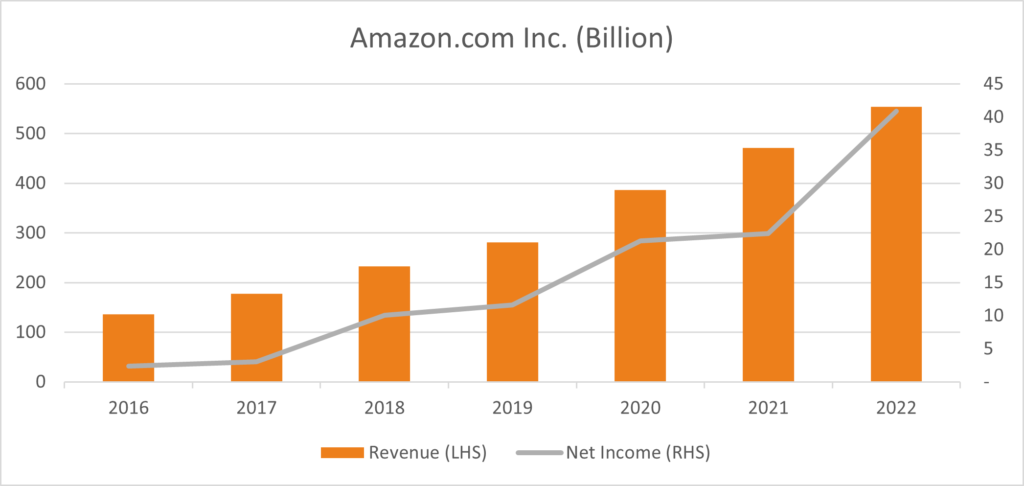

Amazon.com Inc reported a revenue of $110.8 billion for Q32021, a 15% increase compared to YoY Q32020 of $96.15 billion, -2% lower than previous quarter Q22021’s revenue of $113.08 billion and -0.89% lower than analyst’s estimates of $111.81 billion.

It’s web services division (AWS) contributed $16.1 billion to revenue (14.5% of total revenue), beating analyst’s estimates of $15.4 billion by 4.5%. It introduced new features such as Amazon One, faster new-same day delivery, gift-giving and others. The company’s CEO Andy Jassy commented:

“In the first several months of COVID-19, Amazonians played an essential role to help people secure the requisite PPE, food, and other in-demand items needed, and we worked closely with businesses and governments to leverage AWS to maintain business continuity as they responded to the pandemic. Customers have appreciated this commitment, which is part of what’s driving this past quarter’s AWS growth acceleration to 39% year over year.”

Net income for Q32021 was $3.156 billion, -50% lower than previous year’s net income of $6.3 billion for Q32020, -59% lower than previous quarter Q22021’s net income of $7.8 billion, and -32% below analyst’s estimates of $4.46 billion. A labour shortage has led to higher wages being demanded, and the company having to pay lucrative benefits to secure labour e.g. signing bonuses worth $3000. The number of employees rose 30% to 1.47 million highlighting Amazon’s focus ahead of the busy holiday season and its long-term value on delivering what customers want at any cost. The company warned that increased costs could see the final quarter of 2021 finish without any profit despite potential sales as high as $140 billion. The CEO spoke labor shortages and supply chain constraints to continue into the next quarter:

“In the fourth quarter, we expect to incur several billion dollars of additional costs in our Consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues, and increased freight and shipping costs—all while doing whatever it takes to minimize the impact on customers and selling partners this holiday season. It’ll be expensive for us in the short term, but it’s the right prioritization for our customers and partners.”

The company expects labor shortages to continue into the next quarter and costs to rise from $2 billion to up to $4 billion. Accordingly, next quarter Q42021 forecasts for revenue and net income are $138.96 billion and $3.4 billion respectively.

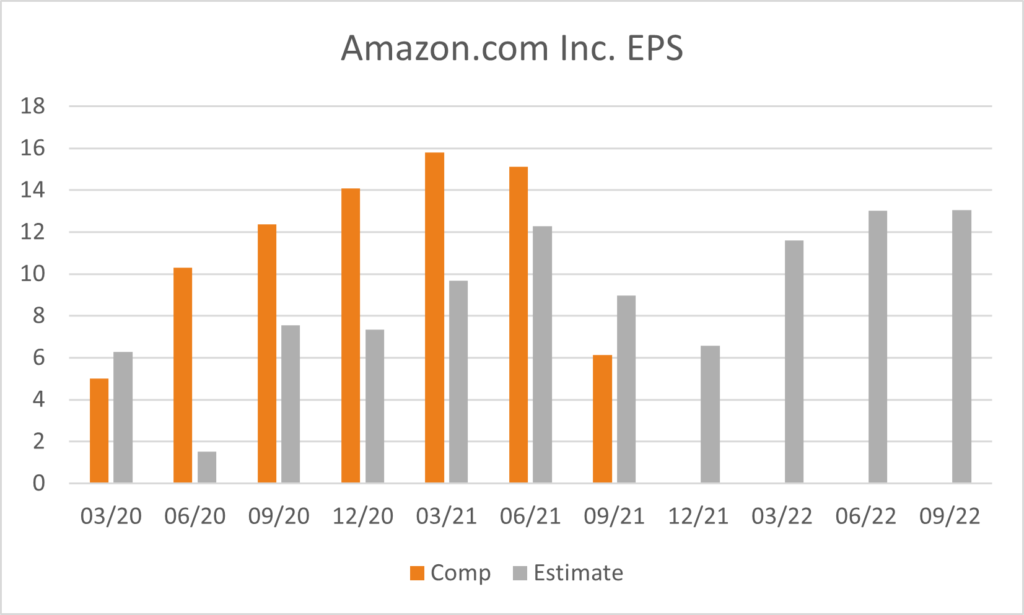

The company’s EPS was for Q32021 was $6.12 (22.16% higher) compared to previous year’s Q32020 $5.01, however, underperformed compared to both the previous quarter EPS of $15.12 (-59%) and current quarter’s estimates of $8.95 (-31.6%). Looking ahead, EPS is expected to be $6.575 for Q42021.

Investors reacted to the weaker than expected earnings with the share price falling –2.15% to $3,372. Analysts continue hold a positive consensus on the company’s future with 100% of analysts having a buy recommendation on the stock, with an average 12-month price target of $4,092.