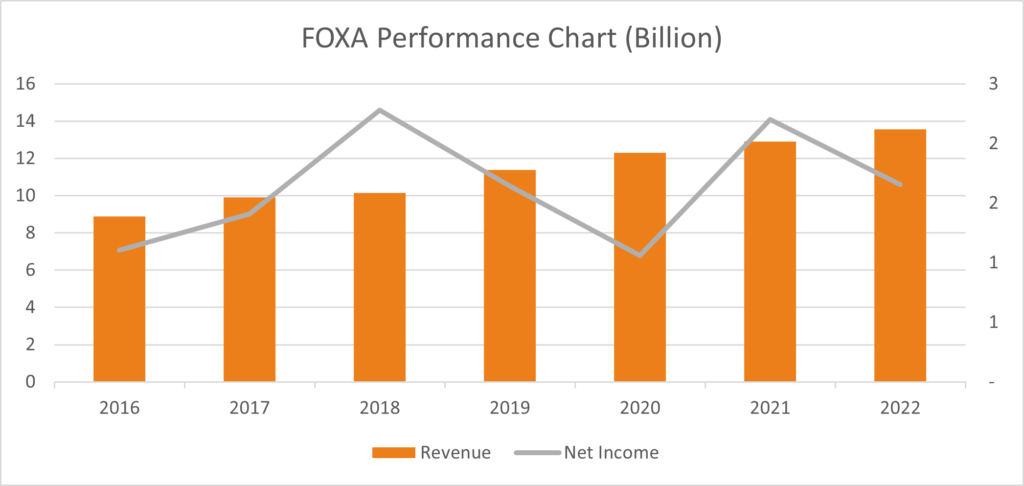

Fox Corporation (FOXA) posted a revenue of $3.05 billion for Q12022, 12.7% higher than previous year’s Q12021 $2.71 billion, 5.36% higher than last quarter’s revenue of $2.89 billion and 3.6% higher than analyst’s estimate of $2.9 billion.

The increase in revenue is attributed to the return of live sports which boosted ads by 17% and affiliate revenue by 9% for the quarter. FOXA has a steady news & sports model which dominates viewership, complimented by its non-core sports betting and streaming with Tubi. Ad supported revenue from Tubi continues to grow rapidly, and according to analysis by Bloomberg could generate $500 billion for the fiscal year. Revenues from affiliate fees, advertising & other segments increased YoY by $134 million (8%), $161 million (16%), and $33 million (15%) respectively.

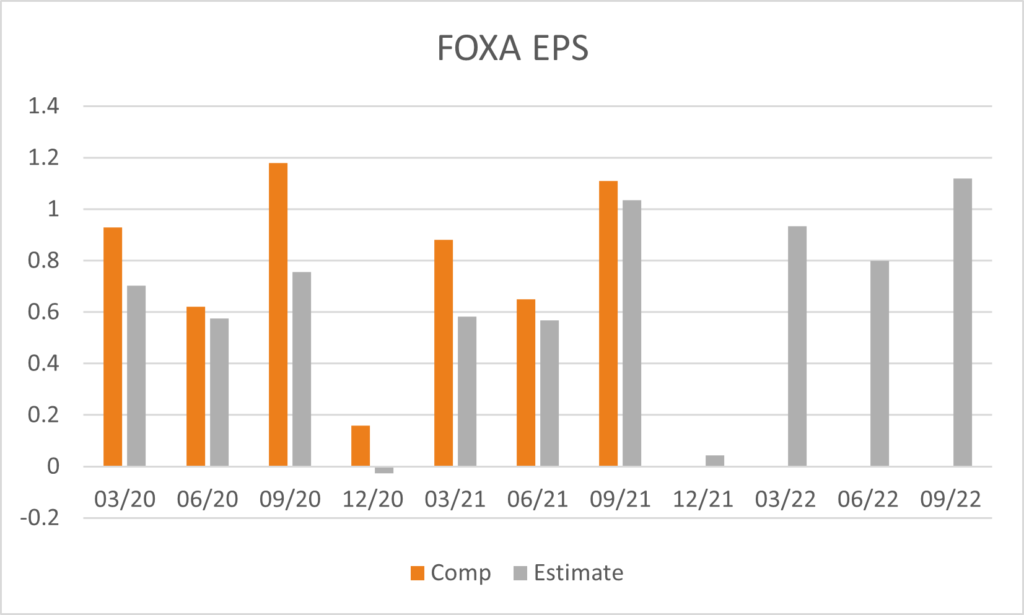

Net income was reported at $642 million for Q12022, -10.3% lower than $716 million in Q12021, 68.5% higher than previous quarter’s $381 million and 7.7% higher than analyst’s estimates of $595 million. This was due to increased programming costs such as college football, broadcast expenses and continued investment in new initiatives.

Ad based revenue may suffer in Q22022, due to lower political campaigning compared to the Q12022, however, overall forecasts for the year are expected to improve with the start of live sports complimented by its sports betting segment and affiliate fees from cable tv. Revenue and net income for Q22022 is expected to be $4.17 billion and $32.89 million respectively.

Executive Chairman and CEO Lachlan Murdoch said:

“We have made a strong start to the 2022 fiscal year with broad-based operating momentum led by the return of a full slate of live events at FOX Sports, ratings leadership at FOX News and exceptional progress at Tubi. As audiences migrate to live news, sports and streaming, it underscores the strategy and priorities that have defined our short history at FOX. We remain focused on bolstering our core brands and leveraging the unique assets that distinguish us to further propel growth and drive value for our shareholders.”

EPS for Q12022 was $1.11, -5.93% lower than Q12021 EPS of $1.18, but higher than the previous quarter’s EPS of $0.65 (70%) and analyst’s estimates of $1.035 (7.25%), with forecasted EPS for Q2022 to be at $0.043.

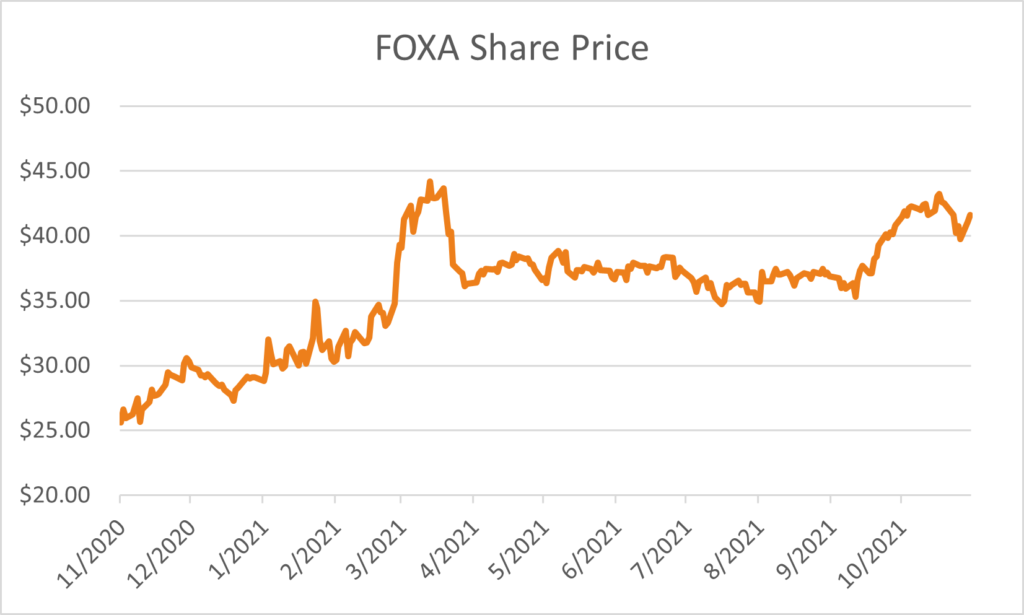

The reaction to earnings was muted, with shares down just -0.05% to $44.57. Analysts maintain a balanced view on the stock, with 54% having a buy recommendation while 42% have a hold recommendation with an average 12-month price target of $44.71, just +3% above the current price.