Fortescue Metals Group Ltd. (FMG) explores and produces iron ore in Western Australia’s Pilbara, and is Australia’s third largest miner behind BHP Billiton and Rio Tinto.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 7.76 – 23.29 | 11,968,600 | 68,999.6 | 11.2% | 57.0% | 16.78 | 3.21 | 18/02/2021 |

FMG operates integrated mining, rail, shipping and marketing teams to export around 180 million tonnes of iron ore annually, leveraging technology to be one of the lowest-cost iron ore producers. Fortescue Metals wholly owns its purpose-designed rail, fleet of ore carriers and port facilities, constructed to support the production and sale of iron ore from its mines in the remote areas of Pilbara. China is by far the most important market for FMG, with 95% of sales generated by China in 2020.

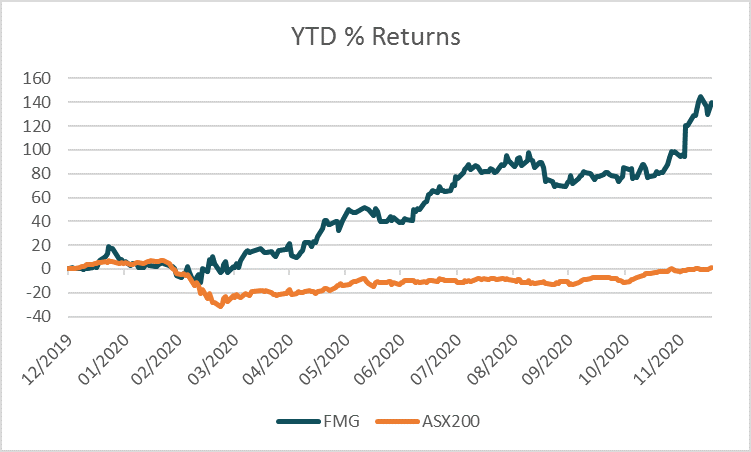

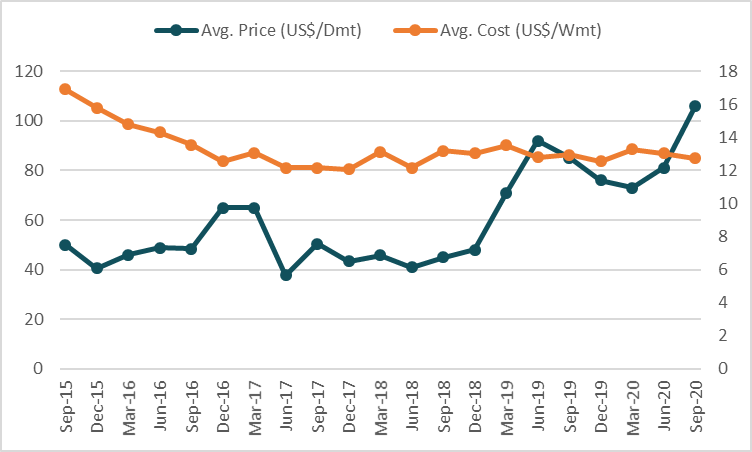

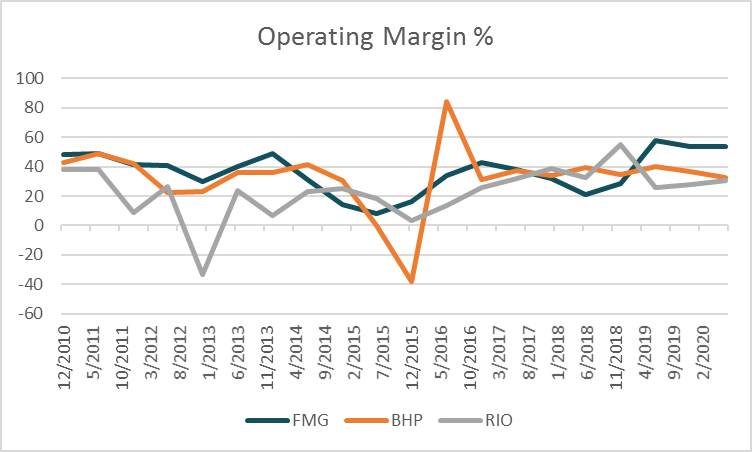

FMG has benefited from surging iron ore prices, up +63.5% in 2020, with its low cost, high-margin assets leveraged to the price of iron ore. However, the iron ore market is expected to move into surplus in 2021, meaning earnings may come under pressure in the medium-term. FMG’s high margin business due to its integrated supply chain with a focus on cost levels may help cushion the impact of any lower prices. Typically the bulk of sales to China has been a low-grade product with 56-59% iron content, however, its new higher-grade projects of Eliwana (60% iron content) and Iron Bridge (67 iron content) should help shift the product mix towards higher-grade ore. With costs largely denominated in Australian Dollars, FMG would receive any tailwind from a falling AUD.

Since 2015, production has been steadily maintained around 170 million tonnes, while the Firetail mine is set to be replaced, with the Eliwana mine and Iron Bridge project set to come online, production could reach 200 million tonnes by 2023.

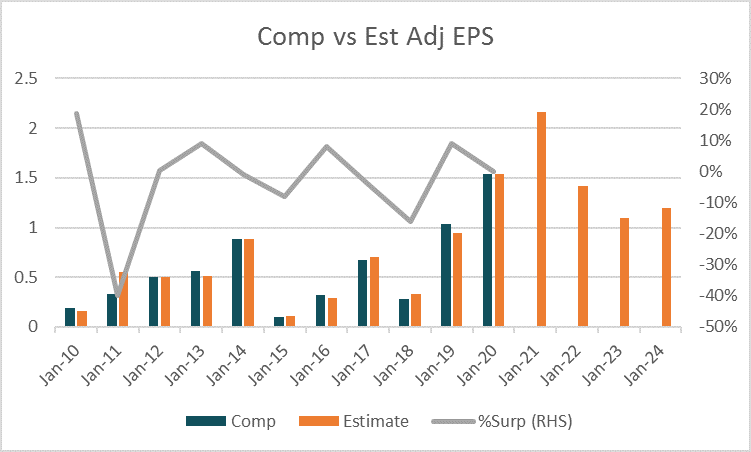

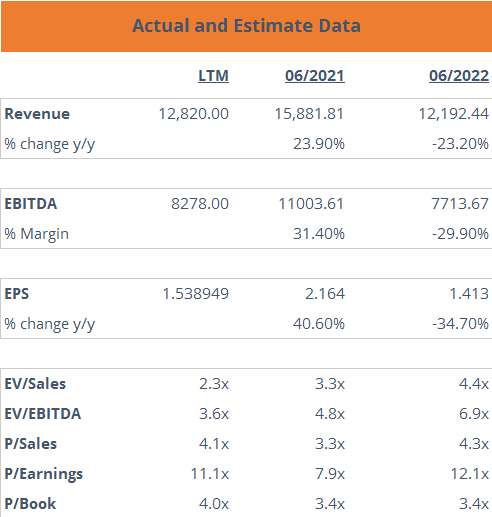

For the financial year ending June 2021, revenue is forecast to rise 9.8% to A$20,993.8m before declining -23.2% in 2022 to A$16,116.9. Adjusted earnings per share is forecast to rise +23.5% to A$2.86 before declining -34.7% in 2022 to A$1.87. Based on these estimates the stock trades on forward P/E ratios of 7.9 and 12.1 respectively, a -1% discount and 44% premium to the peer group averages of 8.0 and 8.4 respectively.

The average target price of analysts covering the stock is $20.01 with 26% of analysts rating the stock as a buy, compared to 16% as a sell and 58% as a hold.