One of the most common concerns that I hear from members is whether now is the right time to invest.

If the market is tracking well or at all-time highs, often the concern is whether there will be an inevitable pullback or recession around the corner. If the market experiences a correction, often the psychological response is that the market will continue trending down. Too often, investors miss a once-in-a-decade opportunity due to an attempt to “time the market”.

A bear market is traditionally defined as a fall of at least 20% off their highs and usually last between 6-18 months. In that period, there is usually one day that represents the bottom of the market and is when sentiment is at its most negative. In this respect, there is usually an average of 253 trading days in a calendar year, which puts the odds of picking the bottom of a bear market at between 1-in-125 and 1-in-375 chance. To put that in perspective, currently, Sportsbet is offering 1-to-101 odds for Kanye West to win the US presidential election.

So, given timing the market is so tricky, and volatility can significantly impact the short-term performance of your portfolio, how do you try and take advantage of a market that is trading at a significant discount?

One strategy that I believe that can deal with this issue is Dollar Cost averaging.

Investopedia defines Dollar Cost Averaging as “an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase.”

Simply put, this strategy involves periodically investing funds over a specified period with pre-defined intervals.

I can understand, rightly so, that the ultimate bulls who believe the market will go up in the long run, think being out of the market is just not necessary. However, for a first-time investor, that idea of trying to find the bottom of the market is always a primary emotive response and can cost a lot of potential return.

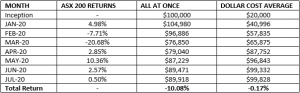

For example, if I have $100,000 that I want to invest in the market. My first option is to invest it all today, which is shown in the “All at Once” column. My second option is to invest $20,000 every month of the first 5 months, which is represented in the “Dollar Cost Average” column.

By investing “All at Once” to portfolio initially drops by more than 20% and then manages to return negative 10%, whereas Dollar Cost Averaging strategy drops by just under 13% and then ends up only slightly negative.

Now the seasoned investors will rightly point out that in the long run the market trends in an upward direction and that the most important factor is “time in the market, not timing the market”. If you were to use the same example every year of the last decade, there would only be a handful of times that Dollar Cost Averaging was more profitable. However, for inexperienced investors the prospect of losing more than 20% of their portfolio over the course of 4 months can be an unnerving experience.

This is where Dollar Cost Averaging really shines; it may provide a potentially better short-term return, but also alleviate some of the anxiety and stress of having your portfolio initially devastated.

Currently speaking there are two schools of thought on where the market is headed. Firstly, some investors believe that the market will make a “V” shape recovery, in which case Dollar Cost Averaging can assist in eliminating some of the short-term volatility that has plagued the market this year. The second school of thought is that we will experience a “W” shaped recovery, in which case Dollar Cost Averaging can assist in lowering your initial exposure to a market pull-back, while also potentially lowering your entry price.

The other main advantage of Dollar Cost Averaging is its ability to limit the emotional toll of losing money. For many investors, the fear of losing money is greater than the prospect of making money. This is most apparent with investors that are new to the market, as they are not accustomed to the cyclical nature of the market. This can lead to individuals becoming disheartened and can lead to some individuals withdrawing from the market entirely.

Like most investment strategies, Dollar Cost Averaging will only be suitable to some investors and should be used as a tool to hedge against volatility, not an investing “silver bullet”. The most important thing to remember is that in the long run, the cost of not being in the market is almost always greater than the cost of being in the market.

To read more about Dollar Cost Averaging in Investopedia click here.