Strategy Objective: The Rivkin Australian Equity Managed Account aims to produce positive average annual returns while seeking to maintain a level of volatility lower than that of the S&P/ASX 200 Accumulation Index over the same investment period.

30 September 2020 Equivalent Unit Price – A$1.0293

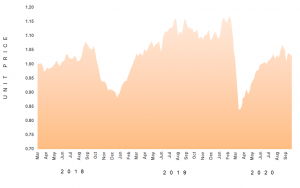

Welcome investors to the monthly update for the Rivkin Australian Equity Managed Account (RAEMA) for September 2020. Equity markets in Australia were weaker in September, with the ASX200 Accumulation Index declining 3.66% for the month. The RAEMA also declined, but held up better than the broader market, with the Equivalent Unit Price (EUP) price ending the month at 1.0293, for a decline of 2.01%.

| RAEMA | |

|---|---|

| Latest Month | -2.01% |

| Quarter to Date | 3.19% |

| Calendar Year to Date | -5.59% |

| Financial Year to Date | 3.19% |

| 12-month | -8.36% |

| Inception | 2.93% |

Monthly Commentary

For equity markets both locally and in the US, September was the first negative month since March, and follows five months of positive gains as equity markets recover from the pandemic induced decline between February and March. Markets remain rather sensitive to the US political landscape, with the Presidential election now less than one month away. This was evident late on Friday when President Trump confirmed he had tested positive to Covid-19, which led to a sharp sell-off into the close for the ASX. More so, wrangling between the Republicans and Democrats over the next round of fiscal stimulus has come to a standstill, with the size and details of the next package now expected to be confirmed after the election results are known. This will no doubt delay the economic recovery currently underway. In Australia, Treasurer Josh Frydenberg delivered the 2021 Federal budget in Parliament on Tuesday night, which has been largely well received. Cuts to personal income tax, originally scheduled for 2022, will now be backdated to July 2021, and will provide an additional $12 billion to Australian taxpayers. In additional, asset write-offs and a large infrastructure spend will aim to boost investment.

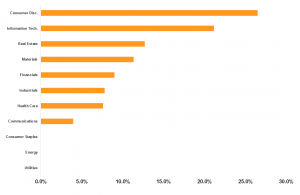

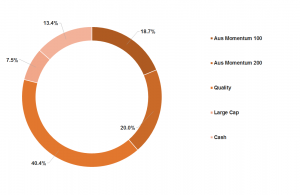

Looking at the current composition of the portfolio, as of month end, we maintain a fairly aggressive stance, with a cash weighting of 13.4%, higher than August, but not as high as other periods of time over the past 12 months. Our Quality and Momentum portfolios remain fully invested, which account for just under 80% of invested funds. This leaves us with 20% at our discretion, of which a little under half we have invested in additional equity opportunities, focusing on larger cap stocks. The portfolio is well balanced, with consumer discretionary and information technology stocks accounting for our largest exposures at 26.5% and 21.1% respectively, followed by real estate (12.7%) and materials (11.3%).

Looking to the month ahead, we would not be surprised to see an uptick in volatility throughout October, as we head towards the US election in early November. Nevertheless, it is important at times like this to maintain a longer-term investment focus, as we believe that any sell off in equities as a result of the political cycle will inevitably be short-lived.

If you have any questions regarding the above or your investments with Rivkin in general, please call us on 02 8302 3605.

Performance

NAV Price Chart

Monthly Returns

Portfolio Composition

Sector Breakdown

Top 10 Stock Holdings

Strategy Weighting

Strategy Description & Information

The RAEMA Strategy invests predominantly in listed Australian companies whose characteristics satisfy one or more of the strategies that occupy the portfolio. These strategies include: Momentum 100 & 200, being two discreet segments (ASX 100 & ASX 200 ex the ASX 100) of securities that are enjoying positive price trends; Quality, being companies with robust earnings profiles that are priced favourably versus their peers; Income, being securities that provide a high yield relative to the broader market; and Low Volatility, which cushions market shocks.

Important Disclaimer

The Rivkin Australian Equity Managed Account is available to wholesale investors only. Past performance is not a reliable indicator of future performance. The value of your investment may rise and fall, and you may not receive the amount originally invested.

Contact

Thomas Silitonga – Director, Rivkin Asset Management

[email protected] – +612 8302 3605