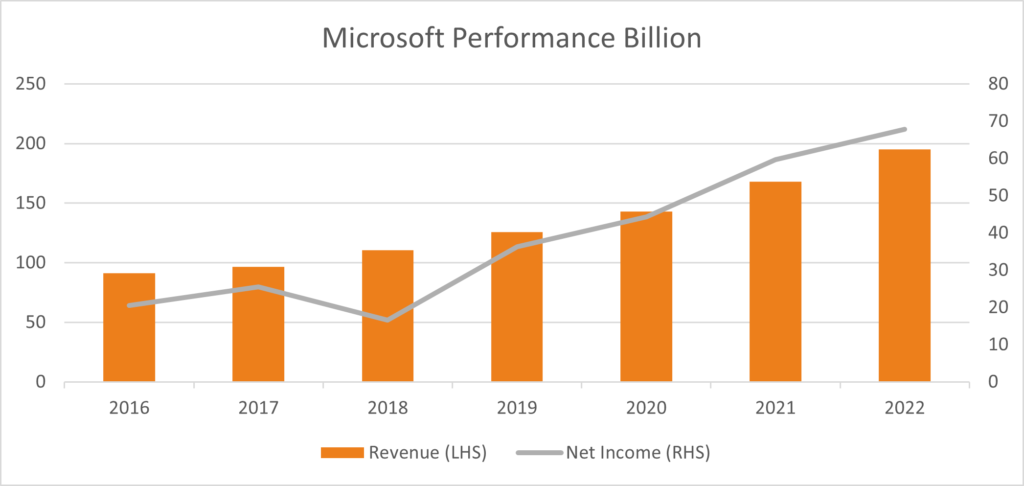

Microsoft corporation’s (MSFT) revenue for Q12022 was $45.31 billion, 22% higher than YoY Q12021 revenue of $37.15 billion.

Microsoft corporation’s (MSFT) revenue for Q12022 was $45.31 billion, 22% higher than YoY Q12021 revenue of $37.15 billion. The latest figures were -1.8% lower than Q42021 revenue of $46.15 billion, however, beat analyst’s estimates of $43.94 billion by 3.1%. The company’s Productivity and Business Processes, Intelligent Cloud and More Personal Computing segments added to the revenue figure with $15.0 billion (11% growth), $17.0 billion (20% growth), $13.3 billion respectively (6% growth). The company’s Chairman and Chief Executive Officer Satya Nadella spoke on the company’s cloud division’s performance stating:

“Digital technology is a deflationary force in an inflationary economy. Businesses – small and large – can improve productivity and the affordability of their products and services by building tech intensity…. The Microsoft Cloud delivers the end-to-end platforms and tools organizations need to navigate this time of transition and change.”

Amy Hood (the company’s executive vice president and chief financial officer) also referred to the revenue contribution of the cloud computing division:

“We delivered a strong start to the fiscal year with our Microsoft Cloud generating $20.7 billion in revenue for the quarter, up 36% year over year”.

Net income for Q12022 was $17.21 billion, 24% higher than YoY Q12021 net income of $13.89 billion, 4.6% higher than the preceding Q32021 net income of $16.46 billion, and 9.7% higher than analyst’s estimates of $15.698 billion.

Revenue and net income for the next quarter are forecasted at $49.92 billion and $17.176 billion respectively, as the company expects the impact of rising global competition, large investments in products and services, government litigation and regulatory restrictions to limit how products are designed and marketed, and M&A to lower revenue in the future.

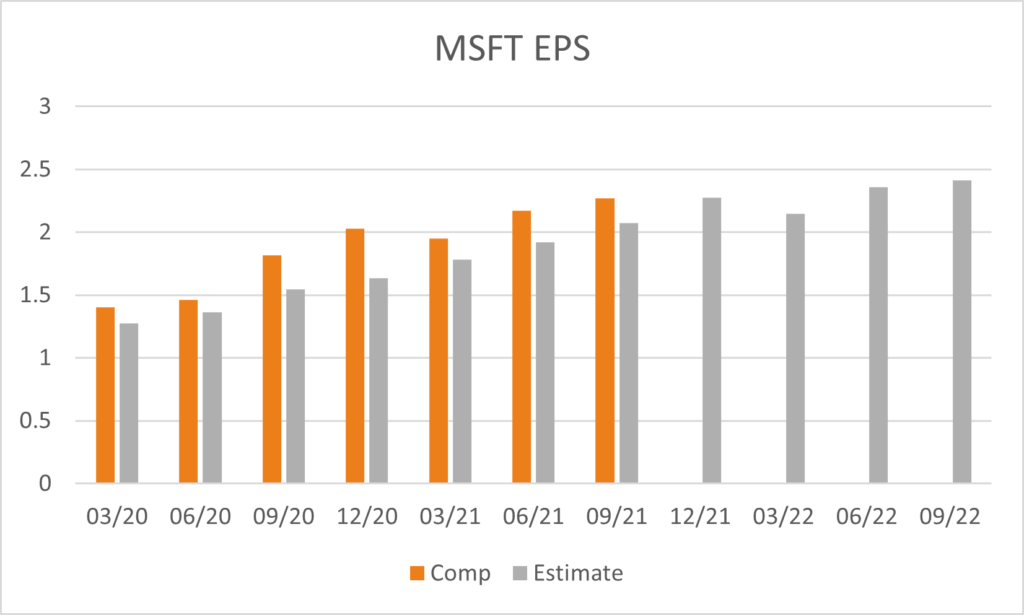

The current Q42021 EPS of $2.27 was 4.6% higher than last quarter’s $2.17 and analysts’ estimates of $2.07. MSFT had returned $10.9 billion to shareholders in Q12022 in the form of share repurchases, with the board of directors authorizing an additional $60 billion share repurchase program in September. Forecasted EPS for the next quarter is expected to remain stable at $2.27.

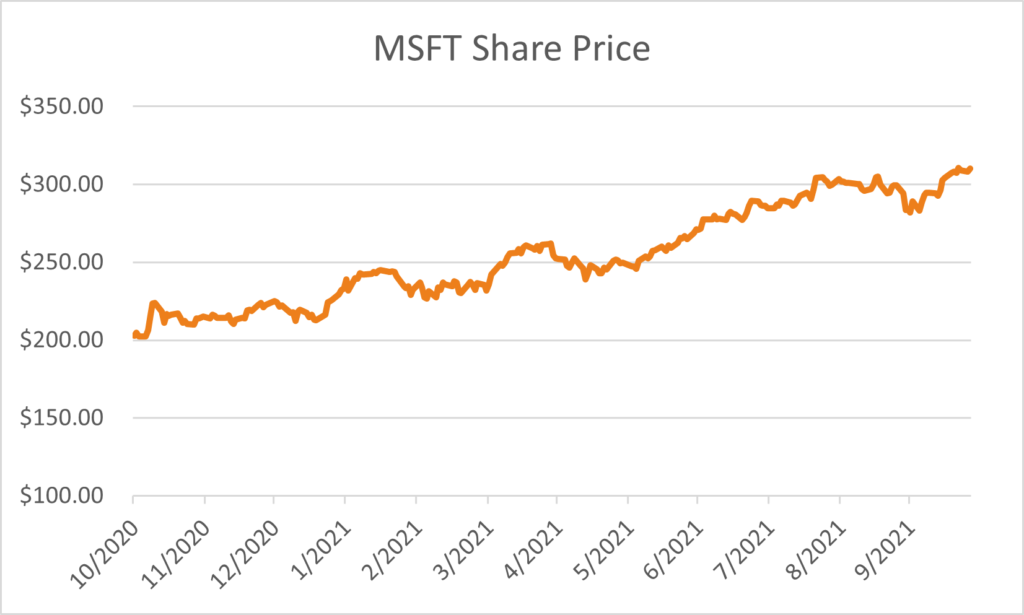

The share price closed at $323.17 on 27th October 2021, $13 higher (4.2%) from the previous day. The stock has a strong/positive consensus among analysts, with 91% recommending buy and the remaining recommending hold.