BHP Group Ltd (BHP) operates as a mining company, engaging in the exploration, development, production, and processing of commodities including iron ore, coal, copper, and petroleum, servicing customers worldwide.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating | Next Earnings Announcement |

| 23.58-47.54 | 7,305,058 | 214,148.9 | 5.5% | 99.7% | 46.83 | 4.21 | 15/02/2021 |

*5 – strong buy, 1 – strong sell

BHP Group Ltd (BHP) operates as a mining company, engaging in the exploration, development, production, and processing of commodities including iron ore, coal, copper, and petroleum, servicing customers worldwide. BHP operates across four segments, iron ore, base metals which include copper, silver, lead, uranium and zinc, coal, and petroleum. Iron ore generates the largest amount of revenue, totaling 49.8% in the financial year ending June 2020. This was followed by base metals, which totaled 25.5% of sales, coal at 14.9%, and petroleum at 9.7%.

BHP primarily operates assets across Australia, Brazil, Chile, Peru, Canada, the United States, and the United Kingdom. A world leader in commodities, it operates long life, low cost, and an expandable portfolio of assets which includes Olympic Dam in South Australia, one of the world’s largest ore bodies of copper, gold, silver, and uranium. The Asian Pacific region generates the majority of revenue with China alone accounting for 63% of sales in 2020, followed by Japan at 9%, South Korea at 6%, and Australia and North America at 5% respectively.

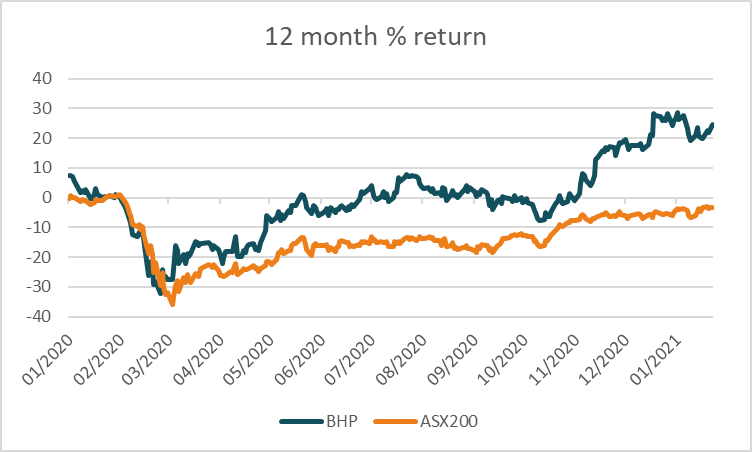

BHP stands to benefit from ongoing easy monetary conditions and expansionary fiscal policy as the world shifts to a reflationary environment. Growth is likely to be driven by firmer iron ore prices, which have risen over 105% in the past twelve months to US$159 per metric tonne. Additionally, firming prices in copper should also provide a tailwind, offsetting lower revenue from coal within ongoing bans in China on importing Australian coal.

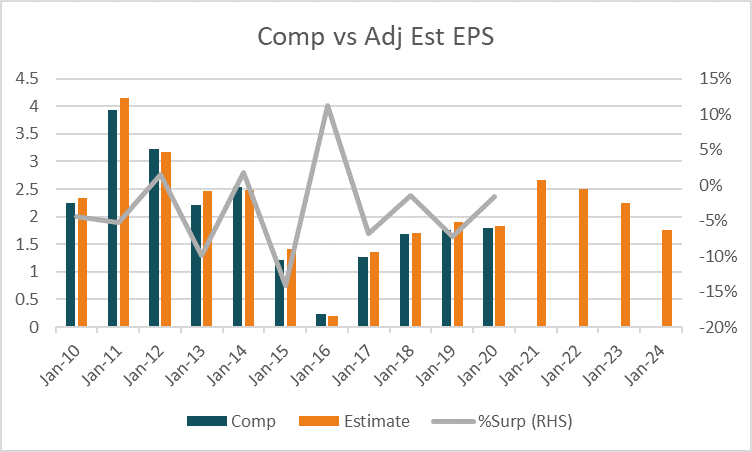

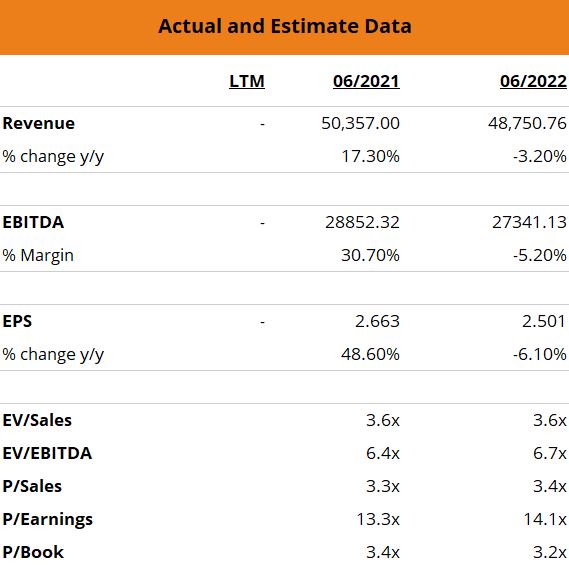

For the financial year ending June 2021 revenue is expected to rise +17% to US$50,357m before moderating in 2022 to US$48,750. Adjusted earnings per share are expected to increase nearly +46% in 2021 to US$2.66 before dipping -6% in 2022 to US$2.50. Based on these adjusted estimates, the stock trades on forward P/E multiples of 13.1 and 13.9, discounts of -22% and -4% compared to the peer group averages of 16.7 and 14.5 respectively.

The average target price of analysts covering the stock is $46.83 with 80% of analysts rating the stock as a buy, compared to 7% as a sell and 13% as a hold.