General Motors Company (GM) designs, builds, and sells cars, trucks, crossovers and automobile parts worldwide.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating * | Next Earnings Announcement |

| 14.32-57.05 | 21,856,738 | 73,645.1 | 0% | 90.0% | 63.79 | 4.80 | 05/05/2021 |

*5 – strong buy, 1 – strong sell

General Motors Company (GM) designs, builds and sells cars, trucks, crossovers, and automobile parts worldwide under well-known brands including Chevrolet, GMC, Holden, Buick, and Cadillac. The company also offers vehicle protection, parts, accessories, maintenance, satellite radio, and financing services worldwide. GM operates across three segments, Automotive, Financial and Cruise, where Automotive operates across GM North America and GM International, manufacturing and selling vehicles as well as stakes in Chinese companies where vehicles are made and sold under the local Baojun, Buick, Cadillac, Chevrolet and Wuling brands and contributes the overwhelming majority of revenue, totalling 89% in 2020. GM Financial contributed 11% of revenue in 2020 and provides automotive financing and retail loan and lease products and services, as well as commercial products to dealers including new and used inventory financing, insurance, working capital, and storage centre finance. Finally, GM Cruise which contributed less than 1% of revenue in 2020 including the business operations for its autonomous vehicle technology.

In line with industry themes, GM is focused on shifting to environmentally friendly cars utilising electricity and hydrogen fuel cells, setting 2035 as a deadline to cease production of the internal combustion engine. Additionally, the company has set a target of selling 1 million battery-powered vehicles by 2025 and investing US$27 billion to improve its technology. Fourth-quarter 2020 sales volume increased 4% year-on-year, the first since 2016 as Chinese unit sales, the largest new vehicle market in the world, increased at 14% being GM’s fastest-growing region.

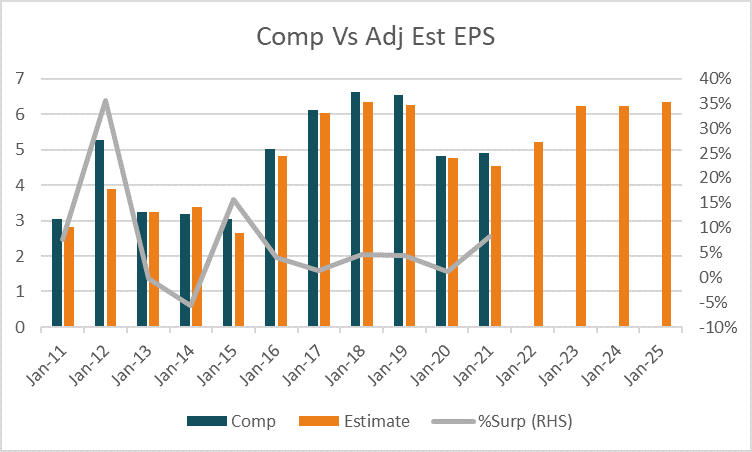

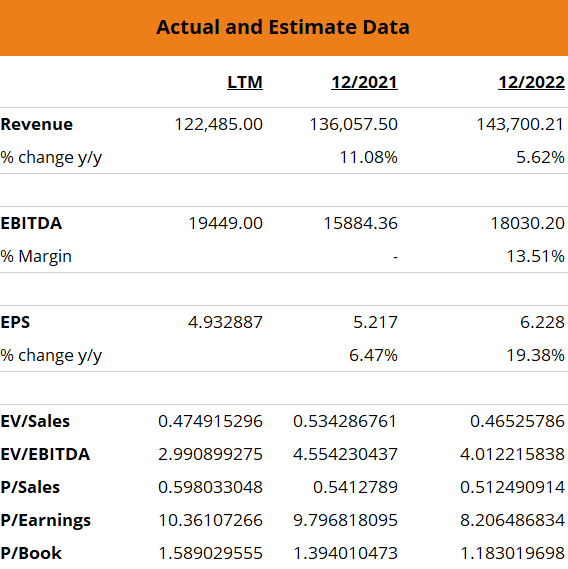

For the year ending December 2021, revenue is forecast to grow +11% to US$136,057m and rise a further +5.6% in 2022 to US$143,700m. Adjusted earnings per share is expected to increase +5.4% in 2021 to US$5.22 and before increasing +19.4% in 2022 to US$6.23. Based on these adjusted earnings the stock trades on forward P/E multiples of 9.8 and 8.2 for 2021 and 2022, in line with the peer group average for 2021 and a +19% premium to the peer group average of 6.9 for 2022.

The average target price of analysts covering the stock is $63.79 with 90% of analysts rating the stock as a buy, compared to 0% as a sell and 10% as a hold.