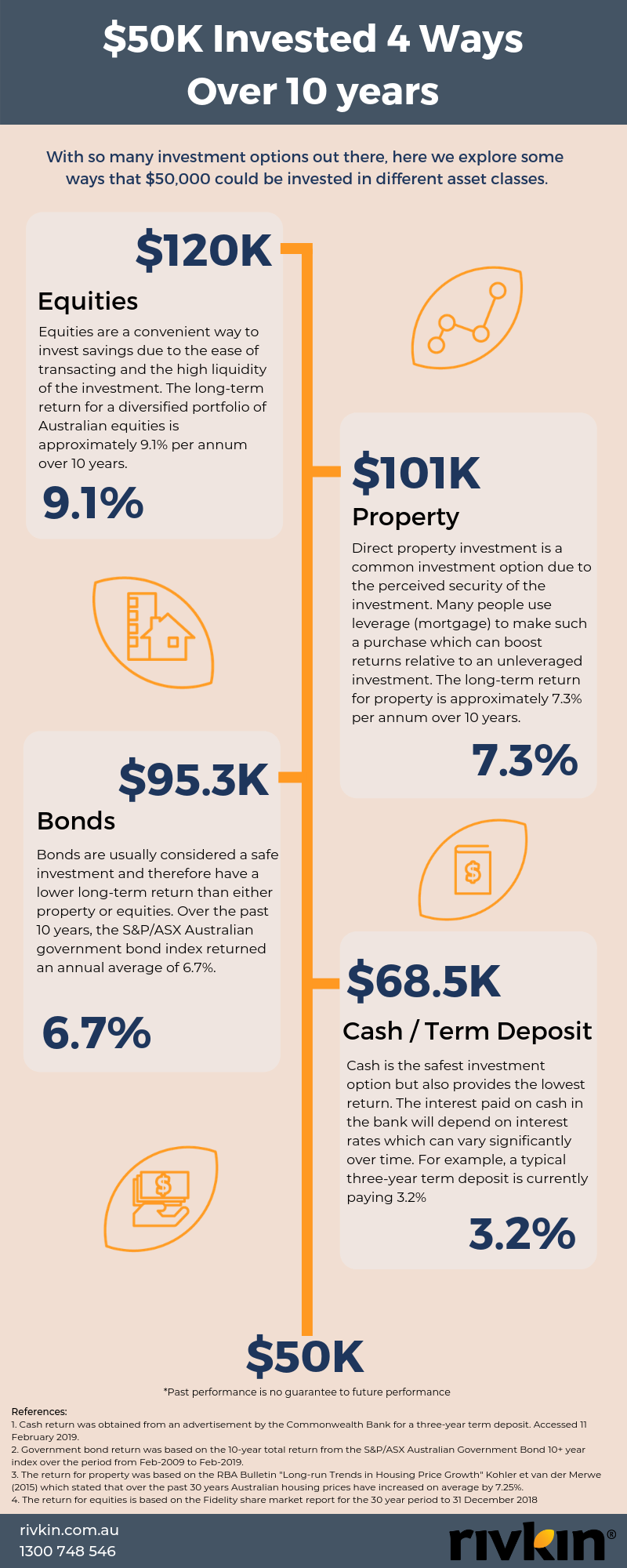

When it comes to investing there's a variety of options out there. But based on long-term historical results, a well-constructed diversified equities portfolio can produce a higher return than other popular asset classes.

Equities / Stocks

The average return from equities is the highest of the four asset classes. Over the past 20 years, investment in equities has become easier and cheaper for the average investor. Online brokerage can be as low as $10 per trade.

This substantially lowers the minimum amount that can be invested without incurring prohibitive costs.

While specific investments can substantially alter the outcome, a balanced portfolio with a long-term view can bring the risk of a negative outcome to a very low level.

Property

The outcome of any property investment can vary substantially depending on the specifics of the investment.

The Reserve Bank of Australia’s publication on the average Australian housing prices over the past 30 years quotes a return of 7.3% per annum.

However, it’s important to remember that investing in properties can be a very concentrated risk and incurs additional costs such as stamp duty, insurance, and conveyancing.

Bonds

Bonds are an asset class that is poorly understood by the average investor and can be difficult to invest in with small amounts. Although there are now Australian Government bonds that can be bought on the stock market, the average Government bond index will produce a lower long-term return.

Cash / Term Deposit

Cash is often seen as the safest investment option.

However, we often see that the interest earned does not even cover the purchasing power lost to inflation. In Australia, we are currently witnessing inflation running at 1.8%.

This means that while a three-year term deposit might run around 3.2%, real growth for the money put in the bank at this rate is just 1.4%.

We specialise in equity investing. Our strategies and experience can help you increase the returns on your investment, at a level of risk you’ll be comfortable with. Using our Value Strategy, we can help take the stress out of selecting and managing a share portfolio. We achieve this by focusing on fundamentals to identify companies with good earnings prospects for investment.

*Past performance is no guarantee of future performance

References:

1. Returns are calculated on the 10-year period between 30th June 2013 and 30th June 2023.

2. Equities are based on ASX200 on a total return basis.

3. Property is based on the Value of dwelling stocks, owned by all sectors for Australia from the Australian Bureau of Statistics.

4. Bonds are based on S&P/ASX Australian Government Bond 10-15 Year Index.

5. Cash returns are based on the RBA cash rate.