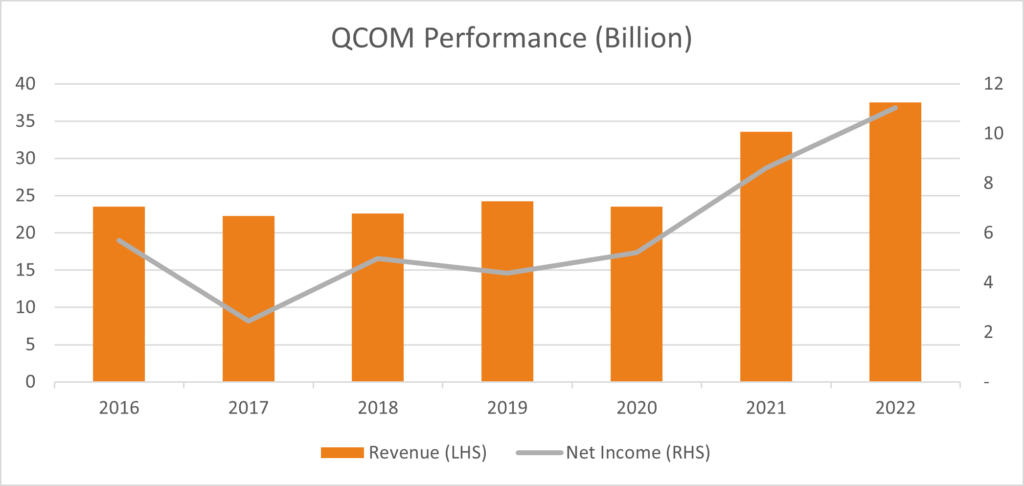

Qualcomm (QCom) reported its revenue for Q42021 at $9.32 billion, an increase of 43.4% compared to last year’s Q42020 revenue figure of $6.5 billion, a 16.6% increase from Q32021 revenue of $7.99 billion and 5% higher than analyst’s estimate of $8.86 billion.

Revenue from smart phone chip sales was $4.69 billion and sales from IOT division was $1.54 billion. QCom continues to diversify its revenue stream, opting to focus on android sales rather than iPhone with CEO Christian Amon noting “The fastest growth opportunity for us in handsets is the Android opportunity”.

QCom is uniquely positioned to take advantage of a diversified revenue stream and is focusing on other industries taking advantage of 5G technology and Internet of Things (IOT) to complement its revenue e.g. automotive, retail POS etc. With Amon stating “Now we have more growth vectors than just mobile,”.….”clearly Qualcomm is no longer defined by a single market.”

Net Income for Q42021 was reported at $2.92 billion, 74.7% higher YoY than Q42020 net income of 1.67 billion, 24.5% higher than previous quarter’s $2.2 billion and 12.4% higher than analyst’s estimate of $2.59 billion.

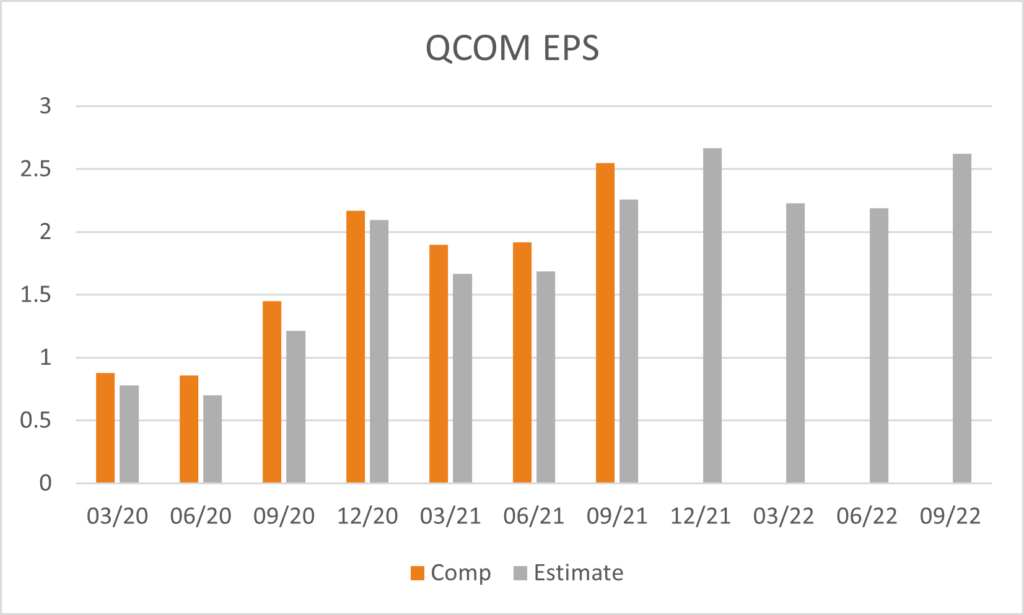

QCom provided updated guidance for the final quarter of 2021 with revenue expected to be in the range between $10 and $10.8 billion, compared to Wall Street estimates of $9.73 billion. Earnings guidance was also revised higher to $2.90 to $3.10, also higher than analysts’ estimates of $2.85.

QCom reported EPS of $2.55 per share for Q42021, 76% higher from Q42020 EPS of $1.45, 33% higher than the previous quarter’s EPS of $1.92 and 13% higher than current quarter’s estimate of $2.26.

QComm has outsourced some of its operations to improve efficiency in the delivery of microchips. CFO Akash Palkhiwala commented:

“We do have constraints really across the board,” …“But we feel pretty comfortable that the overall supply picture is playing out exactly as we had planned.”

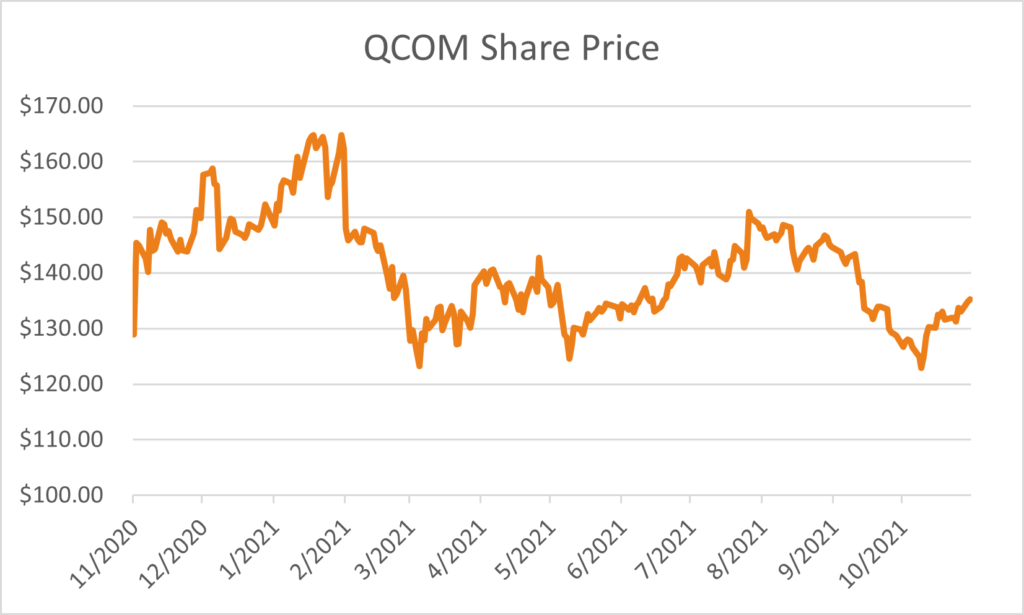

Investors reacted positively to the earnings update with the share price jumping +12.73% to $156.11 the day after, having released earnings after the prior market close. Analysts have a positive outlook on the stock price with 68.6% recommending buys and remaining recommending hold with an average 12-month price target of $179.78, 15% higher than current prices.