Strategy Objective: The Rivkin Low Volatility Strategy aims to provide steady, stable returns, which have a low correlation to the broader equity market. The Strategy involves allocating equal weighting to four different asset classes, via ASX listed ETFs.

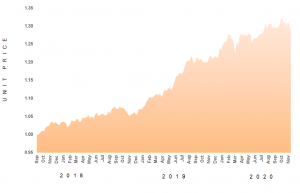

30 November 2020 Equivalent Unit Price – A$1.2903

Welcome investors to the monthly update for the Rivkin Low Volatility (LV) Strategy for November 2020. The value of the LV portfolio declined in November, with the Equivalent Unit Price (EUP) ending the month at 1.2903, for a loss of -1.26%. Over the past 12 months, the LV strategy has returned 5.99%, net of fees.

| PORTFOLIOS | LOW VOLATILITY |

|---|---|

| Latest Month | -1.26% |

| QTD | -0.45% |

| Calendar YTD | 6.46% |

| Financial YTD | 1.70% |

| 12m | 5.99% |

| Inception | 29.03% |

Monthly Commentary

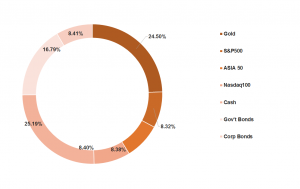

The biggest drag on the portfolio over the course of the month was the decline in the Australian dollar gold price, with the GOLD ETF that we hold at a 25% weighting, declining 10.0% during November. Despite this, gold prices have staged a very strong rebound in prices during the first part of December. The weaker gold price was somewhat offset however by stronger equity prices, with most global equity markets rallying quite strongly throughout the month. IVV, which tracks the S&P500 gained 5.66%, the gains in equities, offset by a stronger Australian dollar, which rallied 4.51% during November.

There were two major events for the month, the first being the U.S Presidential election, while the second was several news announcements relating to the roll out of Covid-19 vaccines. Beginning with the US election, and while the results were closer than expected, the result was in line with prior polling, with Joe Biden declared the presumptive winner. Despite Donald Trump failing to formally concede at this point and pushing his case of voter fraud in several key swing states, a change in the US Presidency seems all but guaranteed. This has been met by optimism from equity investors, clearly excited by a return to a more predictable administration. However, it was the announcement by Pfizer on Monday the 9th that the FDA had endorsed the safety and efficacy of their Covid-19 vaccine that led to sharp move higher in equities.

The announcement by Pfizer has since been followed by two other major pharmaceutical companies announcing that their vaccines are due for release, with the UK being the first major western country to authorize one for use. This week, the UK will begin its initial roll out of the Pfizer/BioNtech vaccine, with health care workers and the elderly in care homes amongst the first groups to receive it.

Looking ahead, and December tends to be a positive time for stocks, particularly in Australia. Based on data over the past 20 years, the average return for December for the ASX200 has been 1.42%, the second highest monthly average behind April (+1.63%). More so, we expect to see additional fiscal stimulus in the US early in the new year once the transition to a new administration occurs.

If you have any questions regarding the above or your investments with Rivkin in general, please call us on 02 8302 3605.

Monthly Returns

Performance

NAV Price Chart

Portfolio Composition

Asset Class Weighting

Strategy Description and Information

The low volatility strategy invests in listed ASX securities (ETFs) that represent multiple asset classes: cash, US equities, bonds and gold. We target asset classes that have a low or negative correlation to each other, with the benefit being a history of lower volatility and higher risk-adjusted returns than equities alone. While the expected return of this strategy will be lower than the long-term average of equity returns, the superior return per unit of volatility makes this an excellent tool to offset some of your more volatile investments. Both the gold and US equity ETF are unhedged, meaning that approximately half the portfolio has exposure to a short AUD/USD position. Given the nature of the AUD as a growth currency to decline during periods of equity market declines, this exposure is advantageous to cushioning the portfolio during periods of equity market weakness.

Important Disclaimer

The Rivkin Low Volatility Strategy is available to wholesale investors only. Past performance is not a reliable indicator of future performance. The value of your investment may rise and fall, and you may not receive the amount originally invested.

Contact

Thomas Silitonga – Director, Rivkin Asset Management

[email protected] – +612 8302 3605