Washington H. Soul Pattinson & Co (SOL) is an investment holding company.

| Key Statistics | |||||||

| 52-Week Range | Avg. Daily Vol (3 Mo) | Market Value (m) | Dividend Yield | Float % | Target Price | Consensus Rating (5 strong buy – 1 strong sell) |

Next Earnings Announcement |

| 16.22-30.84 | 3336,420 | 7,203.4 | 2.8% | 39.6% | 18.70 | 3.00 | 26/03/2021 |

Washington H. Soul Pattinson & Co (SOL) is an investment holding company which owns shares and properties, as well as having interests in coal mining, bulk handling, commercial television licensing, telecommunications, merchant banking, funds management, pharmaceutical retailing, manufacturing, and the processing and marketing of biscuits and cakes. With a flexible investment mandate, SOL is able to make long-term investment decisions and adjust the portfolio mix of asset classes over time, holding a diversified portfolio of uncorrelated investments across listed equities, private equity, property and loans. Originally listed in 1903, SOL is the second oldest publicly listed company on the ASX.

Investments include a 25.3% holding in TPG Internet, the well know telecommunications provider, a 43.9% holding in Brickworks, which manufactures and distributes clay and concrete products, a 50% stake in New Hope Group, a diversified energy company and a 19.3% stake in the ASX listed Australian Pharmaceutical Industries (API) which owns brands Priceline and Soul Pattinson and Pharmacist Advice.

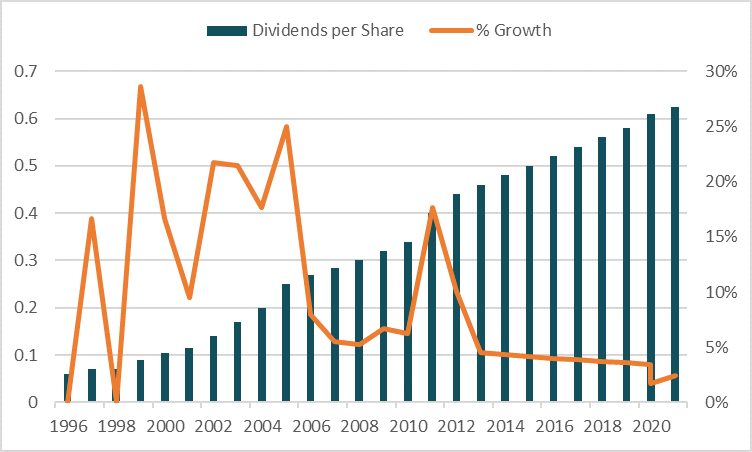

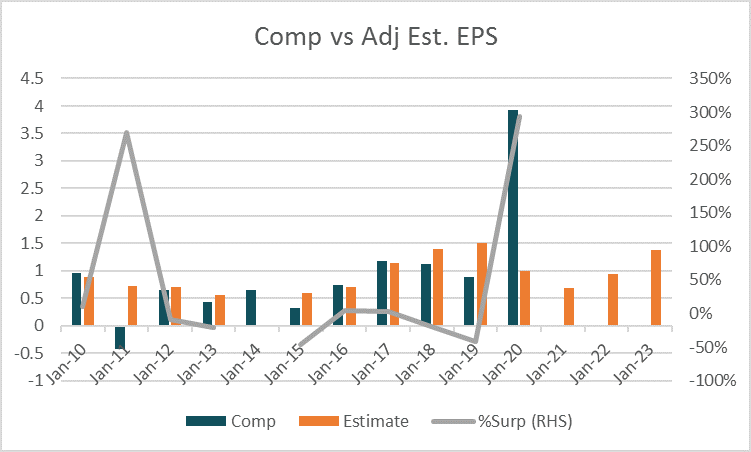

For the financial year ending July 31st 2020, regular net profit after tax fell -44.7% to A$169.8m, with the fall relating to lower coal prices impacting New Hope, the impact of COVID-19 on Brickworks building products business and TPG’s earnings which were impacted by merger accounting. Statutory net profit after tax rose +284.3% due to a non-reoccurring uplift in TPG’s market value. On an adjusted basis revenue fell -14.9% to A$1,329.8m from A$1,562.8m in 2019 and is expected to drop a further -20% in 2021. Adjusted earnings per share gained +467% in 2020 due to non-reoccurring items and is expected to fall -86% in 2021 to A$0.69 before rising +36% in 2021 to A$0.94. Still, dividends per share have risen every year since 2000 and is forecast to continue, rising to A$0.61 in 2021 and A$0.63 in 2022 as shown on the chart below. Based on these adjusted figures, SOL trades on forward P/E multiples of 43.6 and 32.0 for 2021 and 2022 respectively, 67% and 60% premiums to the peer group averages.

The average target price of analysts covering the stock is $18.70 with 33% of analysts rating the stock as a buy, compared to 33% as a sell and 33% as a hold.