Afterpay Limited (APT) provides payment services. The company offers an instalment payment service that is free for customers who pay on time. Afterpay serves customers in Australia, New Zealand, the United States, and the United Kingdom.

Revenue of Afterpay is primarily generated from transaction fees paid by merchant clients relating to Afterpay sales. In the financial year 19/20 86% of revenue was generated by merchant fees, with the remaining 14% generated from customer fees such as late payment fees and financing.

As of the end of financial year 2020, 61% of total sales were generated within Australia compared with 75% the prior year. Meanwhile a focus on the United States saw sales boosted from 15% to 31%. Revenue for the twelve months ending June 2020 totalled $519.2m, up 96% year-on-year, and forecast to increase to $912m in for the 2021 financial year. Earnings per share for 2020 was -$0.08, estimated to rise to $0.08 in 2021 and $0.44 in 2022 that would see the stock trading of forward P/E multiples of 1,206.19 and 230.80 respectively.

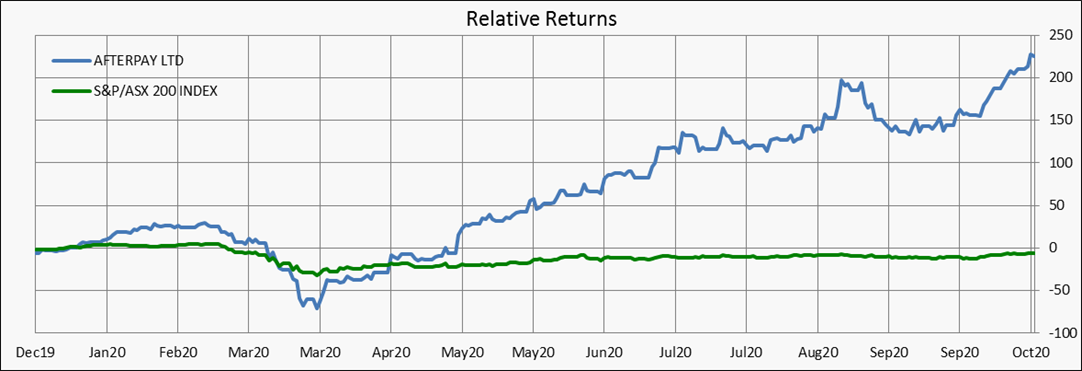

Afterpay recently surged to a new all-time high after announcing it was partnering with Westpac Bank’s (WBC) new online banking platform, which would allow Afterpay to offer transaction and savings accounts along with other cashflow management tools to its 3.3 million Australian customers from Q2 2021. The deal allows Afterpay to scale its business further without the need for a licence from the Australian Prudential Regulation Authority (APRA) or hold additional regulatory capital, allowing it to bypass some of the regulatory risks associated with banking products.