42021, showing YoY improvement of 28.8% compared to $64.7 billion Q42020.

This beat previous Q32021 revenue of $81.43 billion by 2.37%, while falling short by -1.57% of analyst’s estimates of $84.69 billion. This was due to decline in revenue targets for the iPhone, Wearables/Accessories and the Mac product line. The figures do not account for the release of the latest iPhone 13 which was released in the final weeks of the quarter, likely helping to boost sales.

Speaking on the results, CEO Tim Cook stated it was supply chain constraints on microchips (not COVID-19 related disruptions) which had cost the company $6 billion across all devices, specifically to its most popular products i.e. iPhone, iPad and Mac devices with customers seeking to buy new releases of these products likely waiting until November or December for delivery. The executive did highlight growth in its emerging markets (which made up 1/3 of the revenue figure) citing 100% growth in India and Vietnam.

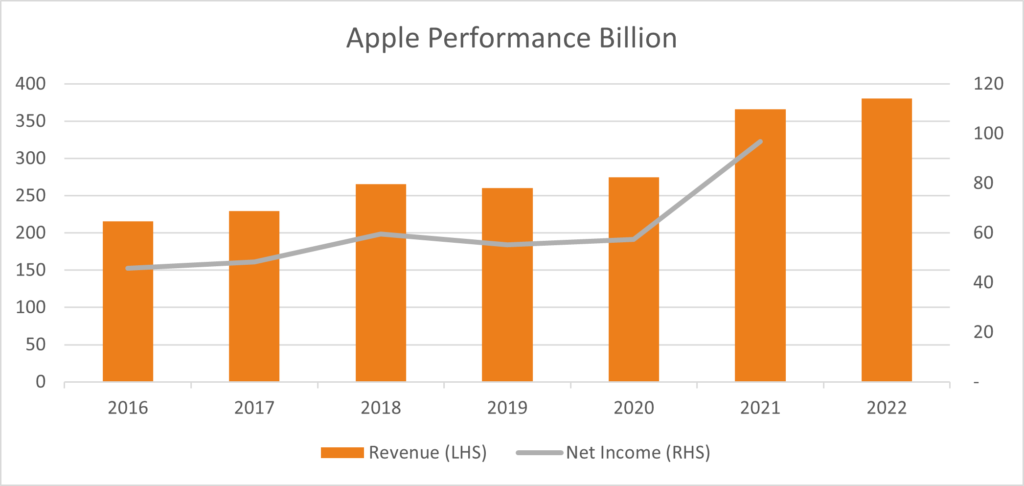

Net income for Q42021 was $20.55 billion, increasing by 62% YoY from Q42020’s net income of $12.67 billion. This was -5.81% below previous Q32021 net income of $21.74 billion and 1.08% above analysts’ estimates of $20.33 billion. Next quarter revenue and net income is estimated to be $89.28 billion $30.86 billion respectively, with the delivery of iPhone orders next quarter. Tim spoke on Apple’s products and its aim to be carbon neutral by 2030:

“This year we launched our most powerful products ever, from M1-powered Macs to an iPhone 13 lineup that is setting a new standard for performance and empowering our customers to create and connect in new ways,”…“We are infusing our values into everything we make — moving closer to our 2030 goal of being carbon neutral up and down our supply chain and across the lifecycle of our products, and ever advancing our mission to build a more equitable future.”

The executive also cautioned against supply chain constraints (not due to Apple product design) which would continue to impact the company’s future revenue for it’s iPad and services division.

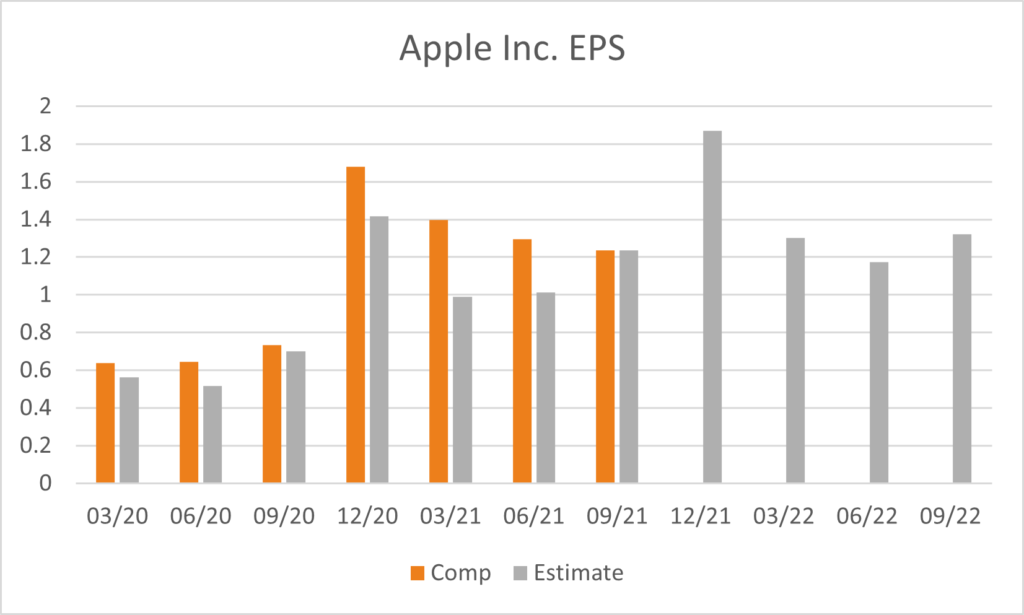

The company’s EPS for Q42021 was $1.235, -4.7% lower than previous Q32021 EPS of $1.296, and in line with analyst estimates of $1.237. Apple’s board had declared a cash dividend of $0.22, payable in November 2021. EPS for the next quarter is forecasted at $1.87. The company’s CFO Luca Maestri, spoke on the company’s cash position:

“During the September quarter, we returned over $24 billion to our shareholders, as we continue to make progress toward our goal of reaching a net cash neutral position over time.”

Apple’s shares fell as much as –5.3% to US$144 in after-hours trading, having risen +2.50% in regular trading before the announcement. Analysts remain broadly positive on the stock, with 79% of analysts maintain a buy recommendation with 17% as a hold, with an average 12-month price target of $166.85 representing a 9.3% gain from current prices.