Reece Group (ASX: REH) is a recent inclusion within the value component of Rivkin's ASX Growth portfolio, and in this article, we'll provide a more detailed summary of the company, as well as the potential outlook, which is designed to be informative rather than a standalone recommendation outside of the portfolios.

Reece Group (ASX: REH) is a recent inclusion within the value component of Rivkin’s ASX Growth portfolio, and in this article, we’ll provide a more detailed summary of the company, as well as the potential outlook, which is designed to be informative rather than a standalone recommendation outside of the portfolios.

Reece is a leading supplier of plumbing, bathroom, HVAC-R, waterworks, and refrigeration products with a strong market presence in Australia, New Zealand, and the United States, serving a diverse range of clients across trade, retail, commercial and infrastructure.

With rising interest rates in 2022 weighing on the share prices due to softening sales volumes as higher rates slow demand, REH’s share price has recovered strongly over 2023, rising 33% to $18.82 although remains well below record highs of $28.47. CEO Peter Wilson candidly acknowledged a slowdown in volumes for 2023, influenced by the ripple effects of soaring interest rates and a shortfall of skilled tradesmen. The latter, in particular, has resulted in delayed renovation projects across households. However, this did not stop relatively robust financial results over the first half of the 2023 financial year with a 23% rise in revenue to a robust $4.4 billion, and their normalised EBITDA soaring by 25% to reach $495 million. Market presence in both the ANZ and US regions has seen substantial growth, with revenues in ANZ rising by 11% to hit $1.9 billion, while the US saw a 34% spike to reach $2.5 billion.

Following a relatively pessimistic outlook in the latest semi-annual report in February, much of these gains can be attributed to expectations that interest rates are near peak levels with inflation trending downwards, while the economy and housing market have so far remained relatively resilient. Their success story continues in the US, where they advanced their strategic plan of upgrading and expanding their network, even as they prioritized talent development and product diversification. Of total revenue, the share derived from the United States has now increased to 54% from 47.5% over four years, underscoring the regions importance for future growth. A highlight of their journey is their California stores now proudly displaying the Reece brand, symbolizing a shift towards a unified brand identity.

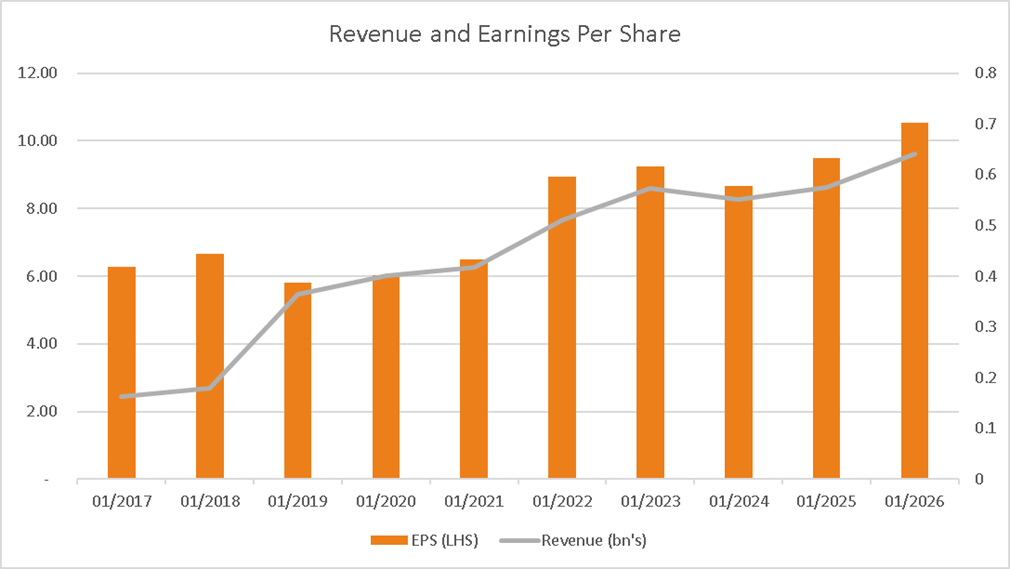

The company’s forward blended P/E multiple is a far cry from the 2021 mid-50’s level, resting at 32.7. Still, the share price hints at anticipated growth with projections of robust revenue and earnings in the pipeline. Reece exhibits all the hallmarks of a high-quality entity, boasting a strong return on invested capital, a core selection factor for the ASX Growth portfolio. Recce is next due to report earnings on August 23rd for the financial year ending June 30th 2023. Expectations from analysts are for a 12.3% increase in revenue over the 12-months to $8.594 billion with adjusted earnings per share expected to rise modestly by 3.3% to $0.62 from $0.60 in 2022.

Despite the recent positive share price performance, the analyst community remains divided on Reece’s future with a roughly even split between hold and sell recommendations. The consensus 12-month price target stands at $15.12, implying a potential -20% slide from the present level. Still, with its impressive 2023 performance, the market seems to regard Reece with a rosier lens, especially considering the unexpected resilience of the US economy.