Aurizon Holdings Ltd. (AZJ) is a rail freight company providing coal, bulk and general freight haulage services in Australia.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating* | Next Earnings Announcement |

| 3.28-5.32 | 10,669,610 | 7,205.2 | 9.2% | 97.0% | 4.72 | 3.75 | 15/02/2021 |

*5 – strong buy, 1- strong sell

Aurizon Holdings Ltd. (AZJ) is a rail freight company providing coal, bulk, and general freight haulage services in Australia and across the central Queensland coal network with specialised track maintenance and workshop support. Aurizon Holdings is Australia’s largest freight rail operator, having listed publicly in 2010 after being government-owned for 145 years.

AZJ operates across three segments, coal, network, and bulk. Coal is the largest revenue generator, totaling 58% of revenue in 2020, transporting 200 million tonnes of metallurgical and thermal coal each year from QLD and NSW to be exported globally. This is followed by network services with revenue generated from tariffs for other train operator’s use of its railroad as well as contracts to service Queensland Rail’s passenger cars, at 22% and bulk at 19% which hauls commodities other than coal in QLD, NSW, SA, and WA hauling over 40 million tonnes per year.

AZJ’s share prices has been hit as a result of an ongoing ban in China on Australian coal, as well as lower coal prices as countries and companies shift towards a greener focus with the Paris Climate Agreement targeting net zero emissions by 2050. While coal haulage accounts for more than half of revenue, AZJ can boost earnings by focusing on bulk haulage to take advantage of strong iron ore prices currently.

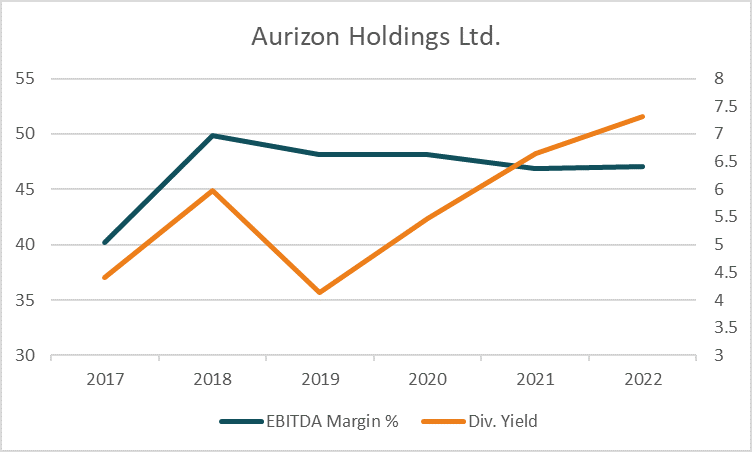

With consistent EBITDA margins and free cash flow generation, AZJ has been able to pay a steady dividend which yields an estimated 6.60% for the 2021 financial year – an attractive level given the lower interest rate environment globally.

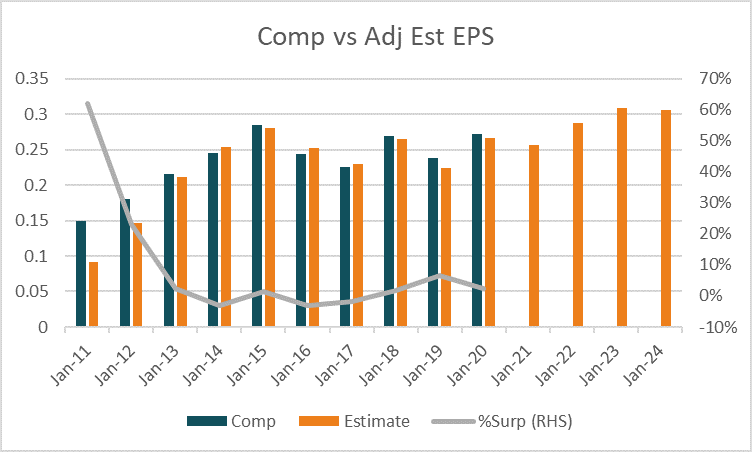

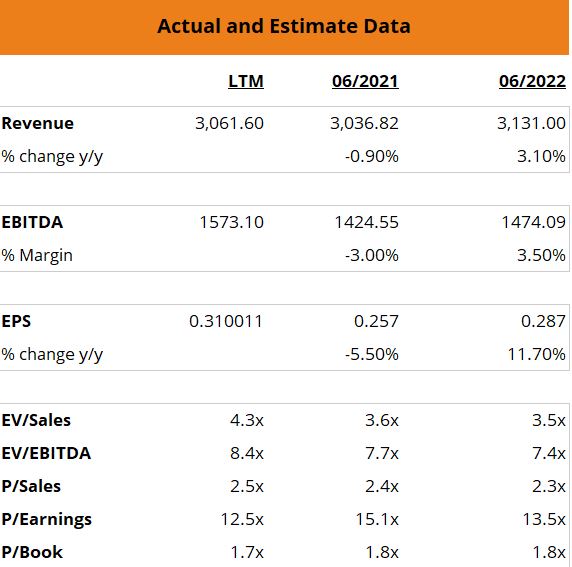

For the financial year ending June 2021 revenue is expected to remain relatively unchanged at A$3,036m and increase slightly by +3% in 2022 to A$3,131m. Adjusted earnings per share for 2021 is expected to drop -6% to A$0.26 before rising +12% in 2022 to A$0.29. Based on these adjusted estimates the stock trades on forward P/E multiples of 14.9 and 13.3 for 2021 and 2022 respectively, -14% discounts to the peer group averages of 17.3 and 15.6.

The average target price of analysts covering the stock is $4.72 with 58% of analysts rating the stock as a buy, compared to 17% as a sell and 25% as a hold.