Cisco Systems (CSCO) reported a revenue of $12.9 billion for Q12022, 8% higher than last year’s $11.9 billion for Q12021.

This was -2% lower than previous quarter’s $13.12 billion and -1% lower than analyst’s estimate of $12.993 billion. In terms of business segments, the secure networks segment reported an increase in revenue of 10% to $5.97 billion. The internet for the future segment, reported the biggest gain of 46% to $1.37 billion. The hybrid work segment declined by 7% to $1.11 billion. Lastly, services revenue increased by 1% to $3.37 billion.

The CEO Chuck Robbins has been aiming to reduce the company’s revenue stream reliance from hardware to software services. He stated:

“Cisco’s technology sits at the heart of the accelerated digital transformation happening today. Our breakthrough innovation, strong demand, and the success of our business transformation positions us well for another year of growth in fiscal 2022.”

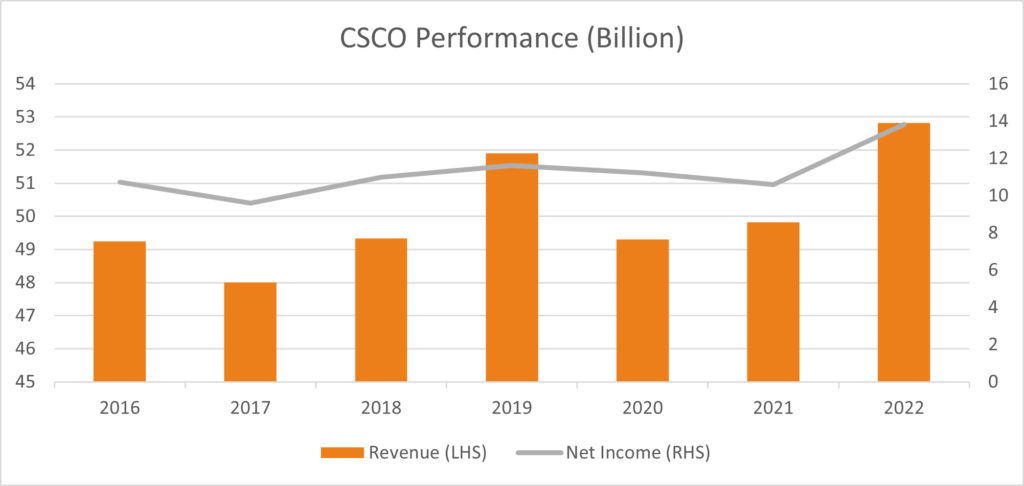

Net income for Q12022 was $3.47 billion, 8% higher than YoY Q12021 revenue of $3.21 billion. This was -2% lower than last quarter’s $3.55 billion and 2% higher than analyst’s estimates of $3.40 billion. CSCO experienced high growth last year when the pandemic began as companies rushed to provide employees with work from home solutions. As offices are reopening, the company aims to take advantage of clients aiming to improve their inhouse infrastructure to accommodate remote working. In order to secure supply, CSCO has had to make upfront payments reducing the company’s profit margins.

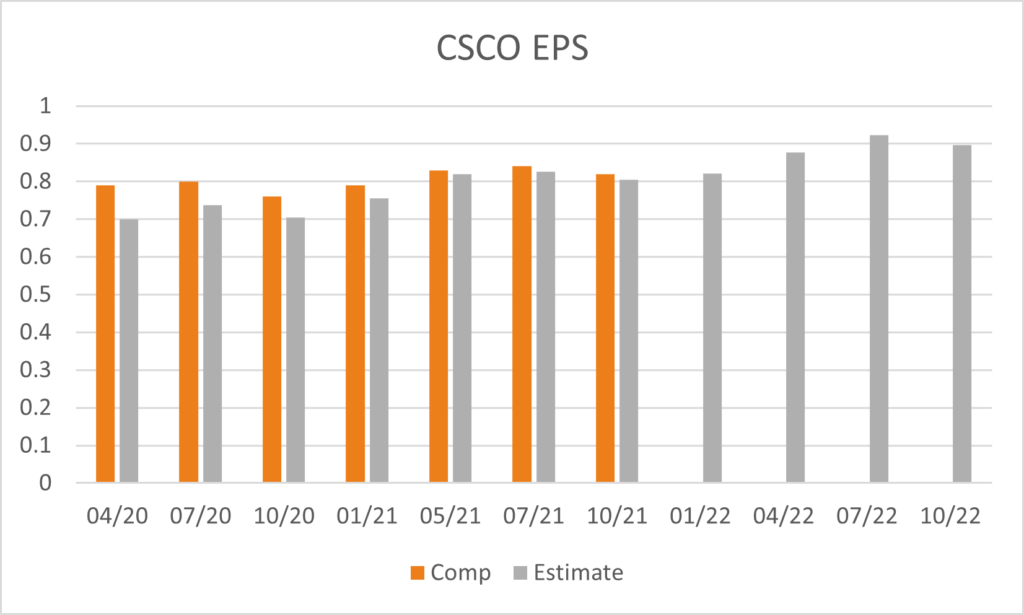

EPS for Q12022 was reported at $0.82, 8% higher than Q12021 EPS of $0.76, -2% lower than last quarter’s $0.84 and 2% higher than analyst’s estimates of $0.805. Management provided guidance on revenue growth between 4.5 to 6.5% for next quarter and EPS to range from $0.8 to $0.82.

Investor sentiment was low, as the share price fell by 8% to $52 in extended trading. Analysts have a balanced view on the stock with 48.4% recommending buy and 51.6% recommending hold, with share price estimated to reach $62.56 in the coming 12 months.